Are You Paying Too Much For Your Car?

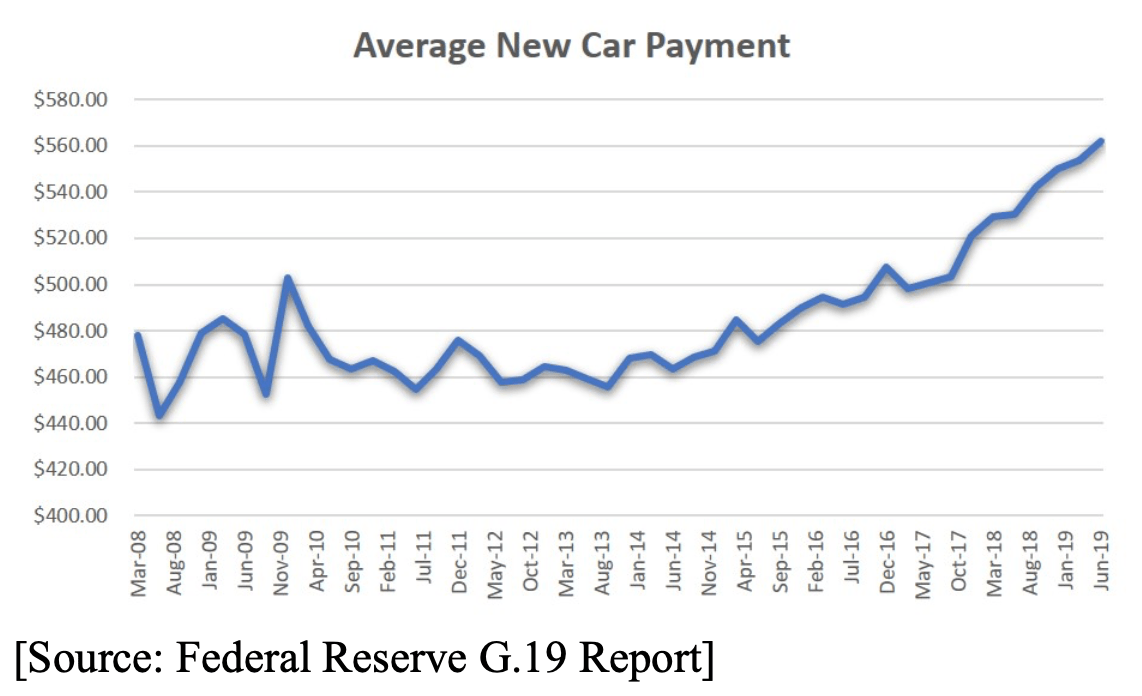

by Financial Design Studio, Inc. / November 21, 2019Over the last five years, there has been a DRAMATIC INCREASE in the average car purchase payment. Let’s look at how much we actually pay for our cars and recommendations to make this less expensive for you and your family.

Other than apple pie, nothing’s more American than having a car. We need them to drive kids to soccer practice. We need them to get to and from work. And how can we take that nice, long road trip to Yellowstone Park without our car?! We Americans love our cars!

Outstanding loans for mortgages and credit cards aren’t that much higher than they were 10 years ago. But the level of auto loans has surged to new highs – to almost $1.2 Trillion.

Car manufacturers have been raising new car prices since the Great Recession. The average new car costing a family almost $37,000 to purchase!

Rising car prices and interest rates have started to push the average car payment to new highs. Even as banks and car companies extend the terms of these loans (to almost 67 months, on average), the average payment on new cars have risen to $560.

This is a 20% increase in average payments just in the last 5 years!

Knowing How Expensive A Car Payment Is, What Can You Do To Lower The Cost?

Owning or leasing cars is a necessary expense in life, but that doesn’t mean we can’t be thoughtful about how much money we’re putting towards our transportation. If you’ve ever felt the budget relief from paying a car loan off in full, you know how good that feels. Let’s avoid getting in over our heads in the first place.

Before you go out to buy a new car, be thoughtful about how much of your budget will have to go towards that monthly loan amount.

Sometimes, opting for that slightly less expensive vehicle can free up enough money in the budget to allow you to enjoy lifestyle activities, like eating out or taking a vacation.

Wondering how this affects your future finances? Schedule a call with Financial Design Studio to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.