How and Why Markets Bottom

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / June 16, 2022

To state the obvious, stock and bond markets have performed poorly in 2022. The S&P 500 index officially entered “bear market” territory this week, having dropped -20% from its January 4, 2022 all-time high. Investors opening their investment account statements to lower account values are no doubt worried about what’s going on. And this creates uncertainty, which creates the desire to “do something.” Too often, however, when investors “do something” in a bear market, it ends up costing them a lot of wealth in the future.

Our post this week is a continuation of our recent post about the anatomy of business cycles. Specifically, this post deals with how and why markets eventually find a bottom, which leads to the next bull market. Understanding the market bottoming process is critical to keeping emotions in check and sticking with your investment plan.

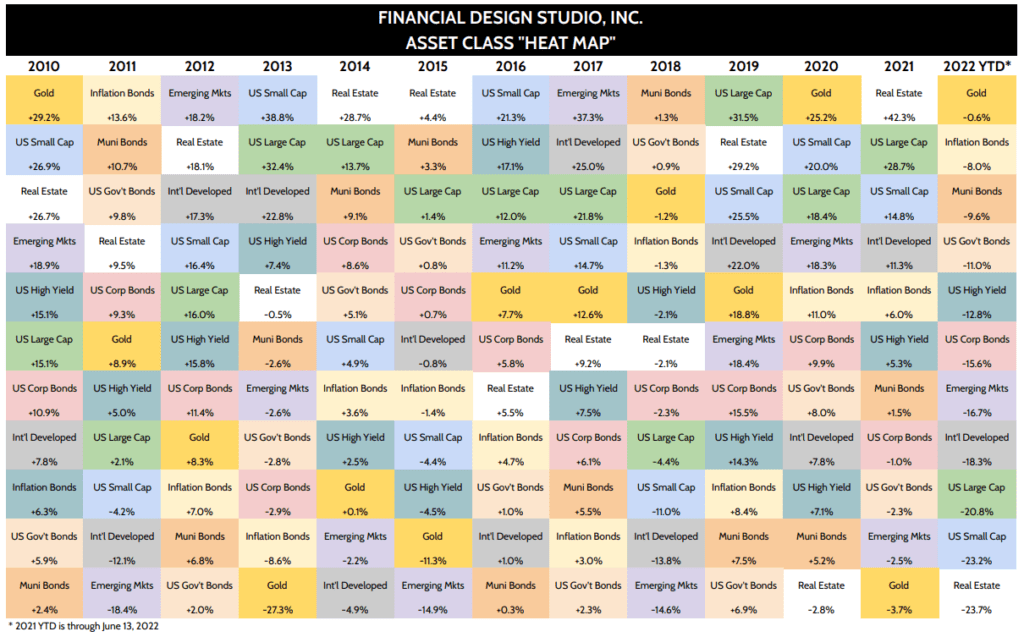

2022 Asset Class Heat Map

This has been a uniquely challenging year. In normal cycles, if stocks are suffering, investors switch to high quality “safe haven” bonds. But that’s not the case in 2022, as high inflation and rapidly tightening Federal Reserve policy have crushed bond prices. Of the major asset classes we track, none are in positive territory at this point in 2022.

Gold has been the only relative haven this year, but it’s still down 0.6% in 2022. Looking down the right-hand side of the heat map, you can see that returns quickly deteriorate, with 8 of 11 asset classes posting double digit declines.

What’s Been Driving the Bear Market?

Markets are going through tough times because the world differs greatly from what it was before. We had 30+ years of low, stable inflation rates. We’ve had 25 years of watching a Federal Reserve ride to the rescue every time stocks took a hit. As we’ve written about before, the new inflation regime we are in changes everything.

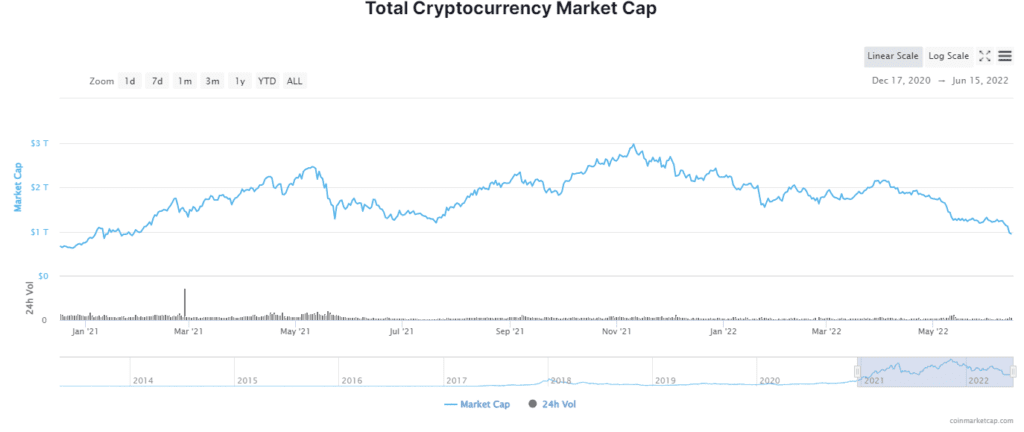

Unique to this cycle is that we had a bull market in everything leading up to it. Stocks surged. Bonds rose. Home prices rocketed higher. And an entire ecosystem of made up cryptocoins came on the scene and garnered $3 trillion of valuation at its peak.

Basically, what’s happening now is that the most speculative parts of the market are getting crushed. The total value of crypto assets has already declined by -68%, or $2 trillion. New tech IPOs that came public in 2020 and 2021 have fallen in similar amounts. These areas were by far the riskiest parts of the market and were fully supported by the Fed’s zero-rate policy and monetary stimulus launched in March 2020.

Bonds have had to re-price what it means to have tight monetary policy. As recently as August 2021, the market expected the Federal Funds rate to be 0.75% by June 2023. Today, the market is expecting that rate to be over 4.1% by this time next year! That is a massive, massive shift in expectations relative to anything we’ve seen before. This tightening is what’s driving crypto and other speculative parts of the market lower.

How Much Further Will Markets Drop?

The million dollar question on many minds is whether markets will continue to drop. No one has the answer to that. I believe, however, that the excesses of the last decade will take time to wring out of the system. That means choppy, volatile markets should be expected, potentially for a couple of years.

This is the fourth major market cycle I’ve seen in my career. 2000-2003 Tech Bubble; 2008-2009 Housing Bubble; 2020 COVID Crisis, and now.

One very important lesson I’ve learned is that the best way to avoid permanent, negative outcomes in a bear market is to make sure you’re not invested in the stuff that goes to zero. That sounds simple, but it’s an incredibly hard discipline to stick to when times are good and speculative assets are rising like crazy.

I’ve alluded to moves we’ve made at FDS to avoid problematic areas, but here are some examples:

- Avoided cryptocurrencies completely

- Reduced over-exposure to U.S. Large Cap Growth stocks

- Avoided investing in stock indexes that invest in money-losing U.S. Small Cap stocks

- Zero exposure to international bonds (Europe & Japan) which we believe to be a one-way trade to the downside

- De-risked corporate bond exposure by lowering allocations towards high-yield bonds and the lowest parts of the investment grade corporate debt market

Avoiding the worst-positioned investment assets BEFORE a bear market begins is the best way to get through a bear market. We’ve done our best at FDS to do just that for clients.

There’s a Price for Everything

One other thing I’ve learned in past bear markets is that your “safest” assets may go through periods where they perform terribly. Those are the moments that cause investors to lose hope and sell at market bottoms. If you lose confidence in what you thought was safe, then you lose all your confidence.

Why do safe assets end up getting sold in bear markets? Because often, it’s the only thing the most aggressive speculators have to sell. If a crypto investor owned some crappy alt-coin that just went to zero and they needed to raise cash, they’re going to sell whatever they own that didn’t collapse.

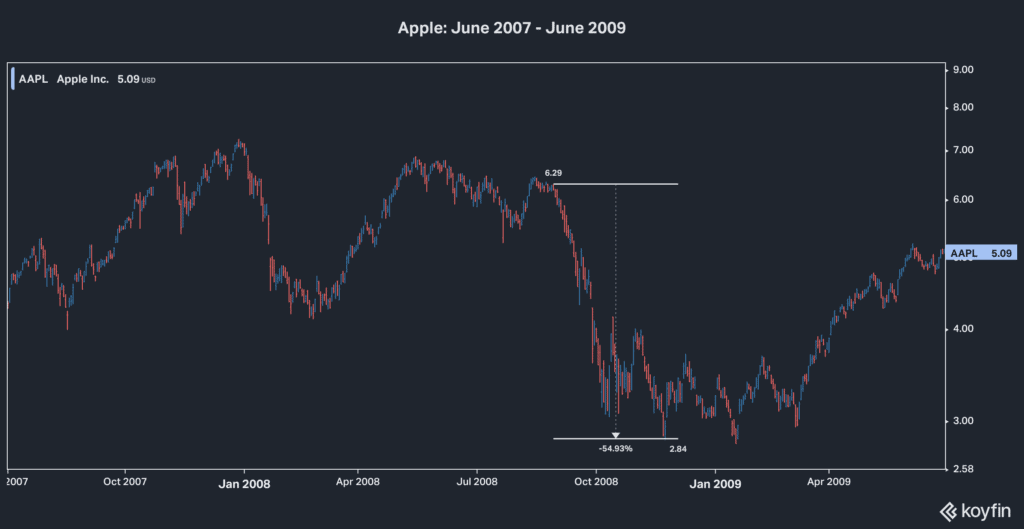

A good example of this is Apple. During the 2008-2009 bear market, Apple’s stock declined by more than half. Did Apple’s business profits collapse by half? No! In fact, Apple’s sales from 2007 to 2009 ROSE by 50% while net profit increased by 60%.

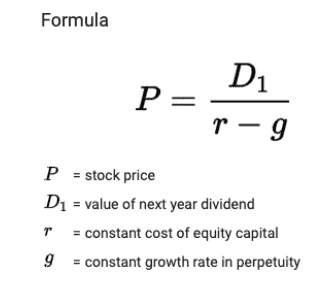

The cornerstone of fundamental investing is the Dividend Discount Model. All you need to know are three things:

- What does the company earn and pay out to investors (i.e. dividends)?

- What’s the company’s growth rate?

- What’s the cost of money, otherwise known as the discount rate?

This is extremely important to keep in mind: As long as you have confidence that a company can earn a profit, it has value. The vast, vast majority of American companies are well-run, profitable enterprises. Meaning, they have value. And if they have value, then every bear market has a FLOOR.

Investors who kept their investments conservative in the boom years are now in position to buy great stocks at great prices as other investors who are over their skis panic sell whatever they can. At FDS, we position client investment portfolios for this exact scenario. When markets bottom – and they will, wherever that may be – we want to be in a position to take advantage of these types of opportunities.

How and Why Markets Bottom

As I type this blog post, the Federal Reserve has just delivered a 0.75% interest rate hike. Stocks are reacting positively, up 1.5%. Does this mark the bottom? Who knows?

What we know is that we spend a lot of time on portfolio construction at FDS. We’re constantly on the lookout for stressed, overvalued parts of the market that create vulnerabilities for client investments. We positioned portfolios to avoid those areas as best we can to protect client capital.

We continually remind ourselves that stocks in good businesses always have a price. They have value. Other investors will hit the panic button in a bear market and sell, thinking they’re protecting themselves. But all they’ve done is cement losses, and they’re now out of the market for when it bottoms and begins a new bull market.

As much as I believe markets will be choppy for a while, I’m extremely optimistic about the long-term outlook. It’s a bit early to speculate on the reasons for that optimism, but it basically boils down to this cycle righting all the wrongs that have plagued our economy for the last 30 years, which sent the middle class into distress. The Fed will be neutered. Wall Street will be neutered. And power will be restored to the People, where it should be.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.