March Madness In The Markets

by Financial Design Studio, Inc. / March 22, 2018March Madness In The Markets

This time of year brings out the pride and fan loyalty of our beloved Alma Mater’s basketball teams. Do you find your emotions on a roller coaster as you cheer on your team amid the various surprising upsets or rising Cinderella team?

This is a pretty close analogy to what we have seen in the markets this month and more prominently this week. I’ve built my brackets and now we can wait to see the outcome from the various issues going head to head with the markets.This time of year brings out the pride and fan loyalty of our beloved Alma Mater’s basketball teams.

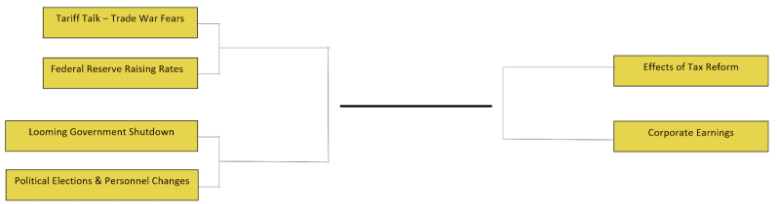

Let’s talk about all the issues that are facing up against the market.

Since President Trump introduced the ideas of tariffs on steel and aluminum we have seen increased market volatility. The tariffs also caused a change in economic advisors. But I am thrilled to see Larry Kudlow fill the role of Economic Advisor, so the outcome was positive. We still have yet to see the final decisions on who these tariffs will affect. Much of the talk lends itself to believe these tariffs are really aimed at China. Consider that the talk of these tariffs may be more to stand up for and stop any trade imbalances than really adding a tax on goods. The effective outcome of these still remains to be seen.

The Federal Reserve did continue the expected rise in interest rates with Jerome Powell’s first showing as the new Federal Reserve Chair. The expected path of interest rates rising was what the market expected to hear. So for the time being this causes less of an unknown, except for long-term impact. As rates continue to rise we will see if the economy is strong enough to withstand them.

This week specifically we have a looming government shutdown. But there is promising activity to show that both parties want to avoid this. The current bill presented would extend government funding through September 2018. At the time of writing this the House has passed the bill, so we await Senate confirmation. If passed, this would help to relieve once issue bringing volatility.

We are also beginning to see special election results, midterm election talk, and primaries in various states. This will continue to be something we watch in order to learn of anything new that could affect the market going forward. It’s too early to tell if there will be any change of House or Senate majorities. But this will be important to watch.

A Cinderella Team?

There is one “Cinderella” item that could pull us back out of the lull the market has seen this month, which is corporate earnings. With the other issues recently, people have forgotten that earnings will be starting in the next few weeks. This is our chance to see how the tax reform is affecting corporations. Will the lower corporate tax rates already start to show in company’s bottom line? It should start to make some impact. You have likely seen a larger paycheck from the tax reform changes. And this could lead businesses to see higher revenues too. Between the potential increase in spending and lower tax rates we hope to see the change reflected in earnings.

As these issues go head to head we are watching for the lasting impact of any of them. Are these merely temporary concerns that go away over time? Or will these become issues down the road as time goes on. We will keep you updated as we consider the outcomes. As of now, we still believe the bull has room to run, but headwinds will bring temporary upsets, known as volatility.

VIEW NEXT

Ready to take the next step?

Schedule a quick call with our financial advisors.