Summer’s Economic Progress Report

by Financial Design Studio, Inc. / June 7, 2018Summer’s Economic Progress Report

School’s out for a summer break, but that doesn’t mean the markets will take a break! In fact, we were encouraging you a few weeks ago to skip the “Sell In May And Go Away” investing theory that believes summer is quiet with nothing to gain by staying invested. This week has provided welcome updates and news stories reminded of the economic strength in place. Let’s review a short progress report to start our summer.

Employment

Monday brought a solid jobs report with record unemployment numbers and also record job availability for anyone looking to be employed. The unemployment rate dropped to 3.8% in May, which ties the lowest reading, and we believe this could be headed even lower. This is great news because it means people who can work, would rather do so, than receive unemployment checks or just not work at all. This leads us to believe that the wage for working is rising higher than what you can earn on unemployment. Eventually as wages continue to rise it will continue to pull people off the sidelines and into the workforce in even greater numbers.

Further, the growth of employment is coming from private sector jobs. Private sector job growth means that businesses are hiring and that happens when businesses are doing well. We would prefer to see private sector job growth rather than job growth from an increase in government jobs, which has remained very low.

Trade

An area that many investors and analysts are keeping a close eye on is trade with other countries. You have likely heard in the news a story of tariffs or a potential trade war with a variety of countries. In the coming weeks we wouldn’t be surprised to see volatility from meetings that are scheduled to take place with other country leaders. There is still much to be optimistic about regarding trade reciprocity that many economic leaders are working toward. These optimistic comments by top white house economic advisor, Larry Kudlow, may serve as a great reminder of what is being worked toward

Market Growth

In light of strong employment numbers, a strong earnings season, and potential progress in areas like trade we have seen the markets continue to push toward new highs. Year-to-date the US markets are positive, giving us a reason to stay invested.

Remember that staying invested for the long-term, through volatility that comes and goes, will reward investors saving toward future goals.

VIEW NEXT

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

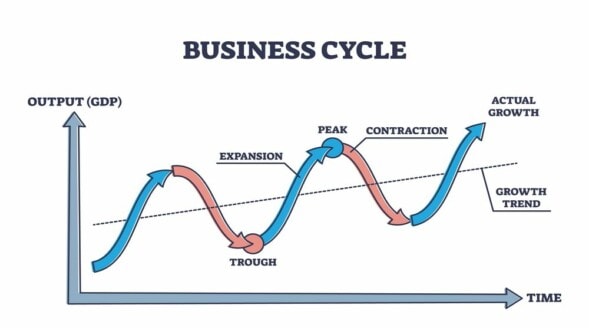

Understanding Stock Market & Economic Cycles

Do you remember what an economic cycle looks like? In this week's post we help you understand stock market & economic cycles and what they mean for investors.

2022 Was Tough, Will 2023 Be Better for Investors?

Will 2023 be better for investors? They just suffered one of the worst investment years ever in 2022. There are reasons for hope in certain parts of the stock and bond market. We give our thoughts on the chances of a recession and path of interest rates in this opening post of 2023.

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.