Thanks-GIVING!

by Financial Design Studio, Inc. / November 25, 2022The most common goal people save for is to have money to last their lifetime. But you might be surprised that another popular goal people have is giving money to charitable organizations who are helping others in need.

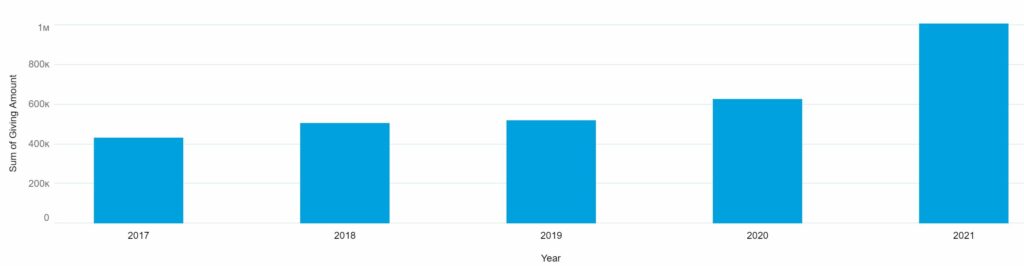

We thought it may bring you some encouragement to see what you and other like-minded individuals and families have achieved toward giving to help others. Here’s the total that our ongoing advisory clients have given since the inception of FDS. This amount includes charitable gifts from 2017 through 2021.

The total amount is: $3,098,647 What an encouraging number!

There are many reasons why people give to charitable organizations. Of course there are people who want to give just simply because they care about others. They would give everything they have to help someone else. The United States tax code also provides an incentive for people to give. Because of this incentive people may be persuaded to give more than they otherwise would. Here are some of the most common ways we see people give money to charitable organizations.

Financial Options for Charitable Giving

Qualified Charitable Distributions from your IRA: An option that could save you some income tax is to give the portion of your Required Minimum Distribution each year directly to not for profit, charitable, organizations. The amount that you give to directly to organizations is distributed income tax free!

Itemize Your Charitable Giving on Your Tax Return: If you give enough to charitable organizations each year you want to consider itemizing versus taking the standard deduction to benefit. When you itemize deductions on your tax return these contributions to charities are a line item that can help you save from paying more in taxes.

Appreciated Stock Gifts: If you’re fortunate to receive stock from your employer that has increased in value over the years you can consider gifting this stock directly to the organization. This saves you from paying the taxes and the charity can sell the stock to receive the proceeds. Organizations then use those funds to support the great mission they have.

Donor Advised Funds: These accounts are common when individuals would like to make a large contribution in one year but they want to give the funds over the course of several years. Or they may want to give the funds to a variety of organizations. Once money is put into a donor advised fund you can’t take it back out. It only comes out when you decide which charitable organization you’re giving it to.

We have a podcast on this subject coming out in a couple weeks! Check out our latest episode on the holidays and awkward finance questions. Subscribe on your favorite streaming platform to stay updated.

Ready to take the next step?

Schedule a quick call with our financial advisors.