Better Days Are Ahead For The Economy

by Financial Design Studio, Inc. / May 21, 2020There’s been a lot of gloom and doom with economic data in recent weeks. Question is: are there any signs that a better economy are ahead? The answer is YES!

Timely Economic Indicators to Watch

There are dozens of economic indicators that are released in a given month. The problem with most of these statistics is that they’re stale, measuring what was happening several weeks ago.

Given the economic shock we’ve seen resulting from COVID-19 stay-at-home orders, these bad datapoints are still filtering their way through official statistics. But there’s one indicator we’re watching closely that is showing a decided improvement in conditions.

Indicator: Gasoline Demand

Each week the U.S. Energy Information Administration (“IEA”) issues a report on many aspects of the energy industry. Gas prices, gas demand, and oil production are included in these reports.

The most interesting number we’re watching is retail demand for gasoline. This measures the total number of gallons of gas that consumers put in their gas tanks during the past week.

The good news? Things are definitely picking up!

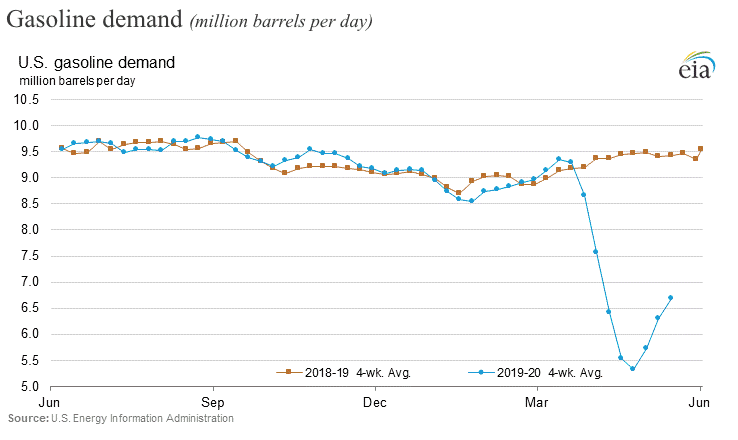

The blue line shows the current situation while the orange line shows what happened a year ago. You can clearly see that starting in early March there was a huge drop-off in gasoline demand. At its low in mid-April, demand for gas was 45% below what it was for the same week a year ago.

That’s a MASSIVE drop!

But since hitting bottom, the demand for gas has increased by 27%.

This is probably one of the clearest signs that things are getting back to normal. People are driving more, whether that’s returning to work or taking family road trips.

Granted, we’re still 30% below where we should be for this time of year. So there’s a long ways to go before we can say we’re totally back to normal. But things are getting better! And other timely indicators are showing improvement as well.

As states being to loosen up stay-at-home orders, we’ll likely see demand for gas increase. With that we’ll also see a rise in gas prices with this better economy.

If you haven’t filled your gas tank in a while, now would probably be a good time to do it before prices go up too much!

Ready to take the next step?

Schedule a quick call with our financial advisors.