2020 Election Impact on Investments

by Financial Design Studio, Inc. / November 5, 2020

The election is over and it’s time to look at the 2020 election impact on investments. What does the investing environment currently look like? While votes have yet to be fully counted, the race appears to be leaning in the direction of a new president, a GOP Senate, and a Democratic House. In other words, a split government.

Until we know the final results our thoughts and opinions on what the outcome means are subject to change. For now we have some initial ideas about the 2020 Election impact on investments and the overall economy.

Will There Be More Stimulus?

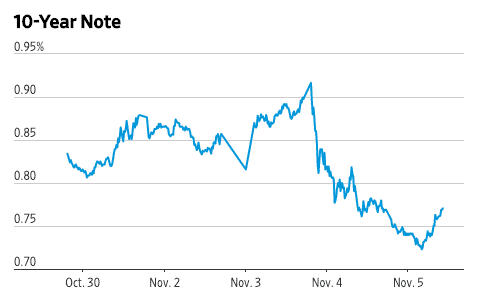

Market View: “A split Congress will lead to gridlock, which will mean less fiscal stimulus and spending.” We see evidence that massive fiscal spending was “priced in” to bond markets. This given that 10-year government bond yields have fallen dramatically this week. Yields had been creeping higher in recent weeks on expectations of another big stimulus bill. The reason why yields would rise on more fiscal spending is the belief that such spending would create inflation.

Our View: We wouldn’t be so quick to write off a massive fiscal spending plan, even with a split Congress. On Wednesday, Senate Leader McConnell made overtures about getting a second Coronavirus stimulus deal done by year-end. Given the scale of economic disruption from the virus, we wouldn’t be surprised to see a bipartisan infrastructure spending plan put together in 2021. If the perception of big spending is back on the table, there will likely be pressure on bond yields to rise.

Is Gridlock Good for the Stock Market?

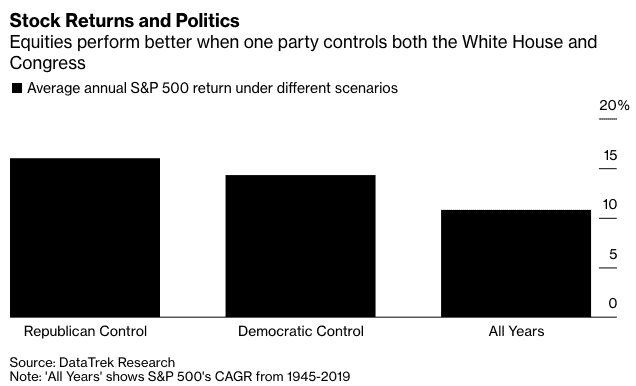

Market View: “Gridlock is good for the stock market.” This is a refrain that’s tossed around Wall Street a lot but the numbers since 1945 don’t back it up. It stems from the belief that with a divided government, the chances of unfavorable policies being implemented is lower.

Our view: As we noted in our blog post previewing the election, we don’t see a discernible difference in stock market performance depending on who’s in power. The numbers above may be skewed by the fact that the last two parties “swept” into power (GOP in early Bush II years; Obama in 2009-2010) were on the heels of major economic and stock market downturns. Stock markets recovered quickly as they took power. From where we stand now, the stock market is already sitting near an all-time high, leaving less room for a “recovery” trade.

What’s Going to Happen to Tax Rates?

Market View: “Taxes are likely to go up.”

Our view: The direction of tax rates is likely higher, but maybe not by as much as what pessimists believe. There was an expectation that a second term for President Trump would mean making the 2017 tax cuts permanent. As it stands, personal tax rates are set to revert to higher 2017 levels in 2026.

It’s hard to believe a Biden administration would seek to make these Trump tax cuts permanent. But given the split in Congress and increasing belief that deficits don’t matter as much (see our September 2020 newsletter), we may not see the tax increases some people expect.

The Wild Card: As noted, all of the above assumes the GOP hangs on to control of the Senate. There are still two races down in Georgia that haven’t been decided. Should those two races get called for the Democrats, then a Biden administration would have control of both houses of Congress.

In that scenario, we think a massive spending plan is almost certain. And as noted in the September 2020 newsletter above, that would mean higher inflation. This is something we don’t believe investors have on their radar.

2020 Election Impact on Investments, Specifically Yours!

So far, the stock market is following the same path it’s been following the last few years: big growth tech stocks are surging, while the rest of the stock market is being left behind. This might be an indication that investors expect a return to the type of environment we saw in President Obama’s last few years in office: gridlock, slow growth, and a lot of monetary policy stimulus from the Federal Reserve.

Yet as noted in our September 2020 newsletter, a lot has changed in Washington since Obama was in office. Namely, the emergence of even more unconventional monetary policy and the rise of Modern Monetary Theory. This theory believes there’s nothing wrong with huge fiscal deficits.

The views we shared in the newsletter are what we continue to believe. We’re likely on the cusp of a significant change in the investment environment. Having fought inflation for the last 40 years, we’re now in an environment where policymakers want inflation. That could have meaningful implications for the environment.

In the meantime, we’ll be nimble helping clients navigate these changes. If you’re wondering how Election 2020 might affect your family’s financial strategy, please reach out to us!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.