Stocks are Splitting

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / August 14, 2020My 13 year-old daughter recently declared that she wants to dress like “they used to back in the 90’s.” Having come into adulthood in the 90’s, hearing her talk about it like the ‘olden days’ is a bit of a gut-shot, but it’s a reminder that old fads eventually do come back.

Two weeks ago, Apple announced that it would be splitting its stock on a 4-1 basis. Tesla followed their lead by announcing their own 5-1 stock split a few days later. Stocks are splitting, which we haven’t seen much of since the retail trading frenzy of the late 1990’s. So let’s get reacquainted with what they are and why companies do them.

How do Stock Splits Work?

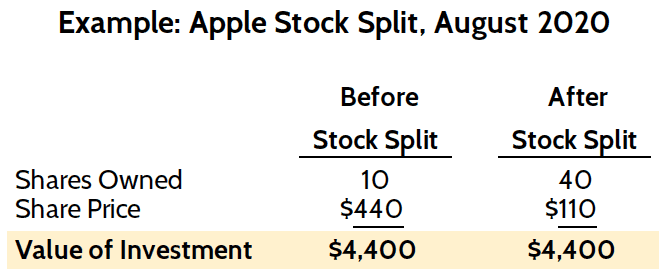

We’ll start with an example of how stock splits work, using Apple as our test subject. Apple’s stock currently trades around $440 per share. If you, the investor, own 10 shares of Apple’s stock then the total value of what you own is $4,400.

Apple announced that they would split their stock on a “4-to-1 basis” on August 31, 2020. That means for every share you own of Apple, they’re going to take that share and then give you 4 shares in return.

Sounds like a good deal, right? Well, not exactly. While you’ll have four shares instead of one, they’re going to divide the share price by 4 to $110 per share. Here’s the before and after.

Economically, there’s no difference whatsoever between the ‘before’ and ‘after’ value of the Apple stock this hypothetical investor owns. Leaving us to wonder, “Why should we get excited that stocks are splitting?”

Why Do Companies Split Their Stock?

Back in those “olden” days in the 1990’s, if you wanted to buy shares in a company you typically had to buy a “lot” of at least 10 shares. You couldn’t buy fractional shares and buying just one share was pretty unusual.

If you had $100 to invest and the stock you wanted to buy had a stock price of $100, you were stuck. Couldn’t do it. But if they split their stock on a 10-1 basis, their stock price would be just $10 and you could go ahead and buy 10 shares for $100.

The purpose of stock splits back then was to help make a company’s stock accessible to retail investors. The lower the stock price, the easier it was for people to buy. Even if there was no economic value to the stock split as we’ve seen in our Apple example above.

Do Stock Splits Indicate a Market Frenzy?

One of the interesting dynamics we saw with stock split announcements in the late 1990’s tech bubble is that the stock would rise sharply. We’ve already seen that there’s no economic value to owning 10 shares at $440 per share versus 40 shares at $110 per share. So why would the stock go up?

Frankly, there’s no good answer. One theory is that yes, a lower stock price makes stocks more accessible to retail investors. But we live in a day and age where it’s no longer a big deal to buy a single share of stock. In fact, there are brokers out there where you can buy fractional shares, like one-half a share.

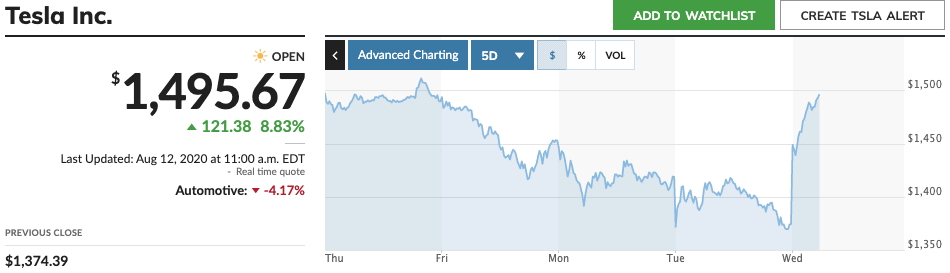

As I write this post Tesla has announced a 5-1 stock split and the stock is up 8% on the news.

Tesla has been a very popular stock with many retail investors. And there’s a belief amongst many investors that a stock split is a sign of confidence by the company. But we’ve seen there’s no economic benefit to either the investor or to the company.

Many market observers, including yours truly, view this type of price action as a yellow flag that investors are becoming frenzied. This is reinforced by the fact that the last time we saw this kind of price action was in the late stages of the 1990’s tech bubble.

Investment Strategy When Stocks are Splitting?

Now that Apple and Tesla have opened the floodgates, it wouldn’t surprise us to see other companies follow suit. Amazon’s stock price is over $3,000 per share and Google’s is over $1,500.

Stocks are splitting, but like the late 1990’s we think this could be a sign that companies are pulling tricks out of the proverbial hat to keep up their stock price momentum. Don’t let stock splits convince you that you’re suddenly getting a good deal. (“The stock’s cheap now!”) Stay level-headed, my friend!

Wondering how this affects your future finances? Schedule a call with Financial Design Studio, financial advisors in Deer Park, to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.