How Tax Deferred Accounts Work [Video]

by Stephen Smalenberger, EA / March 9, 2021Do you know if your accounts are taxable? In this video, we are reviewing what accounts are NOT taxable, or tax deferred. Learn how they work and how they might fit into your financial plan.

There are three types of accounts we have been talking about: taxable, tax deferred, and non-taxable accounts. Let’s talk about tax deferred accounts today.

What are tax deferred accounts?

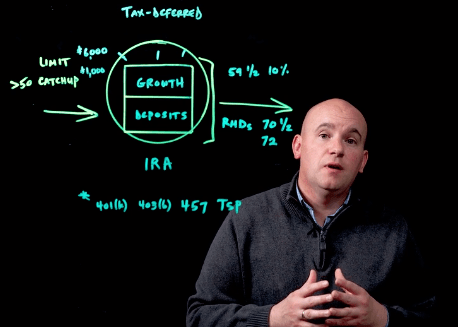

I want you to think about pre-tax or traditional. We are going to talk about IRA’s specifically here. However all of this applies to traditional 401(k)s, traditional 403(b)s, 457 accounts (for state or local government) or TSP’s (those in uniform or federal government).

What are the rules?

Those who can open a tax deferred account would be individuals who have earned income. Meaning they have a paycheck. They may be self-employed but they have income they are earning each year. There is no longer an age limit with tax deferred accounts. So you can be a child or a retiree.

Because these are retirement focused there is a limit on how much you can put in. Currently the government limit for putting into an IRA in years 2020 and 2021 is $6,000 a year for an individual. For those over age 50 they can put in an additional amount of $1,000, called a catch up. For IRA’s and 401(k)s there are different amounts and those change each year as well. Current annual 401(k) contributions are $19,500 plus $6,500 for those over age 50.

Difference between tax deferred and taxable accounts

So the difference here between the taxable account which we talked about last time is now we have this tax protection around the account. An IRA and 401(k), both a tax-deferred account, all act the same. They provide protection. You put money in by depositing or making contributions, payroll deferrals, and the amounts in the account can grow. Because it is invested in that account there is no tax at this time. Its tax deferred meaning the tax happens later when you take the money out.

Now it depends on what age you are when that happens. Here are some basic rules you would follow. If you distribute funds from these accounts before age 59 ½ the government is going to add an additional 10% penalty. However if you wait until you are old enough, meaning you wait until you are 59 ½, you can take that out without the 10% penalty. But the distribution will still be taxable as income. The thought here is when you put the money in you got a benefit. You allowed it to grow and then when you take the money out it’s taxed.

Required Minimum Distributions

There are some additional rules on these tax deferred accounts. You are required to start taking money out by a certain age, which is called a required minimum distribution (RMD). There was a recent change with the Secure Act which pushed that age back from 70 ½ to 72. So those who turned 70 ½ prior to 2020 you have to keep taking your distributions. If you haven’t turned 72 yet then age 72 is is the new RMD required age. We will have more videos on RMD’s specifically.

Tax deferred accounts are great if you want to have some tax benefit on the front end (these early saving years), let it grow, and then later on in retirement ages where you may be in lower tax brackets start taking money out.

Next Steps for Tax Deferred Accounts

These are the basic highlights of how tax deferred accounts work. If you want to dig in deeper and learn more you can learn more about how to calculate and what to do with your RMD. As always if you have any questions please reach out we would be happy to help you.

Ready to take the next step?

Schedule a quick call with our financial advisors.