Friday’s Financial Update 6-30-2017

by Michelle Smalenberger, CFP® / June 30, 2017MICHELLE SMALENBERGER, CFP®

You have likely given more thought to your summer vacation plans this week than to the performance of the financial markets. That’s because this week has been relatively quiet. That means the market has left it to our 4th of July celebrations to provide the fireworks instead of any market headlines!

Investors waiting to hear reports of how the economy and companies are doing can cause anxiousness and therefore more volatility. We have seen intra-day swings in the market of 100 or 200 points up and down recently. When we aren’t being reminded of how weak or strong our economy is we can begin to wonder if things are really as good as they seem. This can lead to more volatility since some investors may begin taking profits ahead of uncertainty. Some may be using this time to rotate in and out of sectors that have traded more or less favorably.

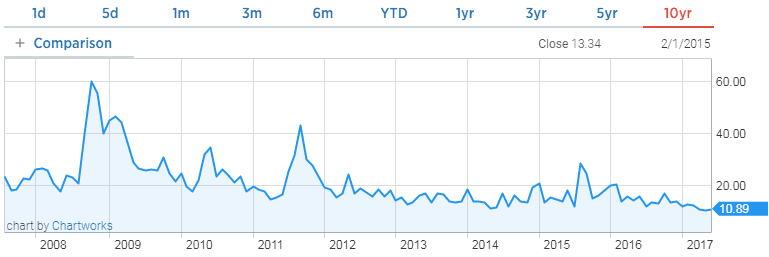

There is an index that tracks market volatility which is known as the VIX. As seen below, you’ll notice how this has changed over the years. The large spike in 2008-2009 is due to the Financial Crisis. This helps to provide a reference for the 10-year lows we are seeing in the volatility index today.

As a reminder, investing in the market does bring risk. And the VIX can help to show how investors “feel” about the risk they are assuming as they desire their portfolios to grow.

As a reminder, investing in the market does bring risk. And the VIX can help to show how investors “feel” about the risk they are assuming as they desire their portfolios to grow.

Even when volatile days come and go, it is important to stay disciplined with your diversified portfolio. Perhaps, like the lack of economic reports in the news this week, you are unplugging and enjoying some time away from work while this beautiful summer weather is here.

We wish you a happy and safe Independence Day!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Understanding Stock Market & Economic Cycles

Do you remember what an economic cycle looks like? In this week's post we help you understand stock market & economic cycles and what they mean for investors.

2022 Was Tough, Will 2023 Be Better for Investors?

Will 2023 be better for investors? They just suffered one of the worst investment years ever in 2022. There are reasons for hope in certain parts of the stock and bond market. We give our thoughts on the chances of a recession and path of interest rates in this opening post of 2023.

Michelle Smalenberger, CFP®

I have a passion for helping others develop a path to financial success! Through different lenses on your financial picture, I want to help create solutions with you that are thoughtful of today and the future. I have seen in my life the power of having a financial plan while making slight changes of direction from time to time. I believe you can experience freedom from anxiety and even excitement when you know your finances are on track.