Fill Up Those Bathtubs With Oil!

by Financial Design Studio, Inc. / April 22, 2020

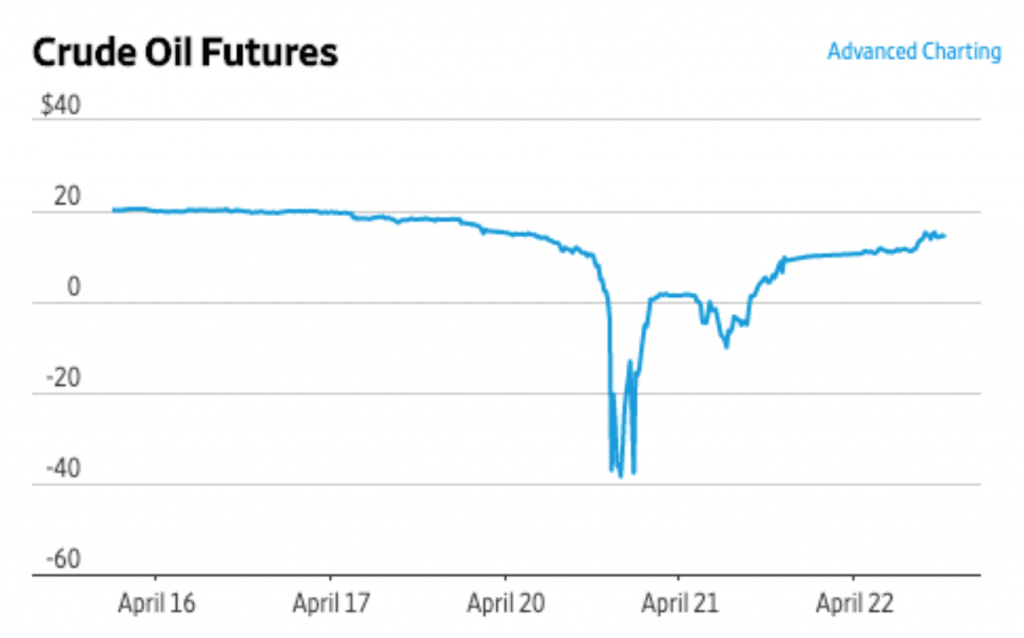

Monday witnessed one of the craziest events we’ve ever seen in financial markets. The price of crude oil dropped below zero, meaning that people would PAY you to “buy” oil.

There’s actually a good reason why the price of oil can be negative, but there’s also a larger takeaway about how bad economic conditions are right now.

When governments started shutting down major economies in response to the COVID-19 epidemic, oil prices collapsed by over 50%.

That was a logical response because the global economy still runs on oil. The current economic slowdown is so severe that the International Energy Agency (IEA) estimates that global demand for it has fallen to levels last seen in 1995!

But what happened on Monday was a clear example of what happens when short-term supply and demand for a commodity get out-of-whack. The oil futures contract for May 2020 delivery expired this week. Holders of this contract faced a choice: if they didn’t sell these futures before expiration, they’d be taking physical delivery of it within a month!

Given the collapse in demand due to COVID, no one wants physical delivery of oil anytime soon.

So as everyone started selling, the price collapsed – to almost MINUS -$40 a barrel.

What markets were saying was, “Please take this oil off our hands…we’ll even pay you to do it!” Oil traders were jokingly talking about filling up their bathtubs with oil that producers were willing to pay them to take.

Prices have since recovered to above $0. And while there were unique supply/demand issues that caused prices to go negative, the drop in oil prices isn’t just a technical event.

The Federal Reserve (the “Fed”) is supporting many parts of the bond market by buying both U.S Government bonds and corporate bonds as well. Even some junk bonds. While this has helped keep liquidity flowing in the economy, artificial buying like this distorts the true picture of what’s really going on in the economy.

Enter oil and other major commodities like copper, palladium, soybeans, and corn.

The Fed is not supporting (i.e. manipulating) prices in these markets. And in all these cases commodity prices have collapsed and have not recovered like we’ve seen with stocks.

The price movement in oil was just an extreme example of what’s really happening in the global economy: it’s at a complete standstill. Low commodity prices are a reflection of the real economy as basic supply/demand curves that we learned about in Econ 101 work themselves out.

For us, it’s a reminder not to get too enamored with the rally in the S&P 500. That’s not to say that stocks are poised to roll over. It’s just a reminder that RIGHT NOW there are extreme levels of pain being felt in the real economy. Not just for oil producers, but also for over 20 million people that have lost jobs in the last six weeks.

Ready to take the next step?

Schedule a quick call with our financial advisors.