Why We Are Seeing Declining Rates Lead To Higher Stock Prices Right Now

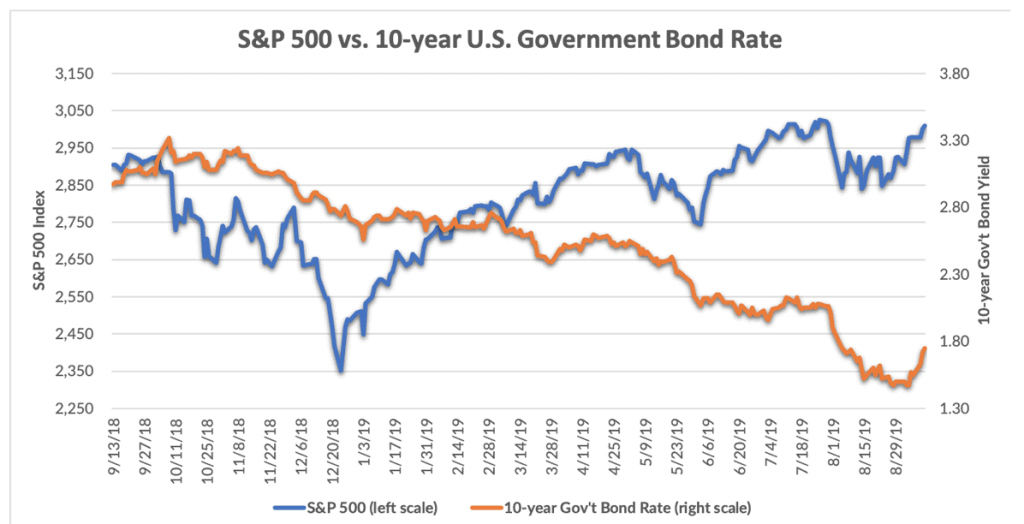

by Financial Design Studio, Inc. / September 13, 2019 On Thursday, September 12, the European Central Bank cut interest rates and re-activated its program to buy government bonds. The Federal Reserve is expected to cut interest rates at its next meeting this month. Both of these moves are to help “stave off” an economic slowdown. As a result, stock indexes here in the U.S. and Europe are sitting near 1-year highs. These declining rates are leading to higher stock prices right now.

On Thursday, September 12, the European Central Bank cut interest rates and re-activated its program to buy government bonds. The Federal Reserve is expected to cut interest rates at its next meeting this month. Both of these moves are to help “stave off” an economic slowdown. As a result, stock indexes here in the U.S. and Europe are sitting near 1-year highs. These declining rates are leading to higher stock prices right now.

Why do stocks love lower interest rates so much?

[S&P 500 vs. 10-year U.S. Government Bond Yield]

You’ve likely heard or seen news about how some interest rates in Europe are even negative.

When faced with a choice of losing money or taking their chances in the stock market, these global investors are obviously deciding to take their chances in stocks!

Does it always work this way, where lower interest rates always lead to higher stock prices?

Not necessarily. If the economy is heading into recession, stocks tend to do poorly even though central banks are cutting interest rates. The fear of a recession’s consequences for stocks out-weighs the fact that bonds have lower and lower interest rates.

In troubled times, investors will seek the safety of government bonds, and U.S. government bonds in particular. That’s why it’s critical to have a balance of both stocks and bonds in your portfolio. Bonds may hurt your portfolio returns a bit when stocks are surging to new highs every day. But when stocks go through a bear market, those same bonds help protect your portfolio from going down as much as the stock market.

Keeping the right balance in your portfolio is what we do for clients. That way you can sleep well knowing that someone is watching your investments closely.

Wondering how this affects your investments? Schedule a call with Michelle and Steve to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.