Like It Never Happened

by Financial Design Studio, Inc. / August 26, 2020

On August 18 the S&P 500 closed at a new all-time high, just six months after its previous high in February. In between, 13 million people lost their jobs and the economy contracted by 1/3. How’s it possible that stocks can be at highs when we’ve just experienced a once-in-a-lifetime economic shock? It’s almost like COVID never happened!

Initial COVID Impact on Stock Market

When COVID-19 washed ashore six months ago, the stock market experienced its fastest-ever bear market, declining by over 30% in just over a month. The recovery has been swift, with stocks posting their fastest-ever recovery after a drop of that magnitude.

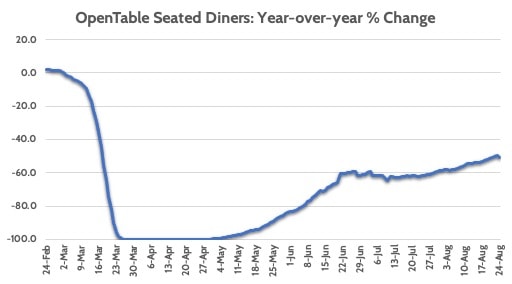

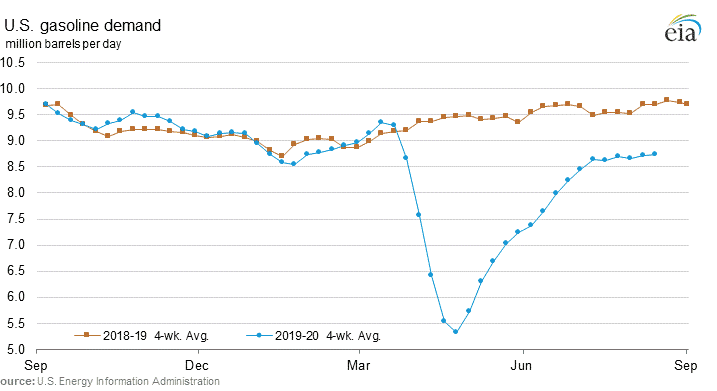

Is it because the economy has rebounded quickly from COVID-related shutdowns? Not quite. The two indicators we watch closely – restaurant reservations and unleaded gasoline demand – are still well-below where they were a year ago.

Key Indicator 1: Weekly Gasoline Demand

Key Indicator 2: Weekly Restaurant Reservations

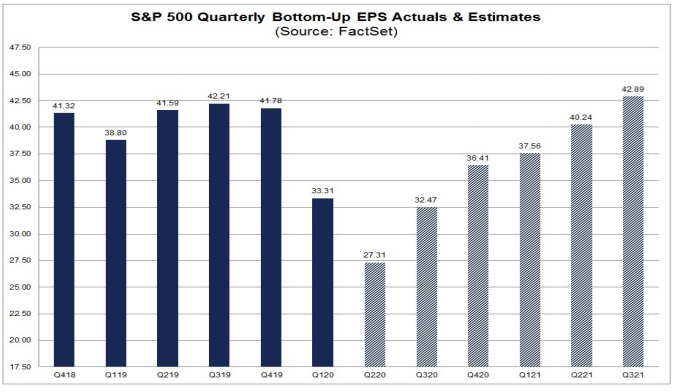

Maybe company earnings are expected to start growing again, driving share prices higher? Strike two! Analyst expectations for company earnings in the S&P 500 Index are only expected to be where they were pre-COVID by Fall 2021.

What’s Really Driving the Market Higher?

So what’s driving the market? Could it be the Federal Reserve’s ultra-loose monetary policy with a promise that it’ll stay that way for a long time? You just hit a two-strike dinger into deep left field at an empty Wrigley Field!

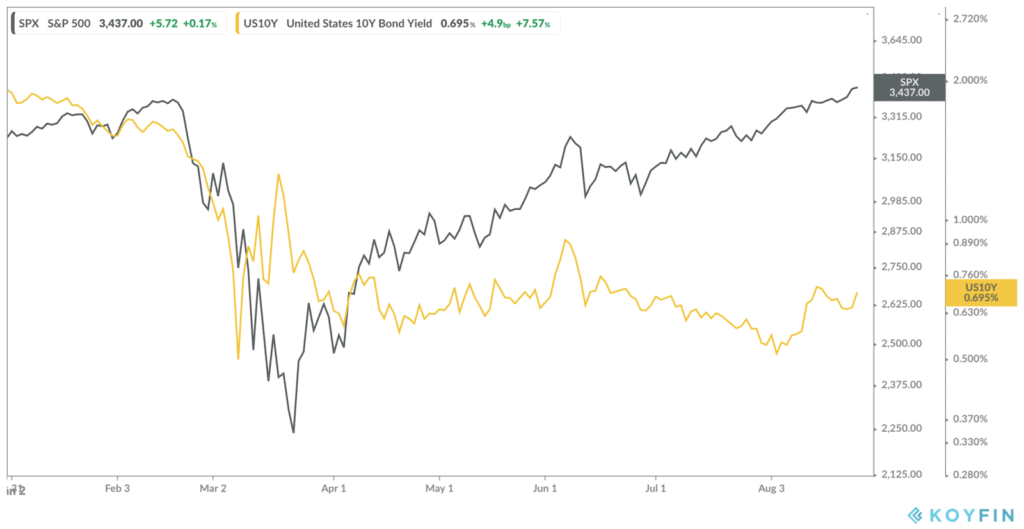

To see the impact the Fed has had on markets, we can look at the year-to-date performance of the S&P 500 Index versus the 10-year U.S. Government Bond rate.

In normal functioning markets, stocks and bond yields will tend to follow each other. As stocks go up – presumably due to economic optimism – bond yields also go up as investors expect the Federal Reserve to start raising interest rates. Conversely, as stocks go down, bond yields tend to go down as people expect the Fed to cut interest rates. It’s not a perfect correlation, but close enough.

As COVID-19 hit in late February, you can see that bond yields collapsed from 1.75% to 0.50% as stocks fell. Yields popped up a bit in March even as stocks fell due to over-leveraged hedge funds having to sell government bonds to stay solvent.

But since then, stocks have surged higher while bond yields have been stuck in a tight range around 0.65%. How can that be?

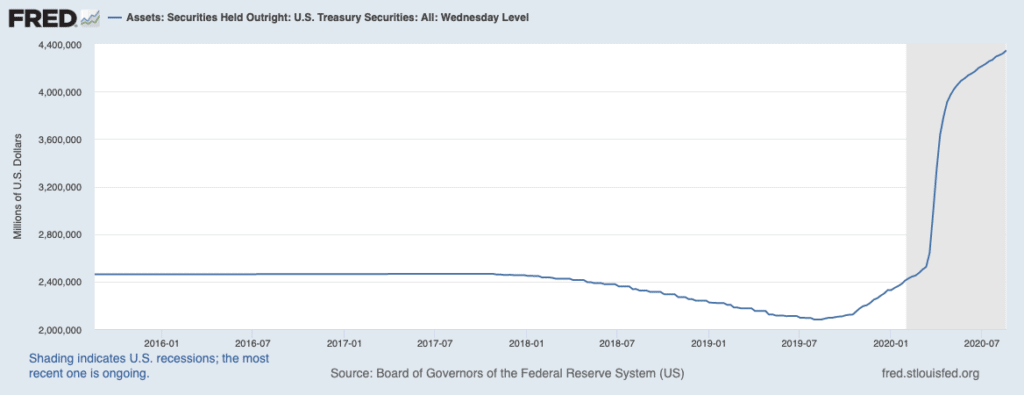

Well, the Fed has been suppressing U.S. government bond yields by buying a lot of bonds. $2 trillion worth of bonds, to be exact.

Aren’t Higher Stock Prices Always Good?

Why is any of this a problem, you might ask? I mean, stocks are at a record high, so that’s good for everyone, isn’t it?

There are two issues at hand.

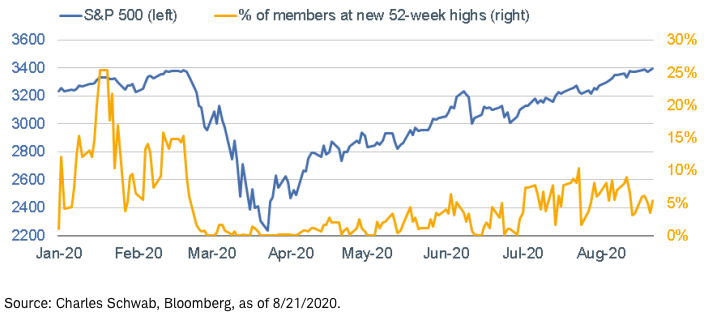

First, the market rally has been extremely narrow, driven by a small handful of stocks such as Apple, Microsoft, and Facebook. The chart below shows that while the overall S&P 500 Index hit an all-time high, only 6% of the companies in the index have stock prices at new highs. We wrote about this dynamic in our August 2020 investment newsletter. (To read about this in the August 2020 investment newsletter click here.)

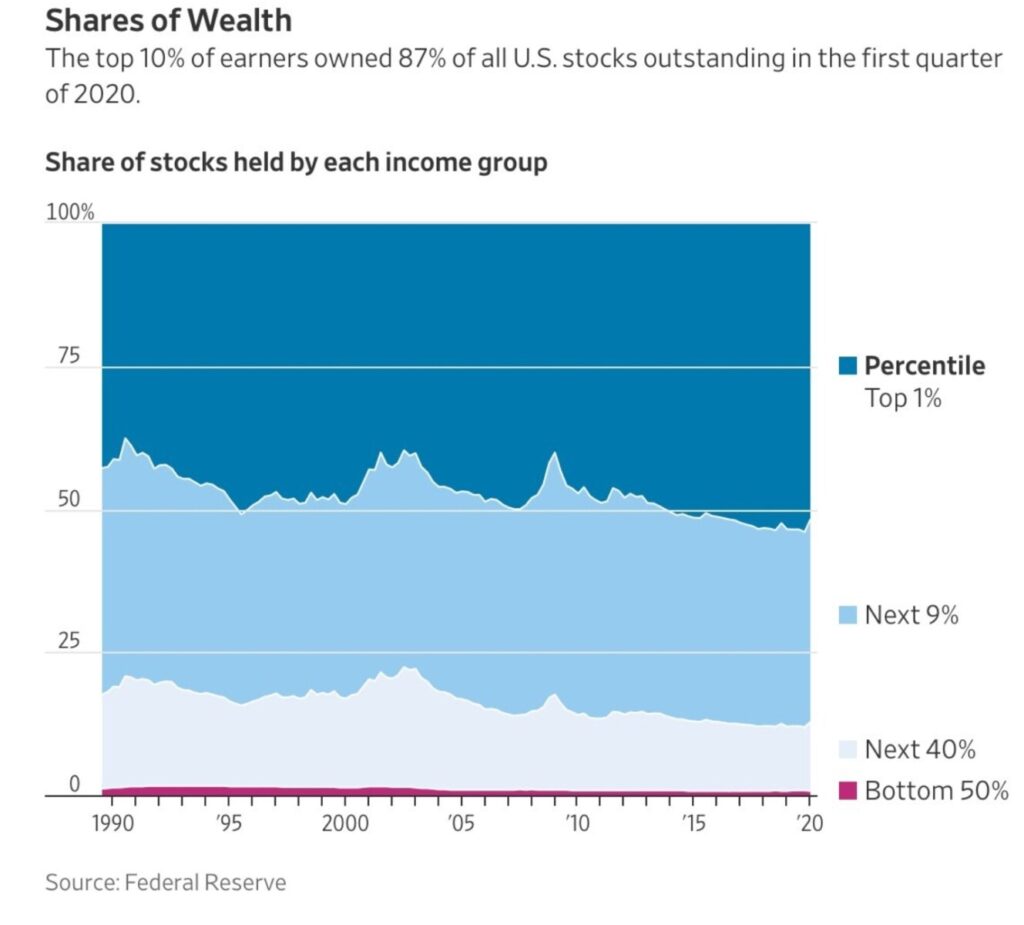

Secondly, stock market wealth is increasingly concentrated in the top 1% of Americans by wealth. As you can see here, they own over half of all stocks outstanding in the U.S. The next 9% of Americans by wealth own another 35%, bringing the share of stock market wealth of the Top 10% to 87%!

Like COVID Never Happened

Now don’t get me wrong, I’d rather see stocks going up than collapsing. Our clients (and my own family!) depend on rising stock markets to meet their long-term financial goals.

But when you look at real economic activity (dinner reservations, gas consumption) vs. what’s happening in the stock market there’s clearly a huge gap. The Fed is the one standing in the gap. They’ve pumped so much stimulus into the market that it’s like COVID never happened.

Which means, the main thing investors should be focusing on is what the Fed is saying and doing. Not even the uncertainty from the 2020 election cycle can overcome a Federal Reserve who’s got the pedal pushed all the way to the floor trying to keep the good times rollin’. Like it never happened!

Wondering how this affects your future finances? Schedule a call with Financial Design Studio, financial advisors in Deer Park, to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.