High Cost of Healthcare in Retirement

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / April 21, 2022

When most people think about retirement, their thoughts are on leisure pursuits, spending time with family, or serving organizations they’re passionate about. In the back of our minds is the reality of getting older and maybe having health issues. Retirement savings sustain our current lifestyle beyond our working years. But it’s important to understand how the high costs of healthcare in retirement factors in the mix as well, even if you’re young!

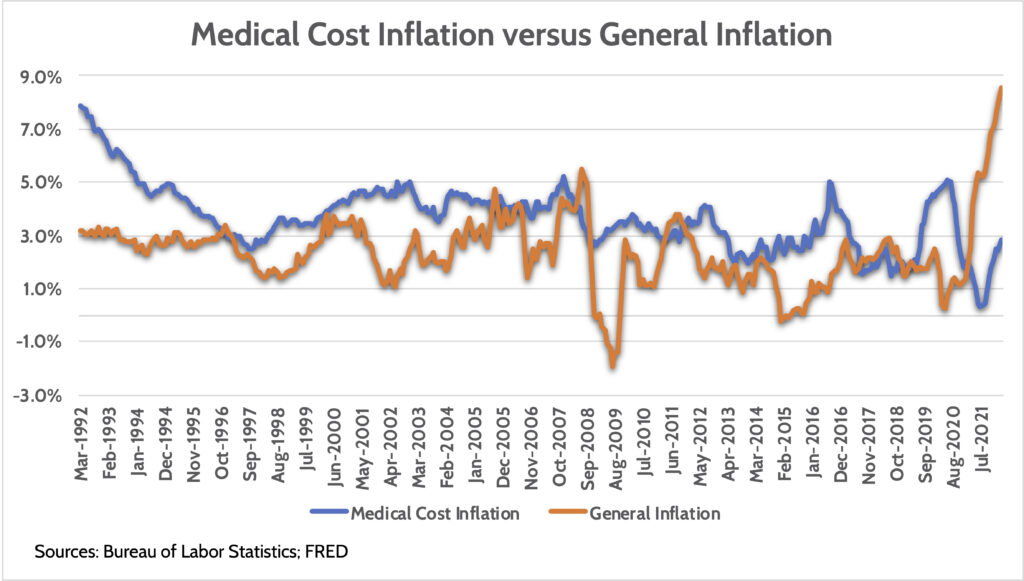

Challenge 1: Persistently High Medical Cost Inflation

It’s safe to say that all of us are very aware of the high cost of medical care in the United States. When you add up insurance premiums, copays, coinsurance, and prescription costs, medical costs can eat up a meaningful portion of our budgets.

Medical cost inflation has consistently outpaced general price increases for over 30 years. How long that will continue is impossible to predict. But as we’ve seen recently with the cost of college tuition, there’s usually a point where costs are so high that demand falls, which limits future price increases.

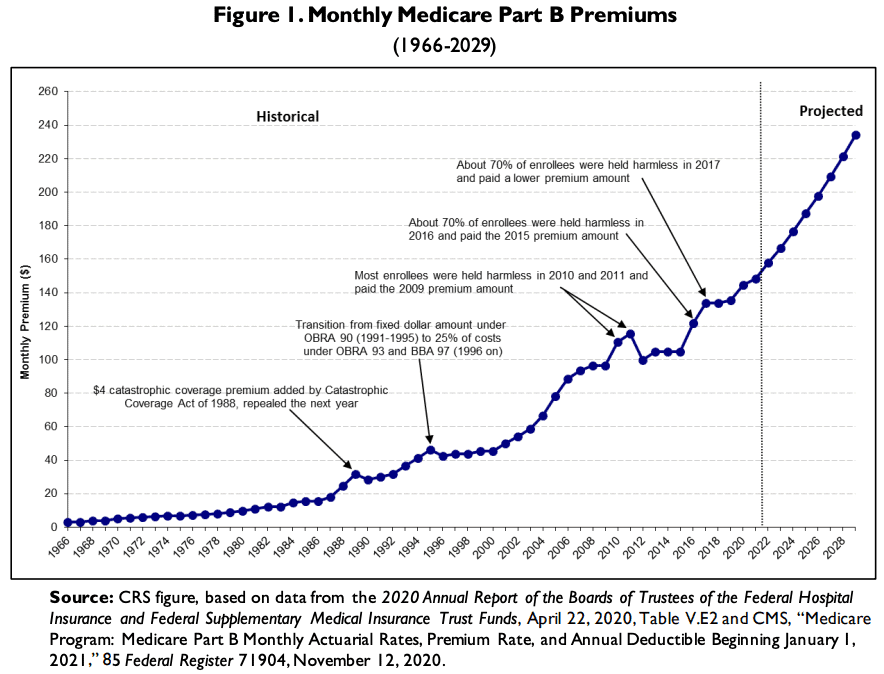

Challenge #2: Medicare Part B Premium Inflation

Every American is required to enroll for Medicare at age 65 unless you’re still working and are covered by an employer healthcare plan. That means paying for Medicare Part B premiums and additional coverage through a more comprehensive Medicare Advantage plan. While Medicare Advantage premiums vary widely, like health insurance, Medicare Part B premiums are clearly spelled out.

Not unlike medical cost inflation, Medicare Part B premiums have consistently increased at a higher rate of inflation. Since 2000, Medicare Part B premiums have increased an average of +6.0% per year. Worse, premiums increased from $148/month to $170/month in 2022, a 15% increase!

Given that everyone is required to enroll in Medicare at Age 65, taking these costs into account is important. This is especially the case if you’re expected to have higher income in retirement, as the government charges you higher premiums based on your income.

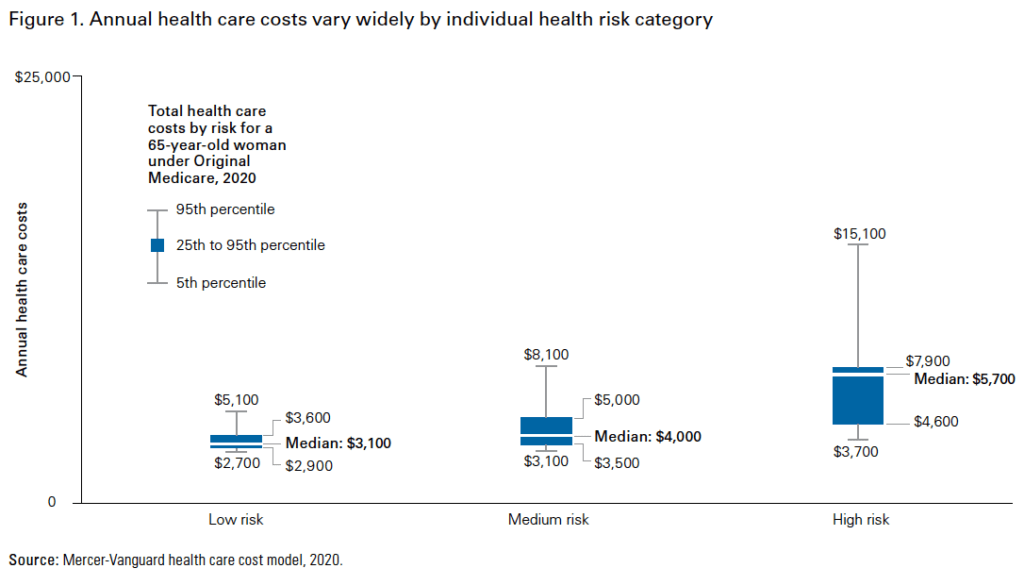

Challenge #3: Estimating Individual Medical Expenses in Retirement

The biggest challenge with estimating future healthcare costs is they depend on each person. Some people will go through life rarely having to visit a doctor. Others are afflicted with chronic diseases with high treatment costs.

As seen in this chart from consulting group Mercer, there are wide ranges in potential medical costs for a 65-year-old. Not only is the difference between low risk and high-risk individuals wide, but the costs within each of those categories are wide as well!

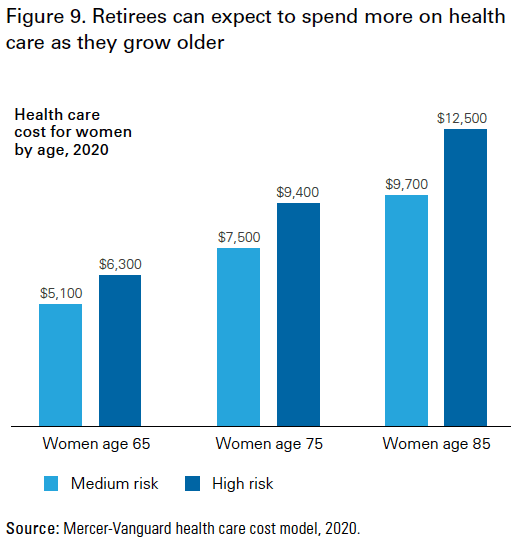

What we know is that costs increase as you get older, which makes sense. Annual medical costs when you’re 65 are almost certainly going to be lower than when you’re 80.

Costs increase faster in the first 10 years of retirement (i.e. from age 65 to 75). Knees, joints, and other body parts that weren’t “broken” at age 65 break down. Your usage of medical care services rises with each year you get old.

Challenge #4: Long-term Care Expenses

The final big challenge with estimating future healthcare costs in retirement is long-term care. There’s a lot under the umbrella of “long-term care.” But in general, this means assisted living or memory care – either in your home or in a nursing facility.

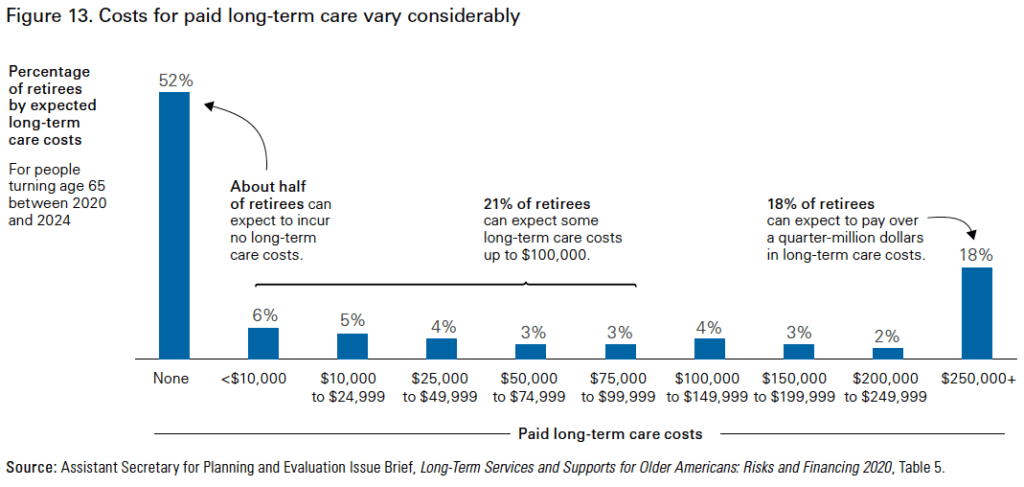

Much like estimating an individual’s health care costs in the future, estimating their need for long-term care is extremely difficult. Why? Based on statistics, about half the population won’t need long-term care when they’re older. But the other half of the population that does can incur very high costs.

Trying to come up with an “average” cost for long-term care is impossible. Think about the various potential outcomes:

- 52% chance of not needing long-term care at all

- 21% chance of needing long-term care costing less than $100,000

- 9% chance of needing long-term care that costs between $100,000-$250,000

- 18% chance of needing long-term care that cost more than $250,000

The bad news with long-term care is that it’s getting prohibitively expensive to buy long-term care insurance to cover this cost. In the 1990s and early 2000s, long-term care insurance was the new “growth thing” in an insurance industry that rarely grows. Carriers gave out policies like candy, only to realize they terribly mis-priced these products. Since then, premiums have skyrocketed and coverage has fallen, making these policies less useful.

How to Estimate Healthcare Costs in Your Retirement Plan?

You’ve seen the challenges with trying to estimate healthcare costs in retirement. So how do financial planners do it?

We like to separate these challenges into two buckets: what we know and what we don’t know. What we know is the cost of Medicare Part B premiums. Everyone has to pay for those. And we know that historical inflation is around 6.0% per year. So we explicitly build that cost into every client’s retirement plan.

What we don’t know is how much medical care you’ll need and whether you’ll need long-term care. To model these in retirement plans, we run various “stress tests” on your plan, assuming you have elevated healthcare costs. That might show up by assuming $100,000 per year for assisted living for 5 years. Can your plan handle that expense? That’s the question we try to answer by stress testing.

How to Prepare for High Cost of Healthcare in Retirement: Health Savings Accounts

If you’re under the age of 50, please listen up! You might have a great savings tool available to you that allows you to save for high healthcare expenses in retirement. It’s called a Health Savings Account, or “HSA” for short.

If you have a high-deductible health plan (“HDHP”) you’re eligible to open an HSA. Many employers offer these plans, but you can also open one if you’re self-employed and have an HDHP. What is the benefit of an HSA?

- You can contribute to an HSA up to $7,300 for a family or $3,650 individually, tax-free. Meaning, you’re able to deduct these contributions on your tax return.

- HSA contributions can be invested for long-term growth, and that investment growth is also tax-free.

- Withdrawals from an HSA – used to pay for medical expenses – are tax free.

You see “tax free” mentioned three times. That’s why HSAs are said to have a “triple-tax advantage” unlike any other account.

Most participants in HSA plans will make contributions each year but then pull that money out as medical expenses come up. There’s nothing wrong with that. Effectively, they’re paying their medical expenses with pre-tax money, booking tax savings of 20%+ depending on their tax bracket.

However, we advise younger clients to think of HSAs strategically. We know you’re going to have medical expenses in retirement. We know those costs might be really high. What if we used the HSA as a quasi-retirement account whose future value is dedicated to paying your future medical expenses?

You would contribute money to an HSA, but instead of spending it each year, you’d invest it for long-term growth, just like your 401(k)s and IRAs. Then, when you’re retired, you have a dedicated source of savings to deal with any medical expenses that come up when you’re older. Remember, the cost of long-term care insurance is prohibitively expensive for many people these days. An HSA invested for retirement allows you to “self insure” the risk you’ll need expensive long-term care.

Understanding the Risks, Preparing for the Future

There are many challenges with retirement planning. Estimating your future healthcare costs is one variable that can make or break your retirement plan.

We’ve seen the challenges of trying to estimate what these costs will be many years into the future. Despite that, we can help you “stress test” your future retirement using a wide range of assumptions. That way, you’ll know whether you need to save more for those contingencies.

For our “young” Under 50 readers out there, a Health Savings Account is a great tool to insure yourself against the risk of high healthcare costs in retirement. Treat HSAs just like your 401(k) or IRA – invest aggressively for the long-term and let those funds grow. That way, if you have high medical costs when you’re older, you’ll have comfort knowing you have a dedicated pool of funds to draw from to deal with those costs.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Preparing to Transition to Retirement [Video]

In this video, Stephanie Geisler, LPC, discusses how to work through emotions of financial choices of making the transition to retirement.

Everything to Know About Health Savings Accounts

Health Savings Accounts have been around for 20 years but are often misunderstood and underutilized. HSAs are powerful savings tools to cover future medical expenses, such as long-term care, or to help fund healthcare for early retirees. We explain everything you need to know about health savings accounts: what they are, how contribute to them,...

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.