Higher Interest Rates are Coming

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / May 5, 2022

The Federal Reserve held a meeting this week and raised interest rates by 0.50%. This was the second hike in interest rates since March as they try to tackle our country’s inflation problem. Markets expected this move, but Fed Chairman Jerome Powell tempered expectations of their moving rates higher too quickly. Higher interest rates are coming, but how high are they going to go? And what should consumers be thinking about as rates move higher?

How Rare Is a 0.50% Rate Increase by the Federal Reserve?

The Federal Reserve held a meeting on May 4, 2022 and raised short-term interest rates by 50bp. “Bp” means “basis points” in finance and each basis point = 0.01%, so when I say the Fed hiked by 50bp that means they hiked by 0.50%.

Rate hikes of this magnitude are rare. The last time we got a hike of 50bp was May 16, 2000. That would prove to be the last rate hike for the Fed in their battle against a runaway tech stock bubble. However, rate hikes of 50bp or more were much more common in the 80s and early 90s when the Fed’s number one fear was inflation.

More 50bp rate hikes are coming, as confirmed by Fed Chair Powell during his press conference.

Why is the Federal Reserve Raising Interest Rates?

The Federal Reserve has two “mandates” given to them by Congress: Full Employment and Price Stability. Currently, the unemployment rate is amongst the lowest it has been over the last several decades. “Full employment” has been achieved.

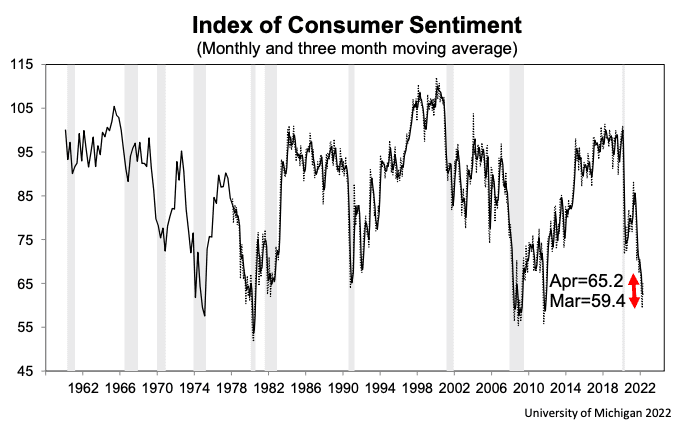

Inflation has been a different story. It has surged to 40-year highs, climbing to a remarkable +8.5%. Interestingly, consumer confidence has collapsed to lows last seen in 2008 when inflation was low, but unemployment was over 10%. So despite plentiful jobs, consumers are very unhappy about the cost-of-living increase.

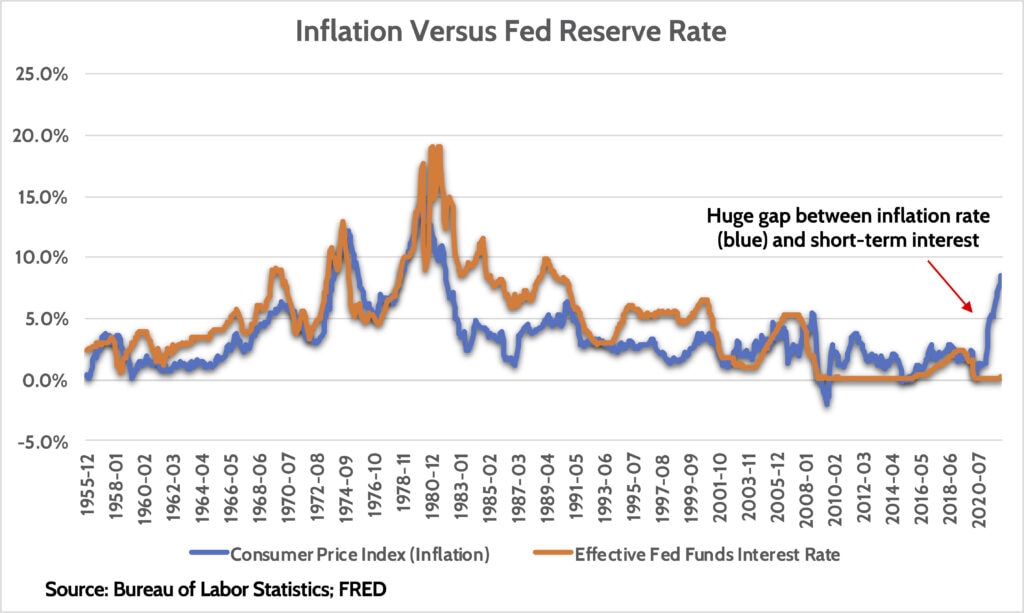

The Fed has finally realized that it needs to tackle inflation. For far too long (14 years, to be exact) they’ve kept short-term interest rates at or near 0%. It has been one of the longest stretches ever where the Fed kept short-term interest rates below the rate of inflation.

Why are they raising interest rates? It’s because it’s the #1 tool for controlling inflation.

Interest Rates Affect the Economy

The Fed’s main “tool” is that they control short-term interest rates. That tool influences – directly and indirectly the cost of money across our economy, from business loan rates to mortgage rates. For most of the Fed’s history, they’ve used this tool to “fine tune” the economy. If it was running too hot, they’d raise interest rates which would cool demand for loans which would cool the prices of the things those loans would buy. If the economy was in recession, they’d lower rates to spur economic activity.

For most of the last 70 years, short-term interest rates (orange line) have been higher than the rate of inflation (blue line). Other than the 1970s, when Fed policy and government spending was too “loose,” this policy of keeping short-term rates above the level of inflation kept inflation in check.

Until a new team of academics took over the Fed in the early 2000s and experimented with new, unconventional policies. Since 2000, short-term interest rates have largely been below the level of inflation. Which didn’t matter to inflation too much until the COVID pandemic unleashed a level of government spending we’ve never seen outside of wartime periods.

For investors and consumers, it’s important to consider how unique the last 14 years have been. With the cost of money being held close to 0%, the cost of borrowing plunged. Business loans, car loans, credit cards, and mortgages alike saw interest rates drop to all-time lows.

When the cost of money is cheap, you buy more. A more expensive car and a more expensive home are easier to stomach when your financing costs drop. Higher sustained inflation means higher interest rates, which means lower spending in the future!

How High Will Interest Rates Go?

Speculating about how high the Federal Reserve will take interest rates is the discussion of the day for investors. How high can they take rates until the economy goes into recession? How high can rates go before stocks go down too much?

Fed Chair Powell takes great pains to avoid answering that question. But bond investors are constantly making their “bets” on the forward path of interest rates. Here’s what the market is saying:

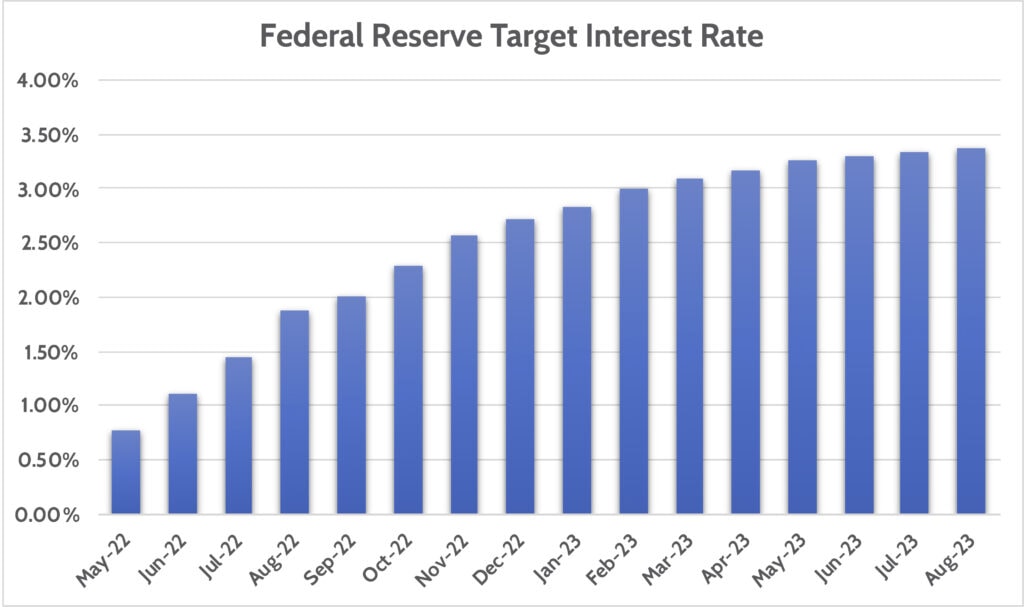

If we look at interest rate “futures” we can back into what the market expects the Fed to do. Currently, the Fed has short-term interest rates set just below 1.00%. But look at what the market is expecting.

- 2.00% by September 2022

- 2.75% by December 2022

- Nearly 3.50% by next Summer!

If the Fed actually increases rates that far and that quickly, it would represent the fastest tightening cycle in four decades. Whether they actually do it remains to be seen. While the market has made its “bet,” markets can be wrong.

My view is that rates won’t get that high in this first round of fighting inflation. I’m convinced we’re in a new regime where inflation is higher and stickier. But inflation will come and go in “waves.” I believe we may be close to the end of Wave 1. As inflation ebbs later this year, the Fed will have room to become “dovish.”

Implications for Investors and Consumers

For consumers, the implication is clear: higher cost of living and higher financing costs are going to crimp spending. It was just a few months ago that consumers were frantically out-bidding each other on home purchases. Home prices surged. But mortgage rates have gone over 5% now, which significantly impairs one’s ability to finance higher prices.

Investors are suffering through one of the worst starts for stocks and bonds in a long time. Under normal circumstances, if stocks are falling, bonds are holding up, providing “ballast” for portfolios. But as interest rates adjust from abnormally low levels, bond returns have also been negative.

It’s been hard for investors to hide out this year. But at the risk of looking foolish for writing this, I suspect bonds will be first to find stability. As seen in the chart above, there are A LOT of rate hikes built into the market. And if our thesis that inflation in the next several months cools, then that will take a lot of pressure off of bonds.

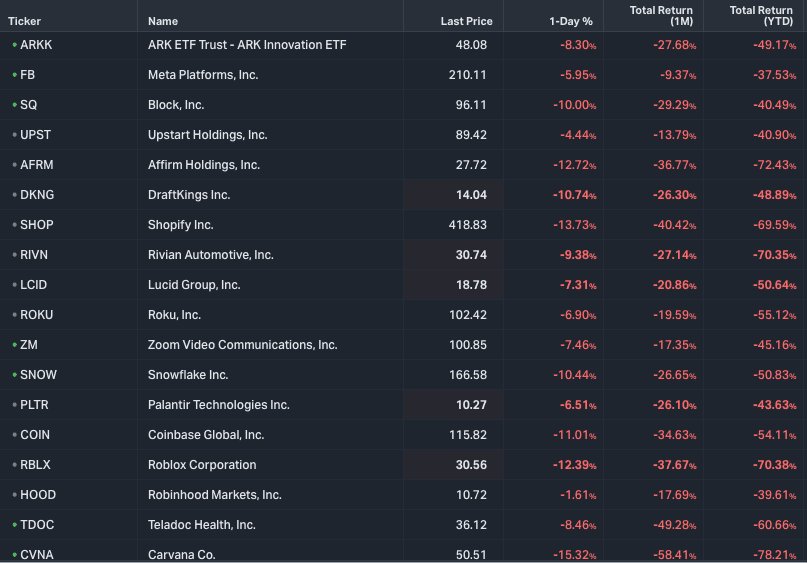

Stocks are trickier. This new, higher inflation environment turns the investments world as we’ve known for the last 14 years on its head. 0% interest rates make it very easy for investors to speculate on growth stocks, particularly companies that recently went public. Already, many of the high-fliers of 2021 have dropped 30-70%.

I started my career in the late 1990s and remember all too well what happened to the “dot-coms” of that era. Most of them had unsustainable, unprofitable business models. Their stocks dropped massively in 2000-2001 and never recovered. While each company you see above has various degrees of potential future success, I suspect many will never come close to their old record stock prices.

In markets such as this, the key for stock investors is to make sure you’re well diversified and not exposed to the craziest parts of the market, such as large cap growth stocks. We at FDS made moves in our client portfolios a year ago to reduce exposure to parts of the market we felt were in unsustainable territory.

Investors need to remind themselves of their investment time horizons. If you’re in your 20s, 30s, or 40s, you have a very long time until you’re touching your retirement accounts. Plenty of time to ride out near-term downdrafts. Even for retirees, it’s important to remember that your own time horizon in retirement can last 20 years or more, which again gives you time to ride out volatility in the market.

Don’t Forget History

We don’t discount how disconcerting it is for investors to open their monthly statements and see values dropping. Saving money for the future is hard and has a real, present day cost. No one wants to see $100 saved turn into $90 a month later.

In times like this, I always go back to history. Societies and markets go through cycles. While each cycle is different and has its unique characteristics, I agree with what Mark Twain once said: that while history doesn’t repeat, it tends to rhyme.

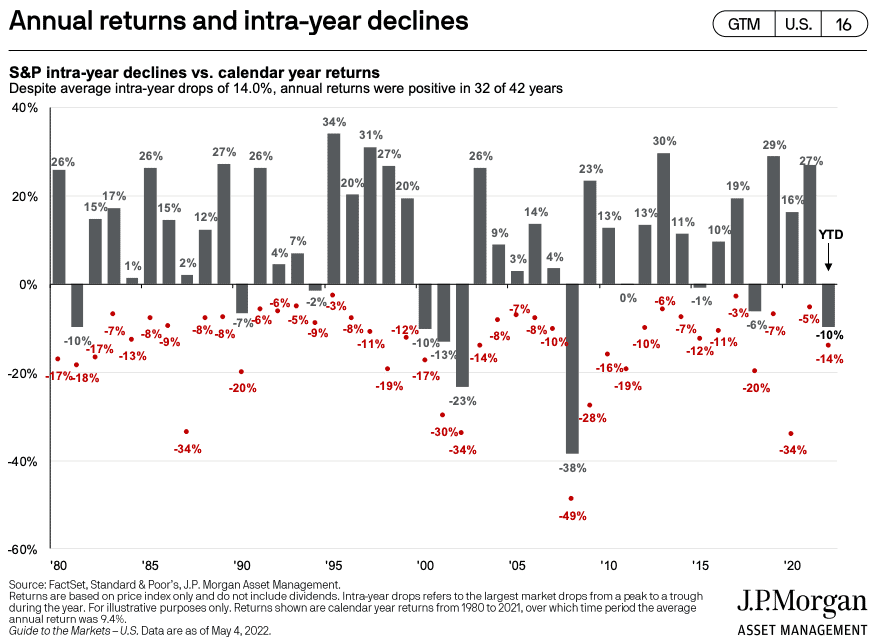

In the last 42 years, there have been 10 years with negative returns. There have been 16 years where stocks were down on the year as much or more than they currently are today (-14%). Put another way, we’re not in “uncharted territory.”

The Fed also goes through cycles – easing and tightening. They’re in a tightening cycle right now. But tightening cycles always lead to easing cycles down the road. Investors that are patient and attentive to their investments are the ones who generate the best long-term returns. Our job at FDS is to do that investment work for you.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Preparing to Transition to Retirement [Video]

In this video, Stephanie Geisler, LPC, discusses how to work through emotions of financial choices of making the transition to retirement.

Impactful Giving: Tax Strategies and Vetting Charities [Video]

We all want to make a difference with impactful giving. In this video, find out how to evaluate charities and employ tax-efficient strategies.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.