Presidential Election Years And The Stock Market

by Financial Design Studio, Inc. / November 12, 2019Like it or not, we’re within a year of the 2020 Presidential Election!

And with it comes the usual assortment of emotional predictions about where the country and stock market will be headed depending on who wins.

Since making emotional investment decisions is an almost sure-fired way of hurting long-term investment returns, we like to “ground” our emotions by looking at history.

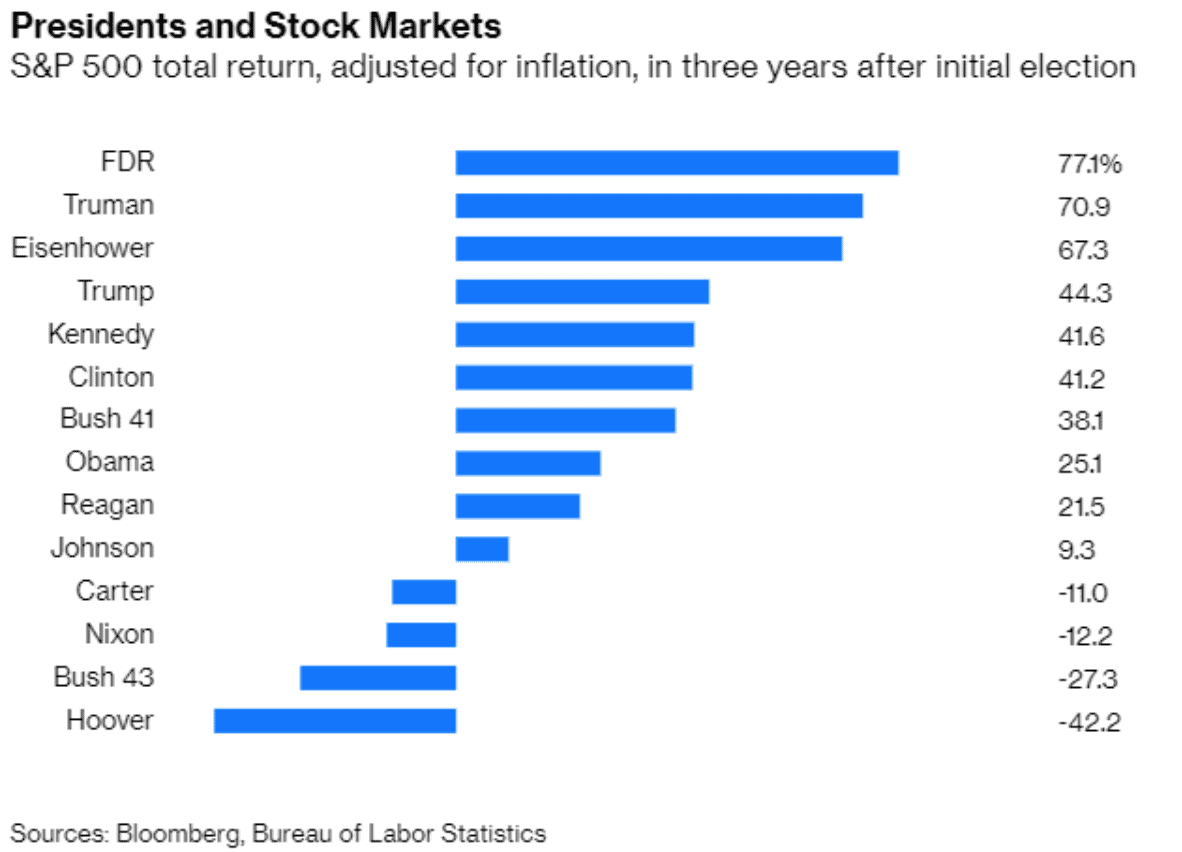

First Three Years After New President

The first thing to look at is how the stock market has done after the first 3 years of a new presidency.

As you can see, returns have generally been good in the first three years of a new president. For the Trump presidency, the stock market has enjoyed its best three-year start under a new president since the 1950’s. This is notable since the stock market had already had a good run during President Obama’s term in office, recovering from the depths of the Great Recession.

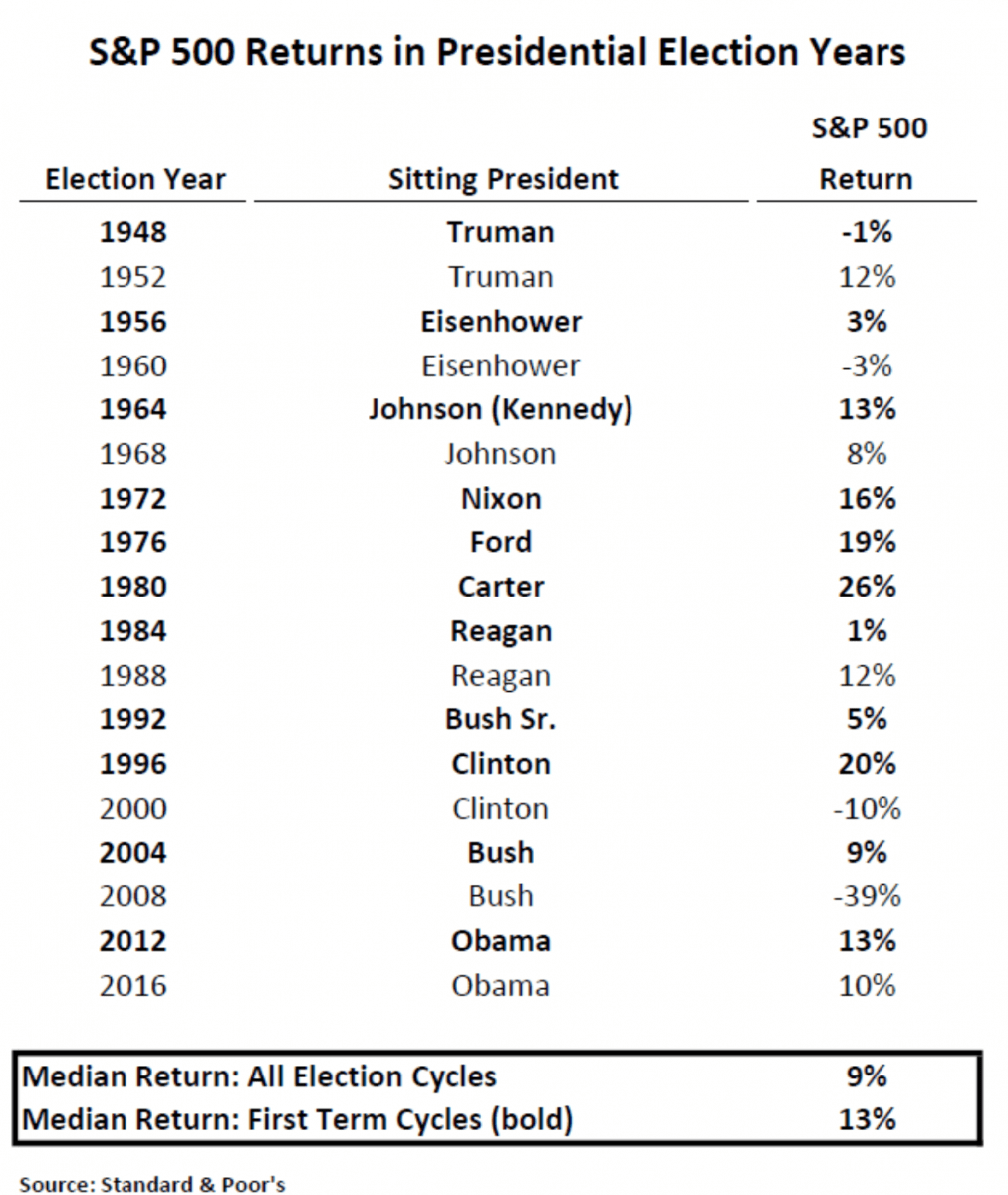

Presidential Stock Market During Election

Next, we can look at how the stock market has done in Presidential election years. The table below looks at all Presidential elections since the end of World War II.

The stock market has tended to do better in election cycles where an incumbent president was running for a second term. You have to go all the way back to Truman in ’48 to find an election year where an incumbent president suffered a negative year in the stock market.

What Do Presidential Elections Tell Us About 2020 And The Stock Market?

Not a lot, actually. While we can take encouragement that the market tends to do well when an incumbent is running for re-election, we must keep in mind that the market has already had a very good run the last three years. Truman and Eisenhower enjoyed very strong markets in Years 1-3 only to see Year 4 returns peter out.

The key takeaway we’d like to leave you with is to not invest emotionally. Election years can drive emotions that cause us to make bad investment decisions. Just remember that through every election cycle – regardless of which side won – America and the stock market have powered ahead.

As the TV commercials say, “Past performance is no guarantee of future results.” But history can at least help “ground” our emotions as we head into the 2020 election cycle. Think long-term.

Wondering how this affects your future finances? Schedule a call with Financial Design Studio to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Time Horizons for Your Investment Goals [Video]

In this video, Rob breaks down what time horizons are, why diversification matters too, and how this strategy works in action.

Understanding Stock Market & Economic Cycles

Do you remember what an economic cycle looks like? In this week's post we help you understand stock market & economic cycles and what they mean for investors.

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.