[Video] How Tax-Deferred Accounts Work

by Stephen Smalenberger, EA / July 18, 2017STEPHEN SMALENBERGER, EA

There are only three types of accounts:

- Taxable

- Tax-Deferred

- Tax-Free

We focused on the Taxable accounts last time. Let’s jump in now and look at the second, Tax-Deferred.

The accounts in this registration category include the following:

- Traditional IRA

- Traditional 401(k)

- Traditional 403(b)

- Traditional 457

- Thrift Savings Plan

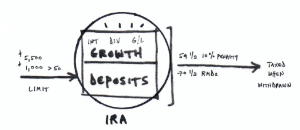

The movement of money within this type of account is seen below:

Who are these accounts for?

Anyone who has earned income from an employer or from self-employment can make contributions or have payroll deferrals. In this case, young children and retirees would not qualify.

How much can you deposit?

The amounts are limited to the annual contribution limits:

- IRAs: $5,500 or $6,500 (if over the age of 50)

- 401(k)s/403(b)s/457/TSP: $18,000 or $24,000 (if over the age of 50)

How are these accounts taxed?

Only the money withdrawn is taxed and is treated in the year of distribution as ordinary income.

Are there any restrictions on the amount that you can withdraw?

Since these accounts are for retirement purposes, there are some restrictions based upon your age. For example, there could be a 10% Early Withdrawal Penalty if funds are taken before the age of 59 ½ if none of the exceptions apply. You must start taking distributions which are referred to as Required Minimum Distributions (RMDs) at age 70 ½.

As always, these posts are general in nature and are meant to be educational, introducing various topics. If anything shared raised a question or prompted some curiosity of a strategy that could potentially be applied to your particular situation… please let us know. We are happy to help!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

How to Find College Scholarships [Video]

In this video, we break down how to find college scholarships for athletics, academics, geography, merit, and more!

Podcast Episode 36: How to Set Your Kids Up For Success

In this episode, we interview Anna Lewis as she shares the opportunities her parents gave her and how they shaped who she became.

Stephen Smalenberger, EA

Steve enjoys getting to know clients and hear their unique stories and the lessons learned which has brought them where they are today. One of the reasons he enjoys what he does is the ability to show the outcome that can be achieved with different choices. He also enjoys continually learning.