Rebound in Small Cap Stocks

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / November 26, 2020Stocks of smaller companies have struggled under the weight of economic uncertainty from COVID-19 pandemic during 2020. For most of the year investors have preferred the safety and comfort of stocks in big, well-known companies, such as Apple and Amazon.

Yet in the last six months – and particularly since the election – there’s been a strong rebound in small cap stocks. A key driver of this new trend is the hope for a vaccine, which would fuel a new economic recovery.

How do Small Cap Stocks Compare to Large Cap Stocks?

While the names “large cap” and “small cap” are self-descriptive, it helps to dig in and understand the lingo that’s often used in finance. “Cap” is shorthand for “capitalization.” Capitalization refers to the value of a company – its market value. So when someone on CNBC is talking about “large cap stocks” they’re talking about stocks of companies that are worth a lot.

The most popular large-cap stock index is the S&P 500. This is an index of the 500 biggest stocks traded in the United States. Apple is the most valuable stock in the index, worth about $2 trillion. Xerox is also in the S&P 500 but is only worth $4 billion.

For small-cap stocks, the most popular index people look at is called the Russell 2000 index. As the name implies, this is an index of 2000 small company stocks. The weighted average value of companies in this index is just $2.5 billion, with some companies only worth around $125 million!

These two indexes – the S&P 500 and Russell 2000 – are the ones we’ll use when comparing performance.

Historical Performance of Small Cap Stocks Versus Large Cap Stocks

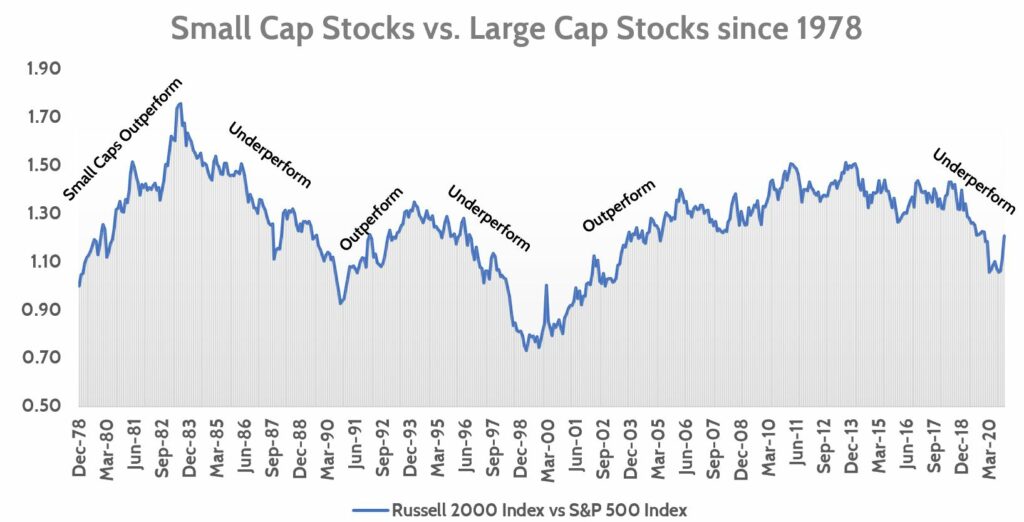

The Russell 2000 index data goes back to 1978. Since that time, the average annual return for the Russell 2000 is +9.5% per year vs. +9.0% for the S&P 500 Index. Better performance for smaller companies makes sense as they have more room to grow than large, mature companies.

Despite the better historical performance for small cap stocks, there have been periods where they’ve done well and other times when they’ve done poorly compared to large cap stocks. Interestingly, periods of sharp underperformance of small caps (1990, 1998-1999, 2018-2019) preceded turning points in the economy and the stock market. Those periods were followed by recessions and tough times for investors.

How have small cap stocks done in 2020?

This year has been a rollercoaster on many levels, as we all know! It’s been the same in the battle between small cap and large cap stocks.

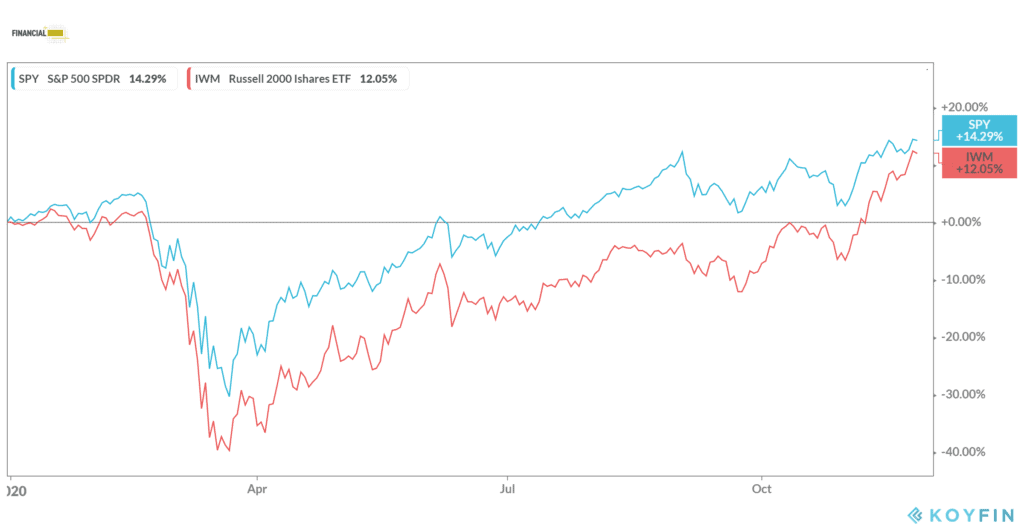

As mentioned above, small cap stocks came into 2020 on a losing streak. As COVID-19 washed ashore and created a lot of economic uncertainty, they reacted badly.

It’s hard to believe that as of late March, stocks were down anywhere from 30-40%. But what’s more remarkable is that we’re sitting here in late November with both indexes up ~13% for the year. After starting out way behind, there’s been a big rebound in small cap stocks as they have caught up with their larger brethren.

Why Have Small Cap Stocks Done Well Since Election?

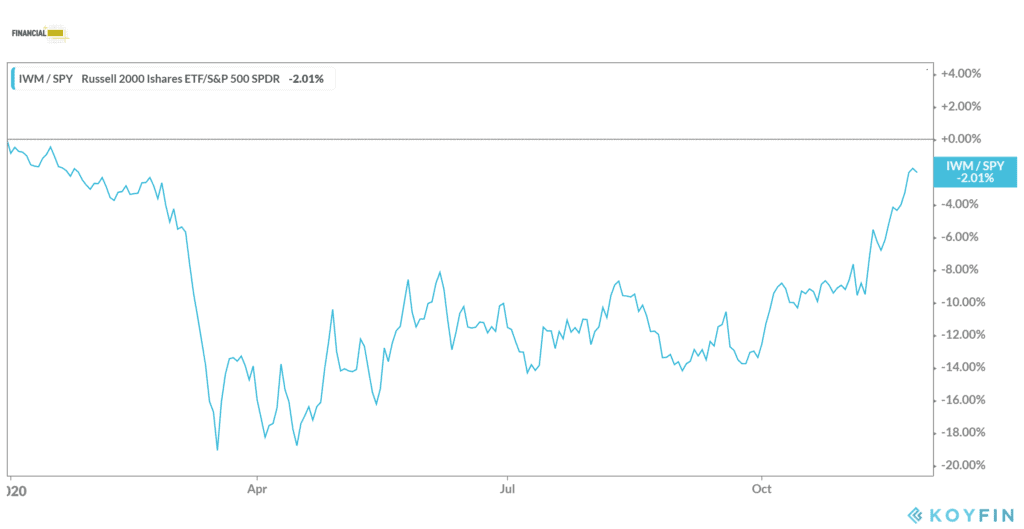

The rebound in small cap stocks has been in the making since Spring. Once the market was able to absorb the initial impact from COVID-related shutdowns, the economy bottomed out and started to recover. The chart here is the same one as above except that it shows the relative performance of small caps to large caps more clearly.

The very strong performance of smaller stocks since Election 2020 is evident. We’ve had 3 announcements in recent weeks about effective COVID vaccines getting close to approval for use. The prospect of returning to normal life is very helpful to smaller companies that have suffered the most from business shutdowns.

Secondly, we think a meaningful stimulus and infrastructure spending bill are more likely now that the election season is over. A second big stimulus bill was held hostage by political wrangling this Fall. But the surge in cases in recent weeks will likely give more oomph to stimulus despite the split government.

How Investment Diversification Helps Your Retirement Plan

The chart at the top of this post showed us that there can be multi-year periods were one type of stock works while the other doesn’t. These periods where either large cap stocks or small cap stocks dominate can make a big difference in your portfolio if you’re not well-diversified.

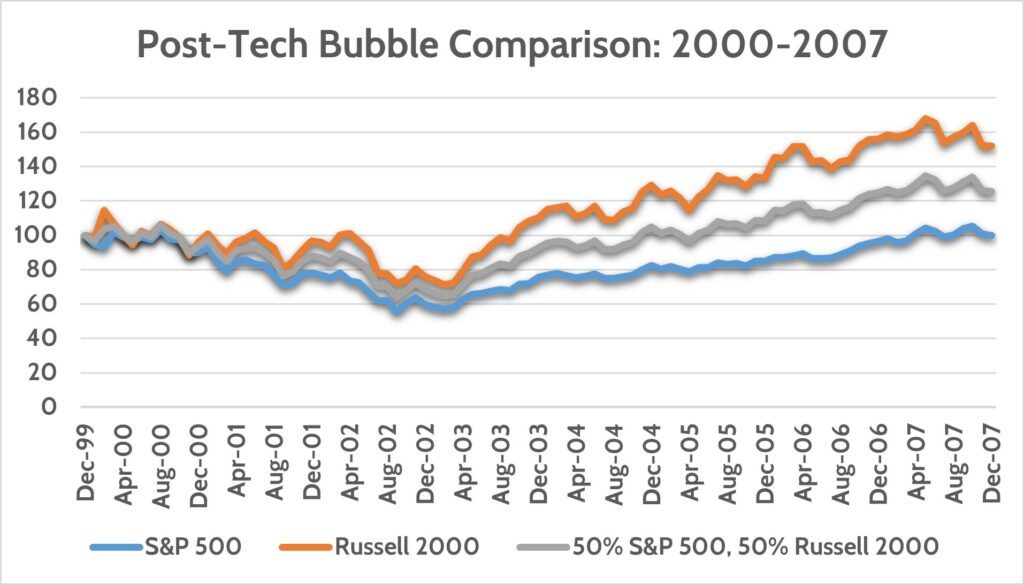

My favorite way of showing this to people is to look at the early 2000’s after the Tech Bubble of the late 1990’s burst. That bubble looked a lot like what we’ve seen the last few years. Big growth companies dominated while smaller stocks were left in the dust.

An investor at the end of 1999 could be excused for deciding to keep all their Stocks eggs in the S&P 500 basket. They had dominated small cap stocks for years. But look what happened from 2000 to 2007. Large cap stocks hit a wall while the small cap Russell 2000 caught fire. In fact, the S&P 500 investor experienced ZERO investment growth over those 7 years!

Here’s the big deal: What if that same S&P 500 investor was in their late 50’s looking to retire 7 years later? Getting zero growth out of the “growth” portion of their investment mix would be devastating to their retirement plan!

Instead of trying to guess whether large caps or small caps would be the “winner,” they could’ve bought 50% of each index and rebalanced it monthly back to that 50/50 mix. In this scenario, they would’ve made about 25% over those same seven years. That’s not a great return over seven years, but certainly better than zero!

Will Small Stocks or Big Stocks Do Better in 2021?

Given how badly small stocks have trailed bigger stocks over the last few years it wouldn’t surprise me to see the rebound in small cap stocks continue their recent momentum. But I hope the last example convinced you that you don’t have to pick one or the other. You can invest in both.

The key to make investment diversification work is to make sure you’re rebalancing your investments when they get too far away from your target investment allocation. That means selling ‘winners’ and buying ‘laggards.’ In other words, buy low, sell high!

That type of discipline isn’t easy in today’s world of 24/7 business news and fast-moving markets. Having a financial advisor (hint, hint: Financial Design Studio!) who has a disciplined investment process can relieve you of the duty to do everything yourself. How can we help you?

Ready to take the next step?

Schedule a quick call with our financial advisors.