Filling Out The FAFSA Form

by Financial Design Studio, Inc. / October 1, 2022In the previous getting started FAFSA resource, we walked you through the key reasons for filling out the 2023-2024 FAFSA form for your college student(s), and how getting an FSA ID is a key first step to fill out the FAFSA itself. If you’re planning on filling out the 2023-2024 FAFSA and haven’t gotten your FSA ID yet, make sure you visit the getting started FAFSA resource to see how to do that!

In this week’s post, we will walk you through the 2023-2024 FAFSA form application so you can see what to expect as you begin the application process with your student. Since every family’s situation is different, I’m not going to dive into every single question you may have. The FAFSA site has a nice instruction guide that you can reference as you go through the FAFSA application.

Quick Note on the CSS Profile

When getting ready for college you may come across another form called the CSS Profile. CSS stands for “College Scholarship Service.” I’m not going to go through the process of filling out a CSS Profile here, but want you to be aware of it.

The CSS Profile is basically a more in-depth version of the FAFSA form that digs further into your financial situation. If your student wants to apply to a school that requires a CSS Profile, they will have to fill out both a FAFSA form AND a CSS Profile.

What schools require a CSS Profile? If your child plans on applying to any of the schools on this list, then they will also have to fill out a CSS Profile. Check with each school to see what their specific rules are.

Helpful Links When Filling Out the 2023-2024 FAFSA

- FSA ID Website: https://studentaid.gov/fsa-id/create-account/launch

- How Financial Aid Works: https://studentaid.gov/h/understand-aid/how-aid-works

- FAFSA Site: https://studentaid.gov/h/apply-for-aid/fafsa

- FAFSA “Who is my Parent?” Infographic

- FAFSA Help Line: 1-800-4Fed-AID (1-800-433-3243)

Things You’ll Need to Fill Out the 2023-2024 FAFSA

The 2023-2024 FAFSA season begins on October 1, 2022. I suggest getting this done as soon as possible (i.e. in October) so your student can focus on filling out college applications. Let’s say that again for emphasis: **Please try to complete your FAFSA by the end of October.** There is a lot of financial aid out there but much of it is first come, first serve. By filling out the FAFSA early, you may also become eligible for school-specific grants that are made on a first come basis.

Here is a general list of what you need as you fill out the FAFSA. Given it can take upwards of one hour to complete the form, I suggest gathering all this data before you start the FAFSA process.

- Student & Parent Social Security Number

- Student & Parent’s 2021 Federal Tax Returns (see below…can electronically import as well)

- Bank statements for parents & students (checking, savings, and CD accounts)

- Value of any real estate owned, other than your primary home

- Investment account statements for parents & students (mutual funds, stocks, and bonds)

- Value of UGMA & UTMA accounts

- Value of 529 Savings accounts

- FSA ID of parent & student (see here for how to get your FSA ID)

- A list of the schools your student wants to apply to

Note what financial information is NOT needed:

- Retirement accounts (IRAs, Roth IRAs, 401k, 403b, etc)

- Cash value life insurance

- Equity in your primary home

How to Apply for FAFSA

Every year the Federal Government changes the application process a bit. In the last couple of years, they’ve launched apps that allow you to fill out FAFSA on an iPhone/iPad or Android device. But guess what?! They “retired the apps in June 2022, so you’ll have to use a web browser to complete the application.

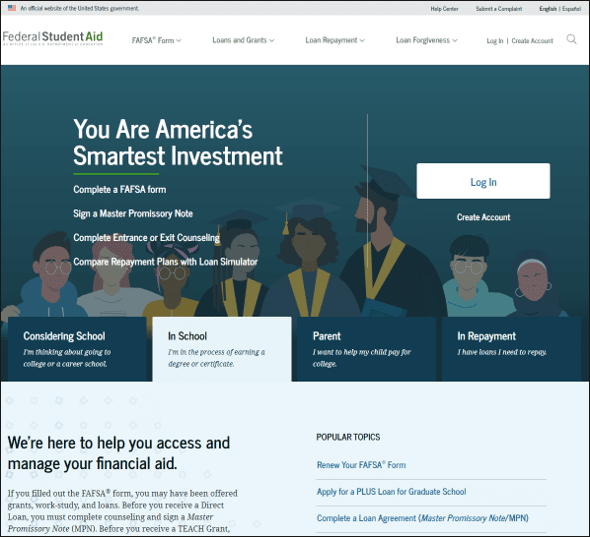

Step 1: Log in to FAFSA Site

When you go to the website, make sure you click “Start Here” under the “New to the FAFSA Process” heading, even if you’ve filled out FAFSA in prior years.

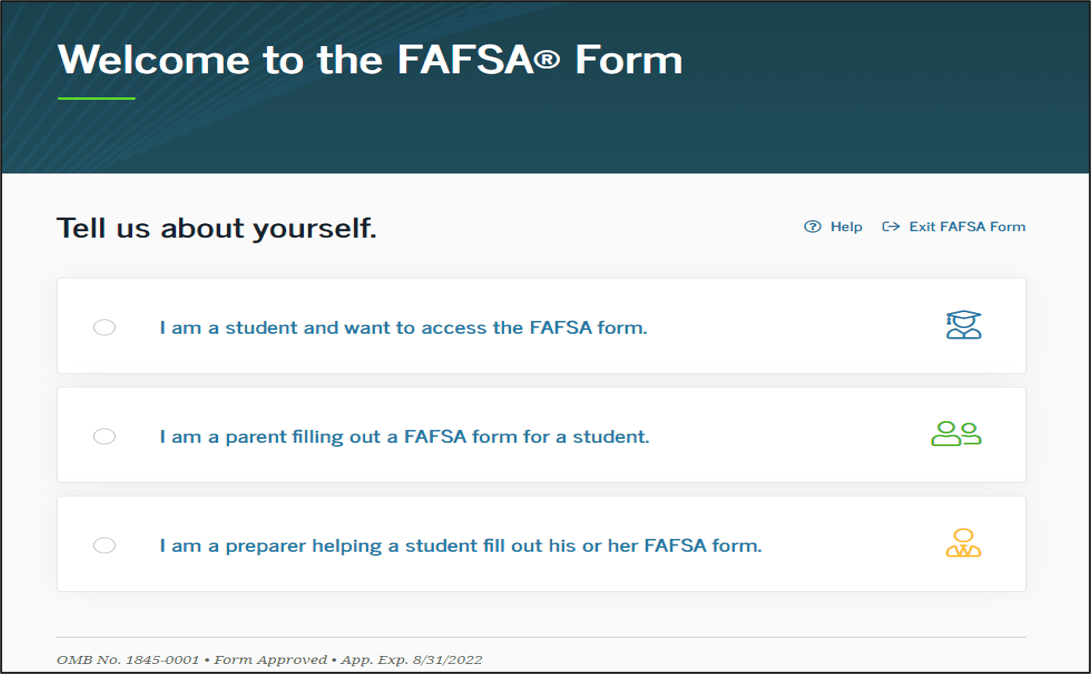

Step 2: Enter Student Information

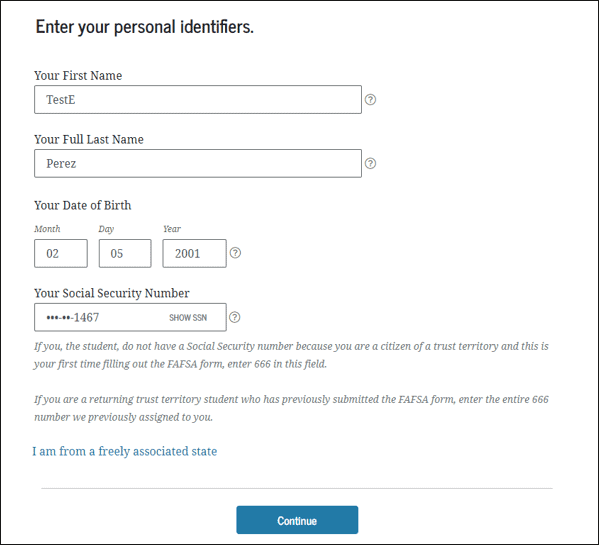

Note! All information you see on these screenshots is using dummy names, Social Security numbers, and other information, all of which are provided by the Department of Education for the sole purpose of being able to see the FAFSA process. No one’s personal information is being compromised here!

The first thing you’ll need to fill out are “Student Demographics.” This will be done on a series of screens as you click Next. Remember, all of the information you’ll provide is for the STUDENT, not you, the parent. Here is a list of information you’ll need:

- Name & Date of Birth

- Student Email and Phone number

- Home address and confirmation of state residency (Note: if you moved to a new state within the last 5 years, be prepared to give FAFSA the month and year that you moved.)

- Student Selective Service (are they registered for Selective Service or not?)

- Student driver’s license

- Parent’s educational history; highest completed schooling

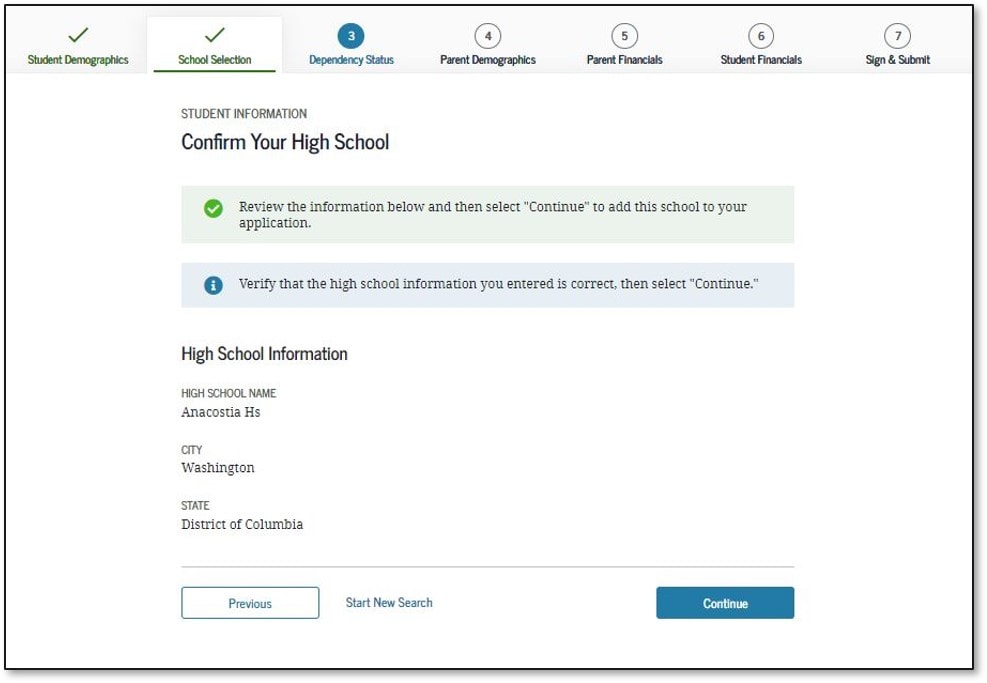

You’ll eventually come across the screen below where you’ll enter where the student attended high school. If your student’s high school doesn’t pop up on this screen search, then you can add it manually on the next screen.

Once you’ve entered all this information, hit “Continue” and it will save your application and bring you to the School Selection tab, where your student will enter the colleges they wish to attend.

Step 3: Select Colleges to Attend

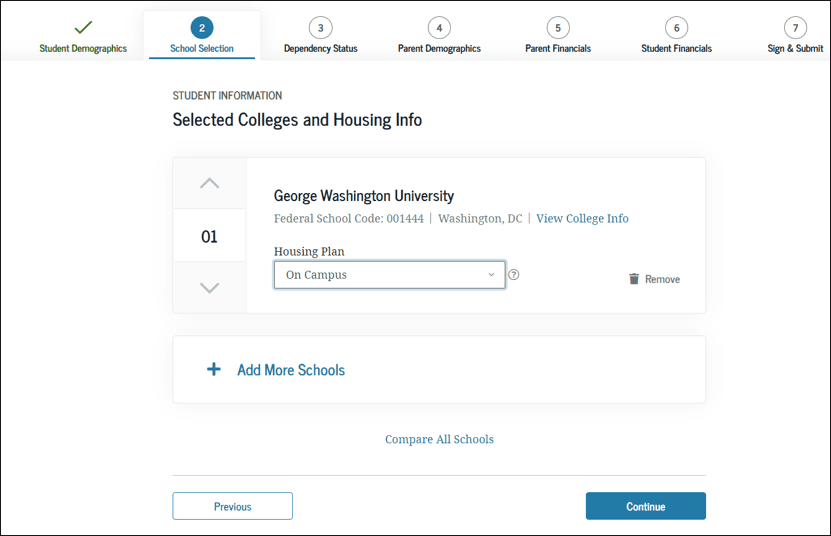

FAFSA allows you to send your FAFSA Application to up to 10 schools. You can send it to more than 10 schools, but that has to be done separately from the initial application process we’re doing here.

There’s no cost to send your FAFSA information to colleges. So if your student has even the slightest desire to apply to a particular college, they should add that college in this part of the FAFSA Application. Most high school guidance counselors will advise students to apply to a handful of “reach” schools (i.e. harder to get in), a handful of “core” schools (i.e. their most desired, achievable choices), and a handful of “safety” schools (i.e. good schools that are a bit easier to get in.)

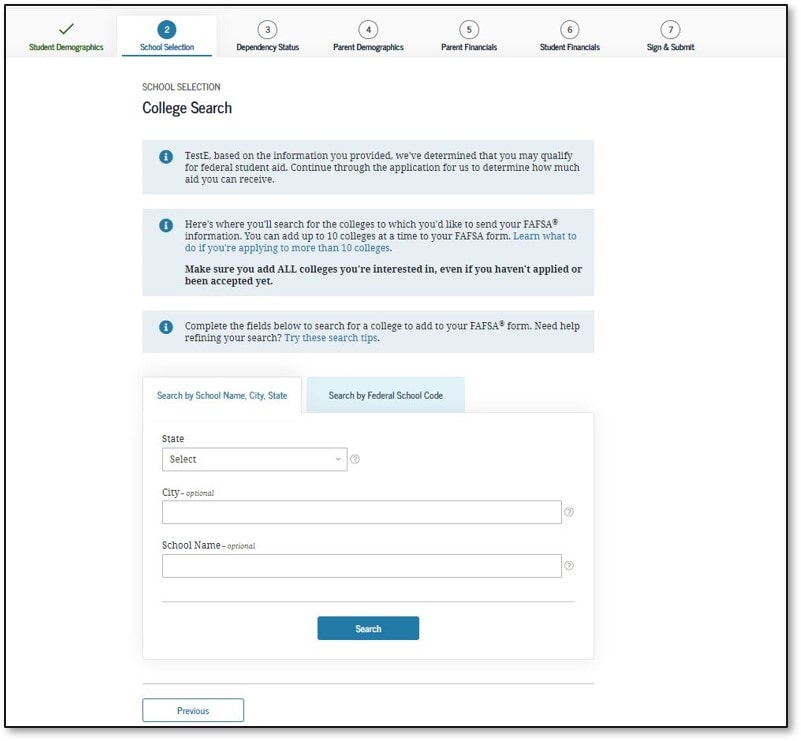

When your student arrives at the screen below, they’ll be able to search for the school by the city it’s in and the name. This should populate the desired school 99% of the time. However, if you have the specific school code, you can also add the school by selecting “Search by Federal School Code.”

As you select each school, the FAFSA system will ask you about your student’s housing plans.

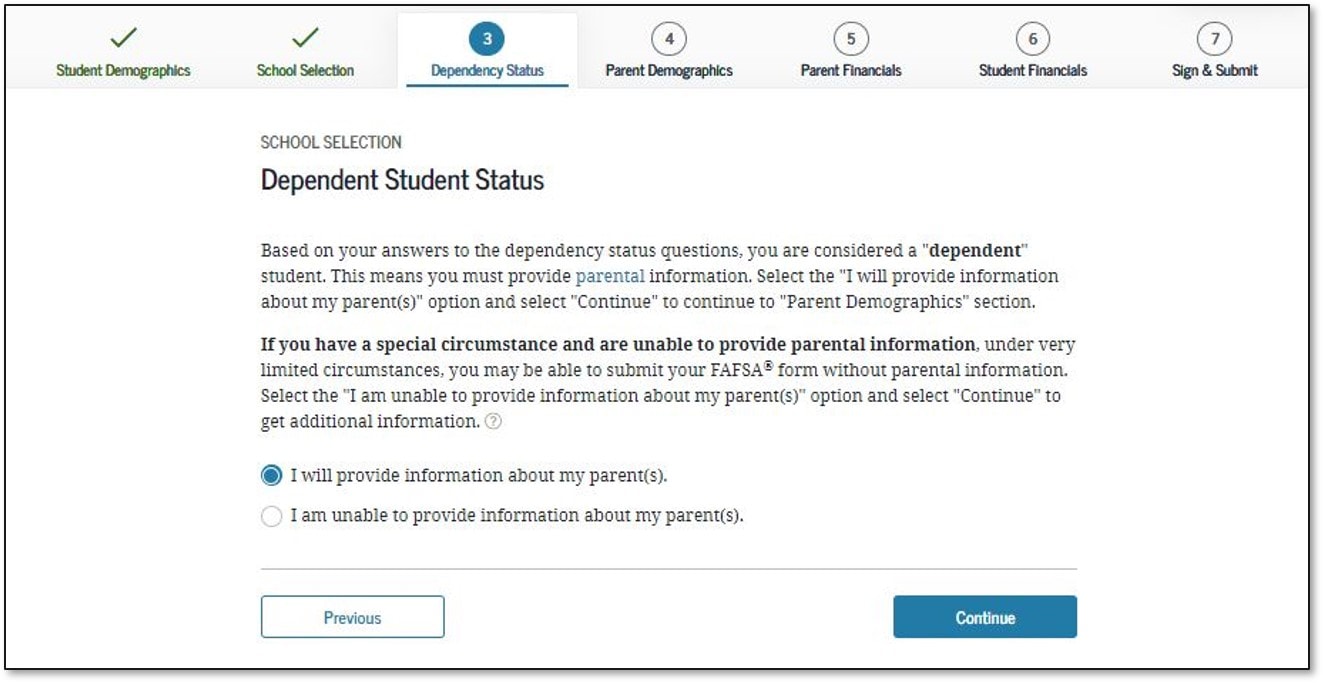

After selecting schools, you’ll be asked to provide more demographic information on your student. These questions will determine whether your student is considered dependent or independent. In almost all situations, your student will be deemed dependent.

- Marital status

- Dependents of the student

- Military service or family situations

Once a child is deemed to be Dependent, they’ll be asked to provide parent information.

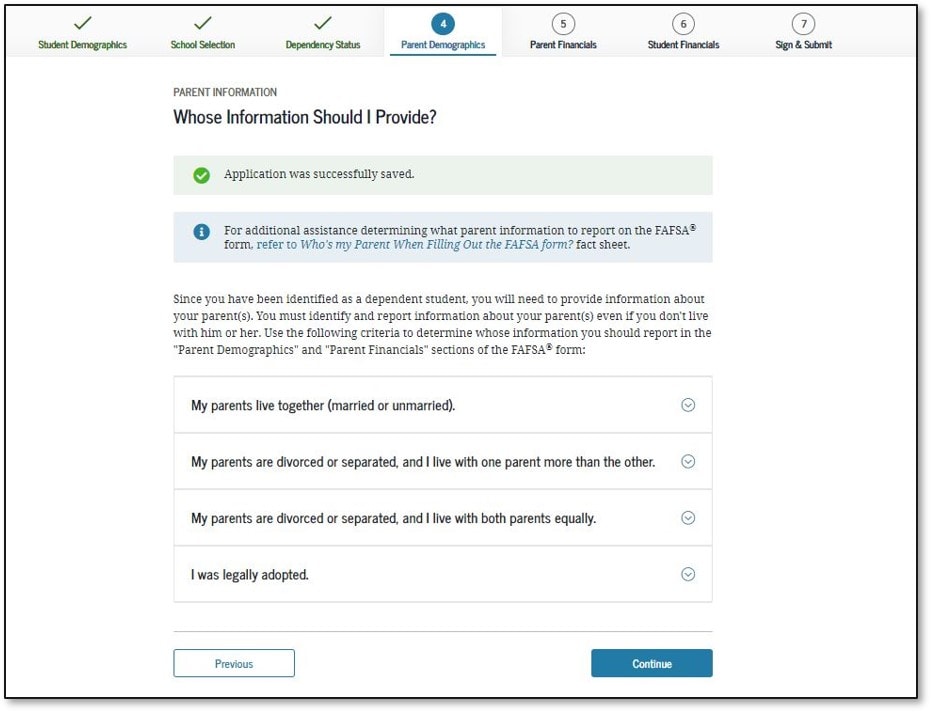

Step 4: Enter Parent Information

When you start entering parent information, the first question that will be asked is about marital status. For students with divorced parents, they’re going to have to choose who’s parental information will be provided (i.e. the father or the mother.)

Be careful here, if you’re divorced. The parent information provided will be the financial information that’s used to determine financial aid for the student. If one parent makes a lot more than the other parent (especially if they remarried), then it may make sense to enter the information of the lower-earning parent if that parent is in fact providing care for the student. We see students lose out on financial aid because they entered the information of a high-earning parent, even though that parent wasn’t responsible for day-to-day care for the student.

After the Marital Status questions there will be a series of questions regarding the parent(s).

- Social Security Number

- First Name, Last Name, Date of Birth

- Email address

- State of residence

- Household size, including the total number of kids that will be attending college in the 2022-2023 school year.

This last point is important. If a parent has more than one child going to college, then they need to do two things:

- Fill out a FAFSA for each child

- Make sure they indicate in this Parent Information section that they have more than one child going to college

Financial aid is easier to get if a parent has more than one child in college!

Step 5: Entering Parent Financial Information

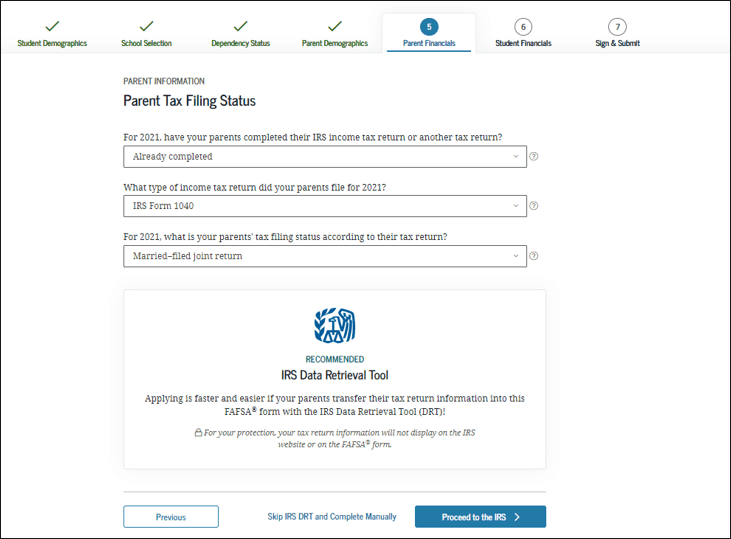

When it comes to determining financial aid, FAFSA looks at the parent and student income data from two years prior to the school year being applied for. So for the 2023-2024 school year, FAFSA will look at income from the 2021 tax year.

If you’ve filed your taxes for 2021, you’ll be able to have the FAFSA system retrieve your information directly from the IRS, as seen below.

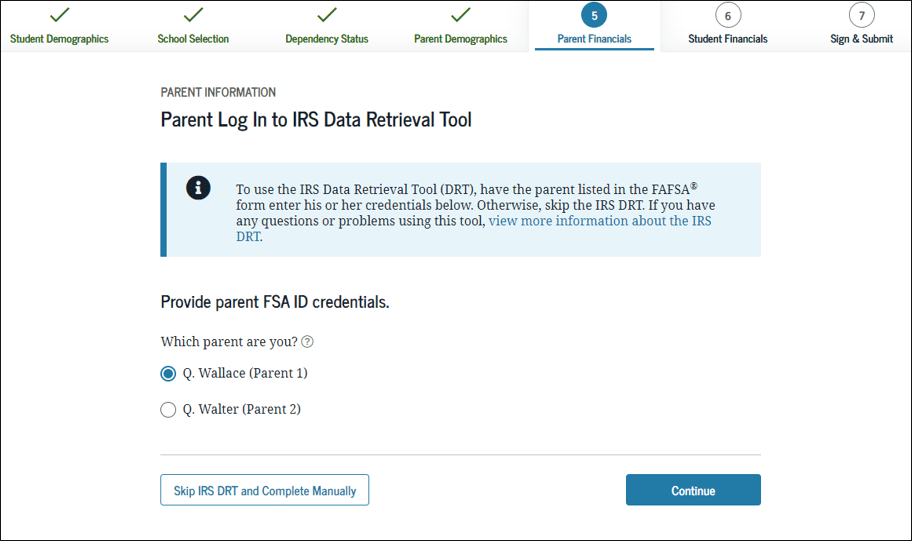

To link to the IRS, you’ll have to use the FSA ID and password of the parent that set it up.

Even though they’re going to pull your 2021 taxes over from the IRS, they’re still going to ask you to confirm some information:

- Adjusted Gross Income

- W2 wages for each parent

- Income tax assessed

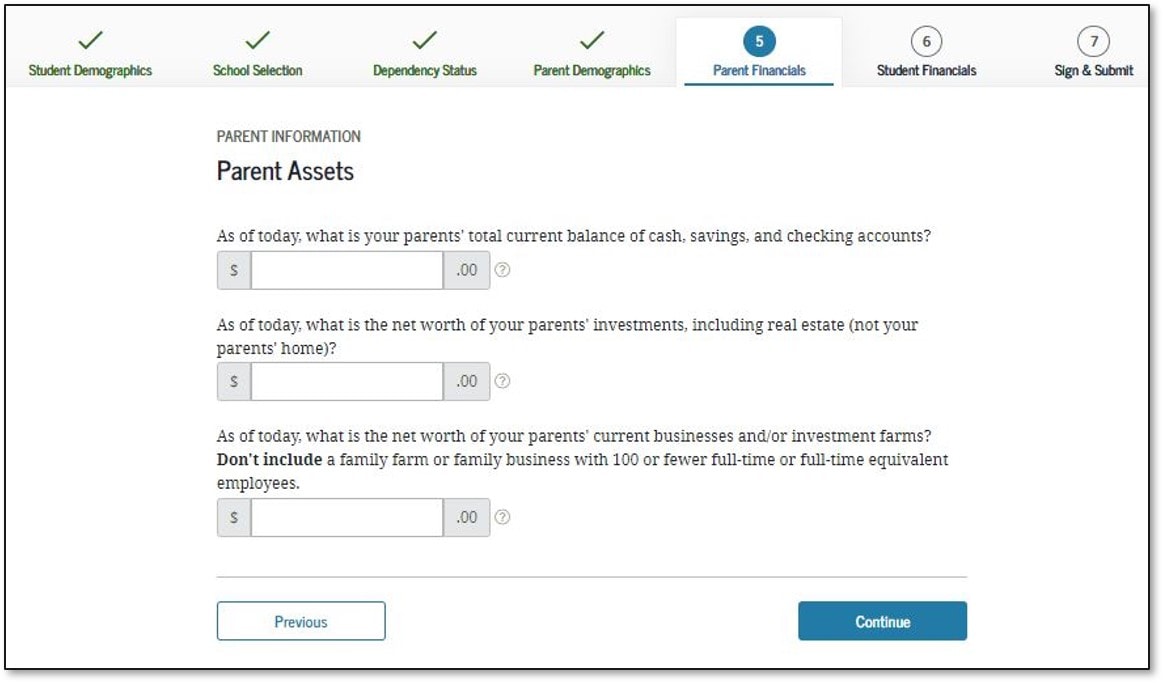

After you’re done filling out income information, you’ll be asked for more detailed financials, such as cash savings and other assets. As opposed to the income information, which was based on 2021 data, all your cash savings and other asset values will be entered as of today.

Two special notes for the second item (net worth of parents’ investments, including real estate)

- Do NOT include the value of your primary residence (i.e. the home you live in regularly)

- If you own real estate other than your primary residence, the Net Worth of that asset is calculated as follows: Value of Real Estate MINUS any Mortgages or Debts against that same property. Click the blue question mark for more information.

Step 6: Entering Student Financial Information

After filling this information for the parents, you’ll be taken to the same screens to enter the student’s financial information. All of the screens are exactly the same as seen for the parent section above.

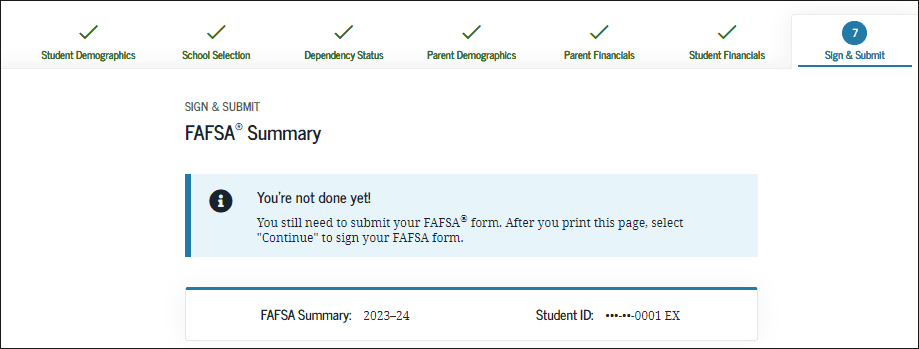

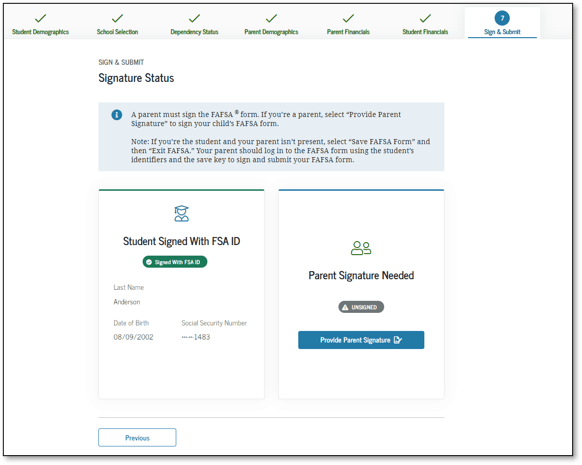

Step 7: Sign and Submit FAFSA

After you see the screen above, it will take you through a series of screens to confirm all the information you entered.

Once you confirm everything, both the parent and the student will have to sign it using each of their FSA IDs and passwords.

After both Student and Parent have signed, you’re done! Your information will be automatically sent to all the colleges your student selected in the FAFSA Application. Now, it’s time for them to fill out applications for each college!

Do You Have to Fill Out FAFSA For Each Child?

By filling out the FAFSA, you’ve just opened the door to receiving financial aid for your college-bound student. Remember, even if your income and assets are too high to receive help, you may still be eligible for school-specific grants. These are given out on a first come, first serve basis.

For parents with multiple children in college, please note that you’ll have to fill out the FAFSA for each child. The good news is FAFSA considers the fact you’re sending multiple kids to college when determining needs-based financial assistance.

Content Disclaimer: This information is subject to change if/when the Education Department makes any updates to the FAFSA application process.

Ready to take the next step?

Schedule a quick call with our financial advisors.