Emerging Markets Quietly “Emerging”

by Financial Design Studio, Inc. / August 7, 2020

Given that the current Coronavirus crisis started in China, one can be forgiven for assuming that emerging market (EM) stocks must be having a terrible year. But over the last few months emerging market stocks have been rebounding, quietly beating U.S. stocks.

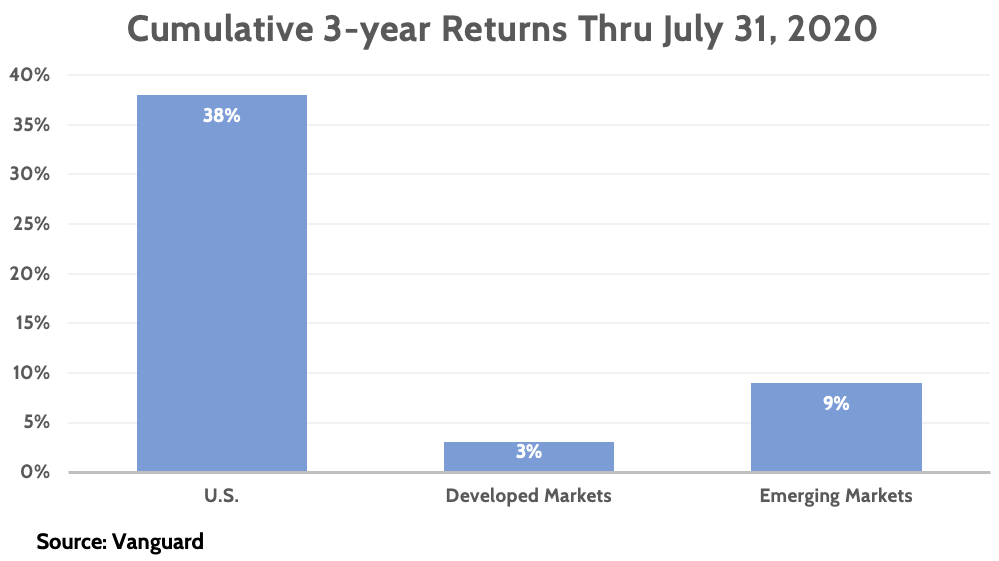

The last 3+ years haven’t been kind to investors who own non-U.S. stocks. The U.S. stock market has roared ahead, driven by large tech stocks, while the stocks in other developed markets (Europe, Japan, Australia) and emerging markets have lagged badly.

Are Emerging Markets Starting to Perform Better?

Developed markets, particularly Europe and Japan, have struggled in recent years as their economies have stagnated. Emerging markets have also done poorly as China’s growth has down-shifted from the breakneck pace of growth a decade ago. From a U.S. investor standpoint, returns have also been held back by a strong U.S. dollar.

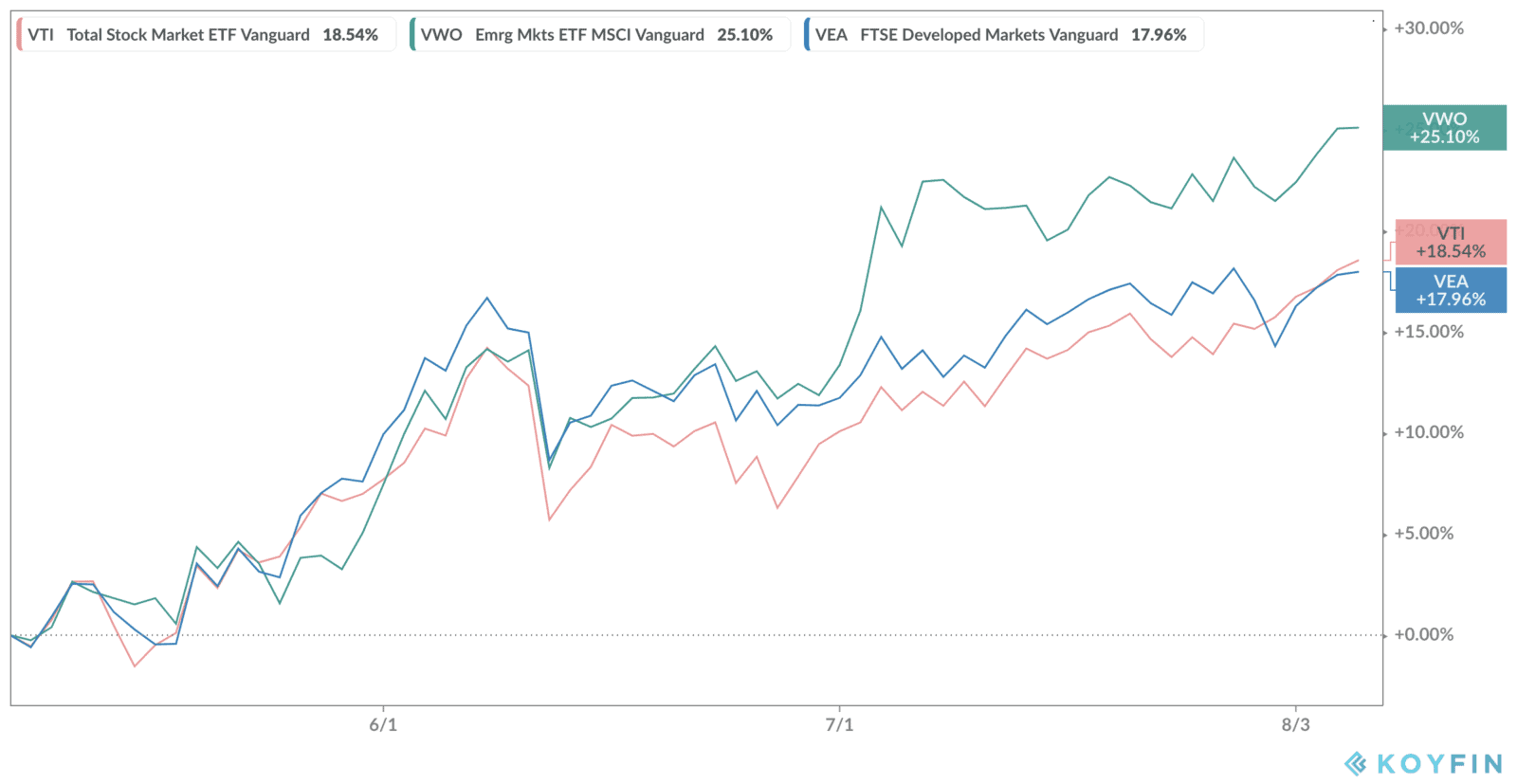

Yet emerging market stocks are rebounding and outperforming both the U.S. and Developed Markets stocks. And by a wide margin at that!

Why are Emerging Markets Getting Attention?

Since the beginning of May, emerging markets stocks are up 25% while both the U.S. and developed markets are up 18%. That’s quite the shift from what we’ve seen the last three years.

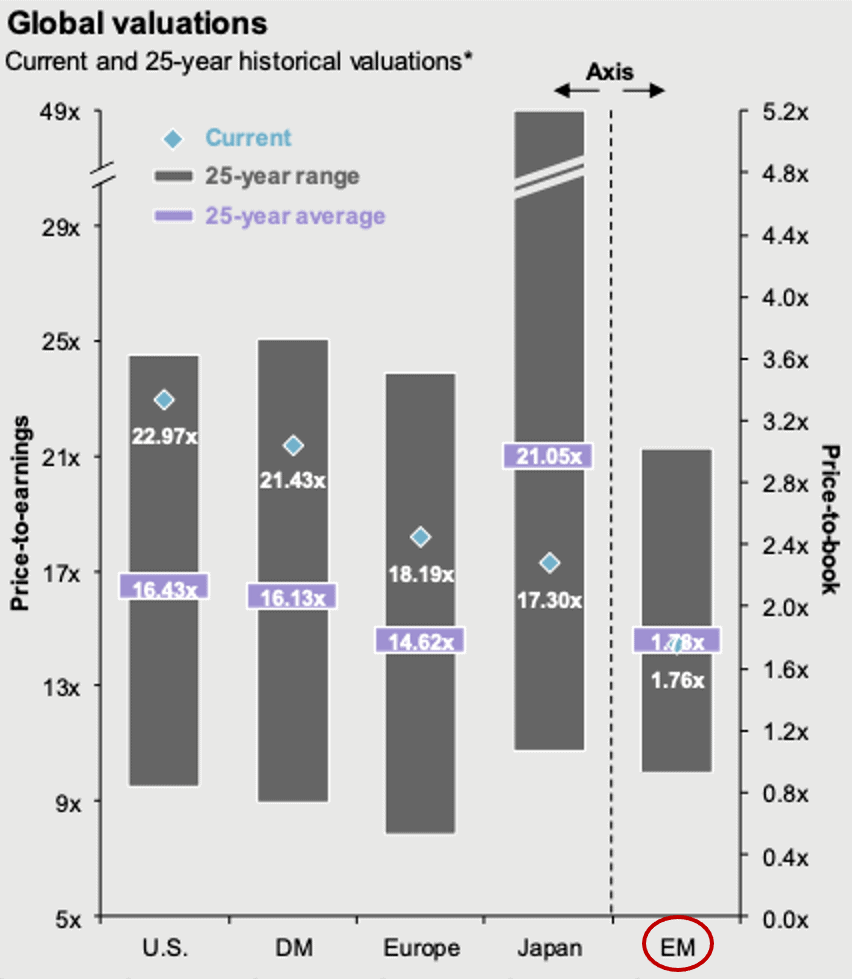

In our view, one of the big reasons for the comeback in emerging markets is that valuations are much more attractive than they are in the U.S., in particular. EM stocks are trading in-line with their 25-year valuation average according to J.P. Morgan, while U.S. and developed markets stocks are trading (well) above their long-term averages.

Emerging Markets Stocks Are Volatile!

Emerging markets stocks are notoriously volatile so the recent out-performance may be nothing more than noise in a fast-moving market. But given how badly the stocks have performed over the last decade relative to the U.S., it’s also possible that an important shift is underway.

Well-diversified portfolios will usually have some exposure to emerging markets stocks. Having a disciplined rebalancing process is critical to investing in EM given the feast-or-famine nature of their investment returns.

Ready to take the next step?

Schedule a quick call with our financial advisors.