What is Life Insurance? [Video]

by Trevore Meyer, CFP® / April 12, 2021In this next four part series we are going to be exploring life insurance. The videos include; what is life insurance, why it’s important to have it, and what are the things you should be looking out for when you’re evaluating it. Now I understand no one likes to talk about what might happen when they die. It’s a morbid and challenging discussion to have. If you can have this discussion with your family ahead of time it can really help. This can take a large amount of stress off of their shoulders when this event comes to pass.

Now a quick disclaimer, we at Financial Design Studio, Inc. do not sell insurance. We do help our clients go through this as a critical part of their plan, because we feel it’s such a critical aspect.

What is Life Insurance?

Like any good complicated question I always think it’s best to start at the base and work our way up. Today we are going to ask what is life insurance? Life insurance is simply a contract between you and an insurance company to protect against the event where you die.

You may want insurance for a variety of reasons. It may provide for those final expenses in the event of a death. Another reason could be to pay off some debt your family may have. Life insurance could also be used to replace some income you were expecting for a number of years thereafter.

Term vs. Permanent Insurance

Now believe it or not there are actually many different types of life insurance you can buy. Rest assured we are going to go through them so you can see what they mean and why they matter.

The main two types of life insurance are term and permanent. Thankfully the names line up with what you would imagine. Term insurance is structured in such a way to cover your life for a set number of years, in other words a term. It is not designed to last your entire lifetime if you live until a ripe old age. Permanent life insurance is designed to last until your advanced years.

Even within permanent insurance there are four subtypes. They are whole, universal, variable, and variable-universal but more on those in just a bit. For now we want to talk about the main difference between term and permanent life insurance. With a term contract when you make your premium payment each month, quarter, or year all of that premium is going towards the cost of that policy. However, with a permanent policy some of the premium that you pay goes towards covering the cost and the other portion actually goes to building up a cash value of the contract.

This is important to know because as you are trying to compare a term policy vs. a permanent policy you might not always be comparing apples to apples. Decisions on which policy to buy might depend on a number of factors for each person and their unique circumstances. That said here at FDS we will typically prefer clients look at term coverage opposed to permanent and here is why.

As you progress through your working career you should be saving money as you go. At the same time you should be paying down the debts that you have. This enables you to be less and less dependent on your income each and every year. In other words you are reducing your need to have life insurance for yourself in the future. That said we do see some situations where it does make sense to look at a permanent policy over a term. A common reason for this is maybe we have someone who has already maxed out their 401(k) policy and IRA’s. All they are really left with from a savings perspective is a taxable brokerage account.

The advantages you may see from a permanent policy is you can actually save into this account. Remember part of your premiums are going to a cash value. But when you save into this account you actually get tax deferral associated with this cash value. Even further, you actually get some creditor protection. Meaning if you have funds in a life insurance contract those are typically not subject to creditors if you were a party to a lawsuit. Even further still, while not always the case, generally speaking we find that term coverage dollar for dollar is going to be cheaper than a permanent policy.

What about a situation when a permanent policy makes more sense than a term policy. There are fewer situations where we may see this, but they do come about. Let’s look at an example of someone who has maxed out their 401(k) and IRA. Really all they are left with to get some tax deferred savings is a life insurance contract or maybe an annuity. In this situation the advantage with a life insurance contract is as you are adding funds into the contract you are actually able to defer the taxes year over year. You wouldn’t have to pay them when you file your tax return each year. That can be a really nice savings.

An additional benefit of the permanent policy is that you can experience creditor protection. This is important because if you are subject to a lawsuit that means any funds in your life insurance contract, generally speaking, would not be subject to the creditors in case they were to win. Now there are state specific rules here so I highly encourage you to review and confirm those. Check the state rules before changing your plans based on this one video.

Four types of Permanent Life Insurance

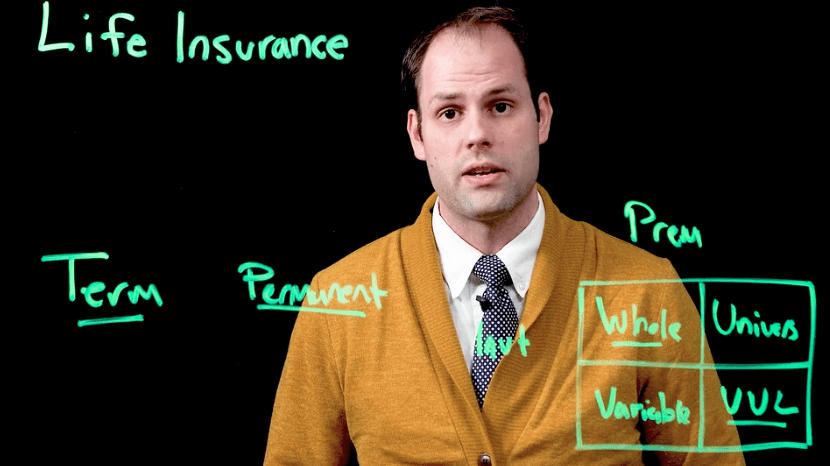

Now, before I had mentioned there are four primary subtypes for a permanent life policy. Let’s spend a little bit more time talking through what those are and why they matter. Essentially the differences come down to two primary variables. Whether or not we can adjust the premium and secondarily if we have investment sub accounts associated under the contract.

So at the top of our chart let’s put premium and on the side let’s say investments. Now we have four boxes in our grid. With the four types we have whole life in the upper left because we cannot adjust the premium and the only investments we have available to us are the company’s general account.

With the universal life contract we can adjust the premiums but we are still limited in the terms of the investments. We can only invest in the insurance company’s general account. In a variable policy we cannot adjust the premiums, but we do have investment options available to us. Think of the investments options similar to mutual funds that you would invest in your IRA or 401(k) through your work. Finally, we have a variable-universal life contract which blends the mix between a universal contract and a variable. You are able to adjust your premiums and you can adjust your investment options.

Which Policy is Best?

If we step back and think through this we see the whole life is the most restrictive. Whereas the variable-universal contract is the least restrictive.

The struggle is not always variable-universal versus a whole life contract. If you are evaluating life insurance policies there are lots of factors that go into what makes a certain policy better. There are even more variables than what we described here. Really it is a case by case decision. There are lots of variables that go into whether you would pick a universal-variable, whole, or even a permanent policy to begin with.

There are lots of other variables that influence whether a certain policy is better than the other. Unfortunately, there are even more variables that we need to consider when evaluating which policy to buy.

We will start going through some more of those nuances in the next videos. Please stay tuned for the future videos we will have coming up on life insurance as we go through more of these variables associated with the decision points you should be aware of with your life insurance contracts. If you have an existing life insurance contract that you would like to review with us or you have questions about please reach out and we would be glad to help.

Ready to take the next step?

Schedule a quick call with our financial advisors.