Finances & Your Family

Friday’s Financial Update 8-18-2017: Investing vs. Gambling

We’ve all seen the news headlines this week of political drama in many forms. The market has been up and down depending on the news of the day. Despite these events, a diversified long-term focused investment plan is still the way to go to weather not only the news but also the market. Thought that…

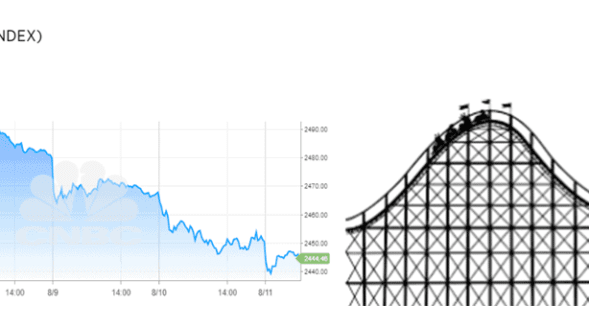

Friday’s Financial Update 8-11-2017

What difference do you notice in the pictures below? These two pictures represent the S&P500 Index performance from this past week and of course, an amusement park roller coaster. The path each of these took is the same. So what can we learn and where do we go from here? First, how did the ups…

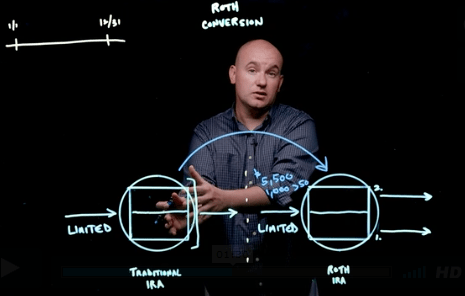

[Video] Roth Conversions: What Are They & How Do They Work?

STEPHEN SMALENBERGER, EA We want to introduce a design element that we like to use in financial plans, when it makes sense. And this strategy is known as the Roth Conversion. Money may be put into a Roth IRA in two forms: Contribution(s) Conversion(s) As explained in prior articles and videos, the Roth IRA contributions…

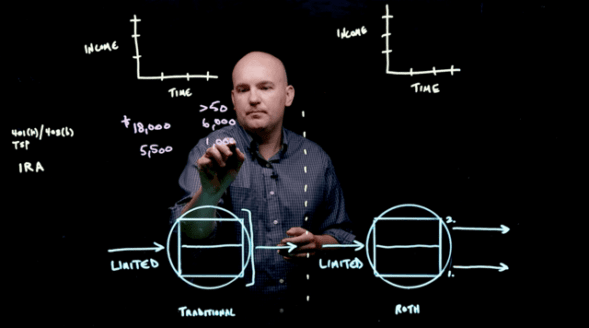

Traditional IRA/401(k) & Roth IRA/401(k) Which is best? [Video]

How do you decide between a Traditional IRA/401(k) & Roth IRA/401(k)? In a prior video we talked about the three different types of account registrations to decide between when saving: Taxable, Tax-Deferred, and Tax-Free. Let’s focus on tax deferred and tax free. Both of those are retirement focused so let’s walk through how much you…

Caution: Speed Bumps Ahead

MICHELLE SMALENBERGER, CFP® Fasten your seatbelts for bumps ahead! Let’s review some of the main stories driving market activity this week. CORPORATE EARNINGS: Companies have reported strong earnings which have continued to push up stock prices. Large gains from companies like Boeing, Ford, Verizon, and AT&T, among many others have reaffirmed confidence in their stock….

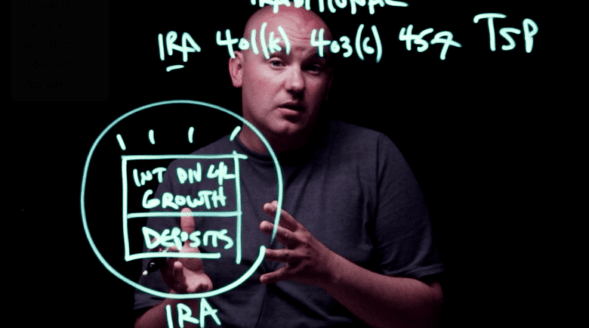

[Video] How Tax-Deferred Accounts Work

STEPHEN SMALENBERGER, EA There are only three types of accounts: Taxable Tax-Deferred Tax-Free We focused on the Taxable accounts last time. Let’s jump in now and look at the second, Tax-Deferred. The accounts in this registration category include the following: Traditional IRA Traditional 401(k) Traditional 403(b) Traditional 457 Thrift Savings Plan The movement of money…