Illinois Is #1 For A Change In College Savings – In A Good Way!

by Financial Design Studio, Inc. / October 24, 2019 The State of Illinois isn’t making many “Top Ten” lists that are positive these days. But there is one Bright spot (pun intended): The Gold ranking of the Bright Start College Savings 529 program as rated by Morningstar.

The State of Illinois isn’t making many “Top Ten” lists that are positive these days. But there is one Bright spot (pun intended): The Gold ranking of the Bright Start College Savings 529 program as rated by Morningstar.

Most states sponsor a 529 college savings plan. You don’t have to live in that state in order to use its 529 savings plan. But a number of states give residents a tax break on contributions made to their home state’s 529 plans, so it’s important that your state’s plan is a good one.

Illinois happens to be one of those states.

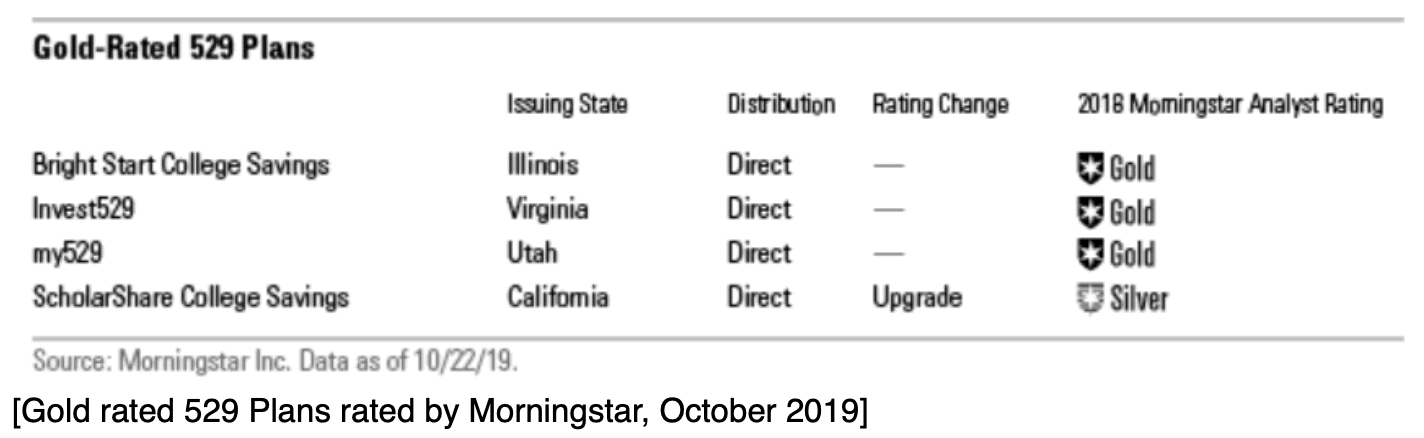

Morningstar’s latest rankings of every available 529 college savings plan in the U.S. gives the Illinois Bright Start program a Gold rating, one of only 4 plans in the U.S. to receive that rating.

It’s been quite a turnaround for Bright Start, which was mired in scandal just 10 years ago!

Key to the improvement in Bright Start is the lineup of investment choices. There is a wider array of brand name choices with low expense ratios, such as Vanguard. The state has also begun offering age-based funds which automatically reduce investment risk as the child gets closer to going to college.

Investing in a 529 college savings plan is the cornerstone of college planning for families. If you’d like to learn more about how they work or in getting one set up as part of your overall financial plan, we’re here to help!

Wondering how this affects your future finances? Schedule a call with Financial Design Studio to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.