Big Social Security Cost of Living Increase Expected in 2021

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / July 28, 2021

In last week’s blog post we tackled the question of whether or not the recent increase in inflation is transitory. This week, we want to bring some potential good news to those who are already receiving Social Security. Because of the recent rise in inflation, we expect a big Social Security Cost of Living increase for 2021!

How Are Social Security Benefits Better than Pensions & Annuities?

Social Security is a uniquely beneficial retirement benefit compared to most pensions and annuities. The key benefit that Social Security has over the other retirement income streams is that the government adjusts the benefit each year for inflation.

Given that inflation has averaged 3.0% per year over the last several decades, this annual increase is important. Without it, a beneficiary would see the actual purchasing power of their Social Security erode by one-third every 10 years!

The vast majority of pensions and annuities give you a level annual payment that doesn’t adjust for inflation. Sure, some annuities allow you to buy inflation protection, but the cost of it is usually prohibitively high.

How Does Social Security Determine Annual Cost of Living Increases?

Each year in October, the Social Security Administration (SSA) reveals how much Social Security benefits will increase the following year. For example, in October 2020, the SSA announced benefits would increase by +1.3%, starting in December 2020.

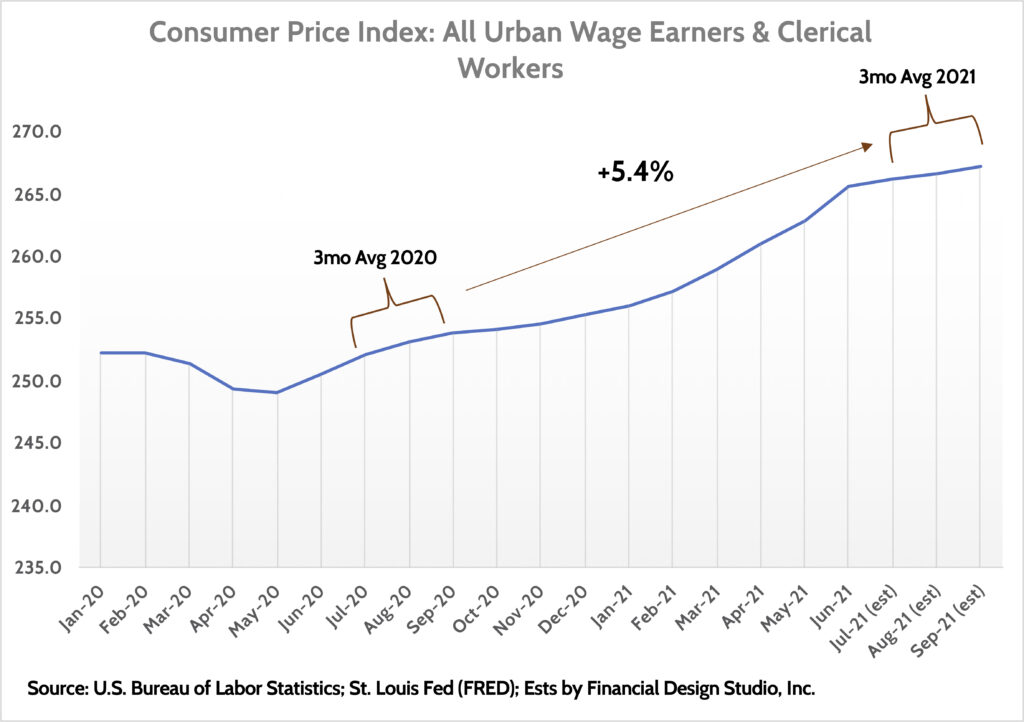

To determine the annual increase, the SSA looks at a special Consumer Price Index calculated by the U.S. Bureau of Labor Statistics. Economists often refer to this index as the “CPI-W.” They take a three month average of the index readings for July, August, and September and compare it to the average of the same three months a year ago.

Since we’re currently in July, now is a great time to estimate how big the Social Security Cost of Living increase will be for 2021. If we assume that the monthly CPI-W increases by an amount similar to the average of what it has increased the last decade, we can get estimated index readings for the next 3 months, as seen above.

How Does the Estimated 2021 Cost of Living Adjustment Compare to History?

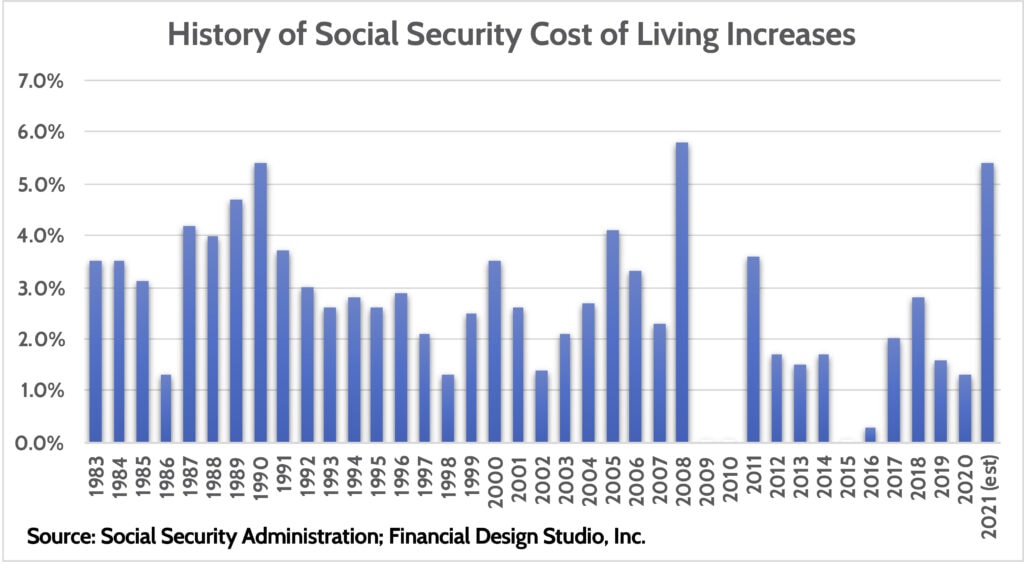

Based on our projections, we estimate that the Social Security Cost of Living Adjustment will be +5.4% in 2021. This is a huge increase compared to what beneficiaries have seen in recent years. In fact, over the last 38 years of history, there have only been two years with a similar or higher increase.

Not since the aftermath of the 2008 Global Financial Crisis have we seen an increase as large as what we expect in 2021. Before that, you have to go all the way back to 1990 to find a Cost of Living increase that topped 5%.

What If Inflation Stays High in Coming Years?

At the outset we mentioned that Social Security is unique in offering a guaranteed, annual cost of living (COLA) benefit increase. Corporate pension plans and all the off-the-shelf annuities you can buy do not offer these COLA increases.

We believe the Fed has boxed itself into a corner in dealing with inflation. The usual tools of keeping inflation tame – increasing short-term interest rates to slow the economy down (i.e. increase unemployment) – are no longer politically viable.

While Social Security beneficiaries are mostly shielded from this inflation, retirees living on pension or annuity income are not. Yes, many insurance companies offer cost of living “riders,” where you can buy inflation protection on your annuity income. But the cost of these riders are often prohibitively high, sometimes reducing your Day 1 annuity payment by 20-30%.

Retirees with corporate pension or annuities need to stress test their retirement income plans against a higher inflation scenario. You may need more retirement savings – such as IRAs or 401(k)s – than you originally assumed.

Higher inflation might also be an issue for Illinois Teachers who are Tier II beneficiaries. The cost-of-living benefit was substantially reduced compared to Tier 1 members. Higher future inflation would leave these teachers at risk of seeing the real purchasing power of their pension benefit erode over time.

What’s Your Retirement Income Plan?

The financial industry spends the vast majority of their time telling you how to save for your retirement. But they don’t spend a lot of time telling you how you’ll use those savings when you’re actually retired!

When we work with near retirees on their financial plan, we’re looking at all aspects of your retirement. We do this to ensure you have a dependable financial strategy that will support your living expense needs while retired.

Deciding when to take Social Security – as early as Age 62, at Full Retirement Age, or as late as Age 70 – can have a big impact on your retirement income plan. Given the unique benefit of Social Security offering annual cost-of-living adjustments, getting this decision right is very important.

Are you nearing retirement and feeling uncertain about how you’ll fund your expense needs? Talk to us. We can give you a retirement income plan to set your mind at ease. Then you can enjoy those retirement years!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Preparing to Transition to Retirement [Video]

In this video, Stephanie Geisler, LPC, discusses how to work through emotions of financial choices of making the transition to retirement.

Everything to Know About Health Savings Accounts

Health Savings Accounts have been around for 20 years but are often misunderstood and underutilized. HSAs are powerful savings tools to cover future medical expenses, such as long-term care, or to help fund healthcare for early retirees. We explain everything you need to know about health savings accounts: what they are, how contribute to them,...

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.