Business Owners: When Does Incorporating Make Sense – Payroll Taxes[Video]

by Financial Design Studio, Inc. / May 21, 2020So you have a business. How is it set up? From a legal perspective and from a tax perspective ie. payroll taxes. Let’s walk through a number of examples, real high level, letting you know the difference. This way when you are dealing with your own finances in your business, you know what is going on.

When Does Incorporating Make Sense – Payroll Taxes

Sole Proprietor

So by default, when most people set up a business, they are set up as a sole proprietor. It is just real business. It is the business and everything that is owned by the business is yours.

There is no separation as far as legal structure. Meaning if you are ever sued or if you have an accident, your assets are all a part of the business. They are one there is no separation.

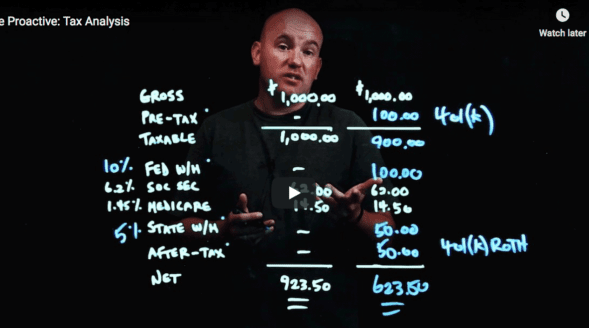

As far as taxes, maybe you have income and expenses, you get to a net income and a net profit, let’s say you have $100,000 net income bottom line – 15.3% of self employment tax means $15,300 in just self employment tax. You have income tax on top of that and state tax, but it is real simple. You have straightforward tax filings. And you put all your income on your personal tax return 1040 on a separate schedule “C” for business, “E” for rental, “F” for farm. That’s where you’d pick up all your income.

LLC

Now let’s say you get a little bit more knowledgeable or you work with an attorney or you go online and set up an LLC. What that does is the tax structure stays the same, you LLC doesn’t provide any tax savings, what it does do though, it sets up this legal protection.

It separates you from your business. So you are protecting your personal assets, you are separating your business. It is now a separate entity.

It is the same tax filings, and nothing additional you have to do.

If that fits you and fits what you are doing – perfect!

S-Corp

But if you are starting to have some larger income levels, there’s some additional savings you can do. It is called an S-Corp election.

It’s really just taking your LLC and making it an LLC plus. And what that allows you to do as an S-Corp is it maintains that separate legal structure, that you already had in the LLC, but now from a tax perspective, you have to start doing different things.

So your business has to start filing 1120S – such as payroll returns and W-2’s to each of your employees, but by doing that you are now enabling yourself to control the self-employment tax. Because down here we are using the same round net income of $100,000 and you decide you are going to pay yourself $50,000.

Now 15.3% is 7650 – you’d cut your self-employment tax (now called payroll tax) in half! That’s just by doing some additional filings, you’d gained $7,000+ in taxes.

The rest of that – the other $50,000 you were getting before, is all going to be coming out as shareholder distribution, K-1, and that is not taxed at the self-employment rate. It is income tax but not self-employment.

So, maybe you are a sole proprietor and you need some protection. Maybe you are an LLC and you need some tax savings as well. Keep that legal separation and add that savings capabilities and you are ready to go.

If we can help you with any of that and introduce you to an attorney, let us know! We can even help with planning out your payroll distributions or answering questions on payroll taxes, we are happy to help!

Ready to take the next step?

Schedule a quick call with our financial advisors.