More of the Same

by Financial Design Studio, Inc. / November 19, 2020

Election 2020 has delivered a divided government. While Biden appears to be winning the Presidency, the GOP has kept the Senate and picked up a few seats in the House. In short, no one came out of the election a clear winner. So the are we in for more of the same?

The investment environment for much of the last 10 years has seen a surge in growth-oriented tech stocks and a steady decline in bond yields. The initial reaction to Election 2020 is a continuation of this theme. There are big tech stocks like Facebook and Amazon surging. Then the government bond yields have fallen back to where they were a few months ago.

Now that we have a result from this historic election, it’s time to turn our attention towards the future. What does this mean for the stock market and economy are we going to see more of the same? The policy outlook may be uncertain, but the outlook for the stock market might be less so.

Divided We Fall?

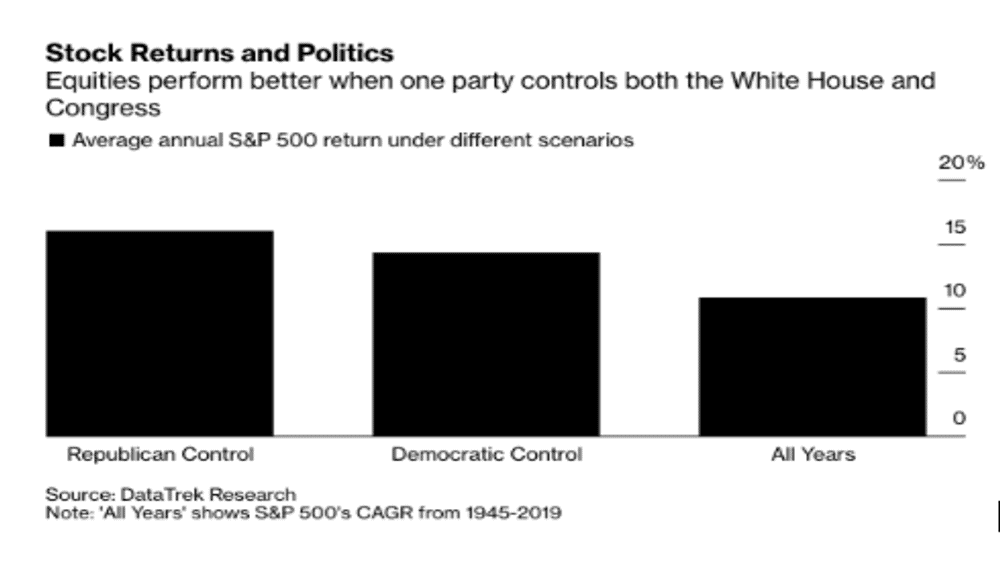

Over the course of my career I’ve heard a lot of market pundits say, “stock markets love gridlock.” The theory is that a divided government means there’s less chance of one side or the other pushing through agendas that are unfriendly to the economy and market.

Yet the data on stock market performance during divided and united governments suggests otherwise. Since 1945, average annual returns for the stock market were better when one side controlled both.

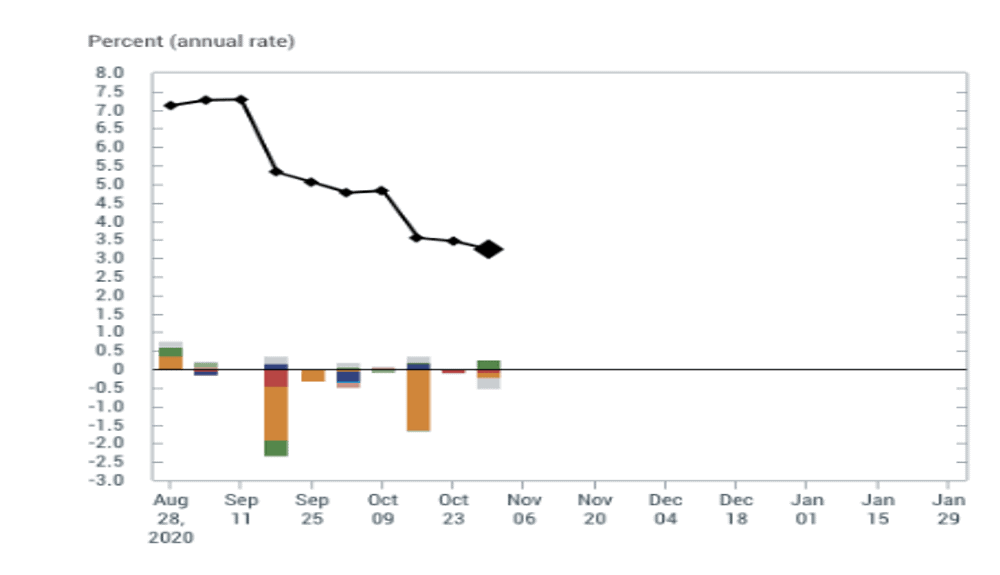

For the economy, a split government this time around is likely to be more negative. The president and Congress were unable to deliver a second round of Coronavirus stimulus before the election. States and small businesses remain under severe pressure from closures. If further stimulus continues to be held up after the election, the impact on the real economy will certainly be bad. Economists have already been slashing their forecasts for economic recovery in the fourth quarter of 2020 (source: New York Federal Reserve NowCast).

Don’t Fight the Fed (Again!)

When it comes to the stock market, we continue to point towards the Federal Reserve as the key driver. In our May 2020 newsletter, we wrote a piece entitled “Don’t Fight the Fed” which detailed how the stock market has become almost completely dependent on the course of Fed “stimulus.” If the Fed is easing policy, stocks go up. If there’s a threat of tighter policy, stocks suffer.

A divided US government means the chances of the economy getting a boost from fiscal policy is lower than it would’ve been had there been a Blue or Red wave. A lot of investors were counting on one side or the other to win decisively, which would’ve unleashed trillions of dollars of fiscal stimulus.

Without fiscal stimulus, the onus will fall to the Fed to keep interest rates near zero for an extended period of time. Furthermore, it’s likely they will continue to support the bond market by buying corporate and high yield bonds, which bodes well for stocks.

If the last 12 months of Coronavirus has taught us anything, it’s the power of Federal Reserve stimulus on the stock market. While the economy collapsed, stocks quickly recovered due to the Fed’s actions to support the market.

There’s a chance that the inability of a divided Congress and President Biden to pass stimulus is so overwhelmingly negative that stocks start to suffer as a result. But the evidence over the last 12 years has taught us that downside could be limited if the market believes the Fed will become more “unconventional” in supporting markets.

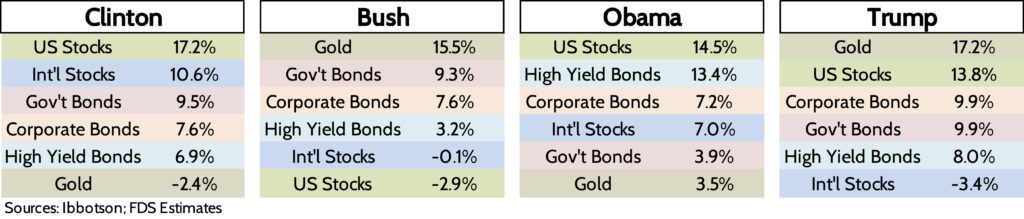

Staying Diversified

While we expect the overall investment environment to be more of the same to what we’ve seen in the last decade, different asset classes will do better than others. History bears this out, as each asset class has its day in the sun, followed by periods where it lags. A look at the annualized returns of six key asset classes over the last 4 presidential terms bears this out.

There are two main goals with having a well-diversified portfolio. First, it takes the guesswork out of where to invest. It’s impossible to consistently predict which parts of the market will outperform from year-to-year and getting it “wrong” can be costly. When you’re well-diversified, you have a toe in the water in each asset class, meaning you’ll participate in those that do well and those that lag.

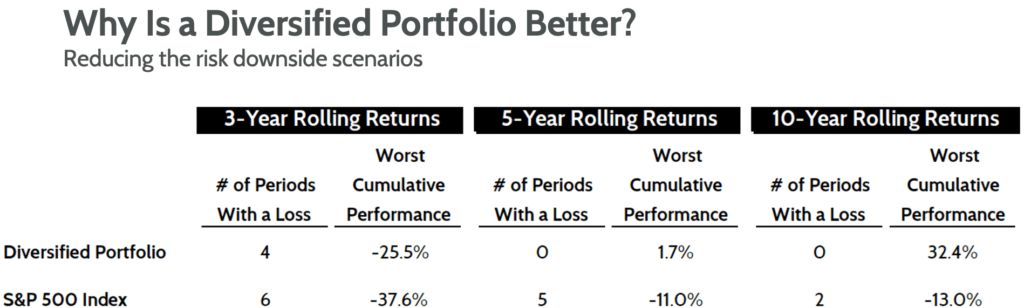

Secondly, a well-diversified portfolio is less volatile, particularly when you look at multi-year periods. In our FDS Winter 2020 event, I shared a chart of how the returns of a diversified stock portfolio compared to investing only in the S&P 500 index. While the cumulative returns from 1990 to 2019 were very similar, there was less chance of experiencing a bad multi-year outcome from being diversified.

Above, you can see there have been several cases since 1990 of the S&P 500 index delivering negative returns over various 3, 5, and 10 year periods. But the diversified portfolio hasn’t experienced a single 5 or 10 year negative return performance period. That can change, of course. But the point here is that have a diversified portfolio has well-served investors over the last 30 years.

Your Plan; Your Future

Regardless of how you feel about the results of the 2020 election, please keep in mind that your life story is not built around election cycles. The career you enjoy, the kids you send to college, and the retirement date you choose are driven by your family’s personal needs. Politics may inform your choices around some of these things – such as tax strategies – but your financial decisions are largely driven by what’s happening in your life. A life that’s unique to you.

As we stressed in last month’s newsletter, it’s important to keep your eyes on your personal goals. That’s what we’re here to help you do. We’re here to remind you of all the “whys” behind the goals you set when you first started working with us. To bring you back to those tangible goals and desires that can make a positive impact in your life, your family, and your community.

One of my favorite song lyrics is from a very old Grateful Dead tune, Betty and Dupree: “Wake up Betty, see what tomorrow brings….it might bring sunshine, and then it might bring rain.”

It’s a reminder that every day is a new day. Some of those days are going to stink. But many others are going to be great. Being able to adjust to these changing days on the fly is what makes life rich. Having a partner like FDS at your side helping you along the way helps keep your emotions in check and eyes on the thing that matters: your life story.

Ready to take the next step?

Schedule a quick call with our financial advisors.