Relief from Investment Worry: Recession, Trade, Q4

by Financial Design Studio, Inc. / January 17, 2019During the midst of the past few months a question we’ve asked is “How did you feel during the volatility of the past few months?” Were you concerned that it would affect your overall plan and started to worry? Were you reminded that the market doesn’t always move higher but has points of volatility over the years?

We’ll discuss some worries you may have and try to point you toward considerations to provide relief from the worry.

Global Trade Tensions: What will happen if this issue lingers?

We are starting to see from the 4th quarter of 2018 that trade tension with other countries can actually impact US business. We are not totally clear and free from any impact. What we are seeing is that the impact is company specific. For example, you may recall a couple weeks ago Apple cautioned they had not sold as many products in China as they estimated. This news led to the stock moving lower.

When negotiating from a point of strength it’s easier to stand your ground. Both the China and U.S. economies have reportedly been slowing over the past few months, even if minimally. Whether that slowing has affected jobs, specific companies or the overall GDP, this weakening of economies may keep negotiators at the table before any massive impact is felt by consumers. Eventually negotiators should listen to continued economic weakness to bring action. We are hopeful that the hint of weakness pushes toward progress.

Recession: That sounds scary.

Economic weakness tends to make us worry about the likelihood of an upcoming recession. A recession does not have to be long and severe and they’re not all the same in length. But we tend to jump directly to this thought when we hear about the potential presence. A recession can be mild. Do you remember the definition of a recession? It is defined by “reduced” trade and industrial activity, but the definition doesn’t signify that has to be “extreme”.

When we look in the rear view mirror over time we see our economic past. Be careful not to review data as it comes and fear the worst too soon. Additional weakness to what we see today could actually prove somewhat limited. We’re already presented with weakness and various risks as we’ve discussed.

Fourth Quarter Earnings: What if a company’s stock moves lower?

Remember that corporate earnings being reported now are results of the holiday shopping season. You may recall companies reporting holiday sales records like Amazon. So far, results are mixed with either positive surprises or disappointing misses. The results tend to be company specific. If the items we’ve mentioned above have an impact on a company directly then we are seeing that in their earnings result. If the company isn’t impacted by the items we’ve noted then it seems the holiday quarter showed strong sales.

Continued positive earnings over the next month could help to pull the market higher even in the midst of the risks we’ve touched on. If you find yourself worrying you can always make some minor changes to minimize the volatility you feel from your portfolio. Appropriate changes are warranted if needed. But be cautious of making changes that can hurt your overall financial plan for the long-term. Remember we will be keeping watch over all we’ve discussed!

We are here to help if you need guidance about any changes you think might be necessary.

Wondering how this affects your investments? Schedule a call with Michelle and Steve to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Time Horizons for Your Investment Goals [Video]

In this video, Rob breaks down what time horizons are, why diversification matters too, and how this strategy works in action.

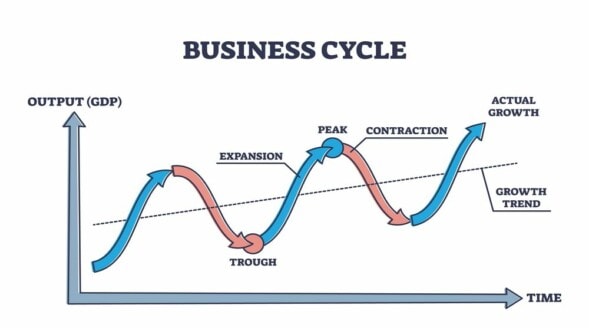

Understanding Stock Market & Economic Cycles

Do you remember what an economic cycle looks like? In this week's post we help you understand stock market & economic cycles and what they mean for investors.

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.