Who’s Ready for the Election?

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / October 22, 2020

If the first presidential debate between Donald Trump and Joe Biden is any indication, we’re in for a heckuva election in November. So who’s ready for the election? Investors have their views about what the election of one or the other will mean for the stock market. Oftentimes, the worst fears of these investors never came to pass. History can be a good guide to keep investors grounded heading into an uncertain period. We’ve noted in the past that emotions are Enemy #1 of successful investing. To help avoid that trap, let’s see how previous election cycles turned out and how that knowledge can help us stick to our investment plans.

First Year After an Election

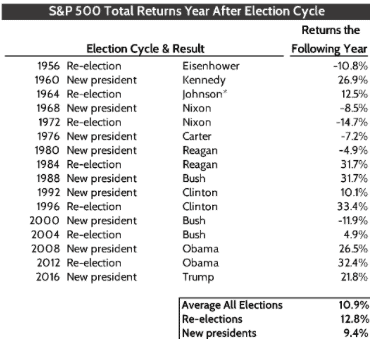

We’ll start by looking at annual returns of the S&P 500 Index in the year after a presidential election. To put these returns into historical context, the annualized total return of the S&P 500 index for all years from 1926 to 2019 is +10.2%.

The average return in the year following the last 16 presidential elections is very close to this long-term average at +10.9%.

Stock market returns in the years following the re-election of an incumbent proved better than when a new president was elected. We can only speculate as to why. Maybe investors favored certainty over the uncertainty of change? Still, average returns when a new president was elected aren’t far off the long-term average (+9.4% vs. +10.2%).

Surprisingly, we’ve only had two incumbents defeated since the 1950’s: Carter in 1980 and Bush Senior in 1992. In the wake of those elections, Reagan’s first year as president saw negative returns of -4.9% while Clinton enjoyed returns of +10.2%. Given the stark policy differences between Trump and Biden, many investors worry about how 2021 will turn out if Biden is elected. While a small sample size, history suggests it won’t make a huge difference.

Contested Election?

On Election Night 2000 I went out with a group of guys from work to the Saloon Steakhouse in Chicago to enjoy some filet mignon and watch the election results. After 4 hours we finally had to call it a night. Little did we know it would take over a month until that election was decided!

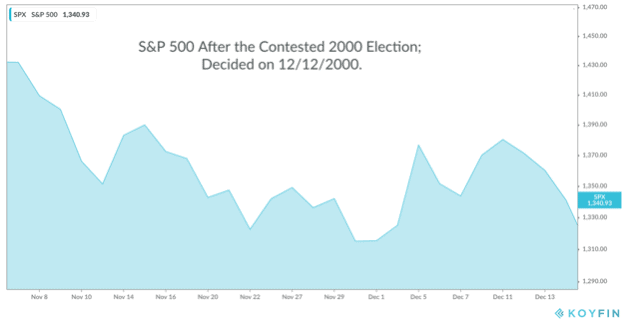

Prognosticators are preparing the public for much of the same in 2020. With mail-in ballots figuring prominently in this year’s election, the prospects for a contested election are clearly higher. But how did the stock market handle the Bush v Gore battle 20 years ago?

There was an initial move lower in the stock market by 5% in the week after Election night 2000 (November 7, 2000). After that move lower, the stocks treaded water for a few weeks until the election was finally decided on December 12.

The year following this election happened to produce one of the negative returns you see in the table above (-11.9%). But it’s important to remember that the Tech Bubble started to burst in mid-2000 and the 9/11 attacks happened in late 2001.

No one expected a contested election in 2000, whereas almost everyone is expecting one this year. We’ve always found that the stock market discounts (i.e. prices in) events well-before investors start talking about them. As such, we believe this view (contested election) is already built into stock prices. (Famous last words?)

1st Term vs 2nd Term

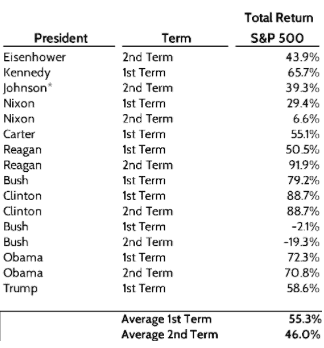

The last item we’ll look at is average stock market returns in a president’s first term vs. their second term. The results, we’ll find, are remarkably consistent.

First terms in office tended to be better, which makes some sense. New face in town. New ideas, and a renewed sense of confidence. What’s remarkable is that each change in president flipped between Republican and Democrat, except Bush in 1988. Despite these changes in party power and the obvious policy implications of those changes, the stock market performed well. That’s a good reminder ahead of this very tight election.

Do Presidents and Elections Even Matter?

Presidents and elections obviously do matter for the country in terms of political philosophy and tangible policy. However, after looking at all the data here, it’s hard to find any stock market pattern at all. Regardless of whether the incumbent kept his seat or not – or which party was in power or not – the stock market has basically produced returns close to long-term averages through all of it.

What’s important to point out is that during these years, there were major events going on that created uncertainty for investors. Vietnam War. Kennedy assassination. Civil Rights Movement. Great Society. Nixon resignation. Stagflation of the 70’s. Iran-Contra. First Gulf War. 9/11. Second Gulf War. Great Financial Crisis. COVID-19. You get the idea. Through all of that – and through all the changes in party politics – America has continued to power forward.

Now, Who’s Ready for the election?

So if you’re asking who’s ready for the election, our message to clients as we head into the 2020 election season is to stay calm and stick to your plan. If Biden wins, sure, we’ll have plenty of debate about future fiscal policy and tax changes. But just like previous changes in power, Americans adjust and move on. If Trump is re-elected, the big question is whether the tax cuts enacted in 2017 are made permanent. Currently, the tax cuts for individuals are set to expire at the end of 2025. History has favored the patient investor. Let the timing of your financial goals – not politics – dictate what you do with your investments.

Ready to take the next step?

Schedule a quick call with our financial advisors.