CARES Act: New Deductions & Charitable Contributions

by Financial Design Studio, Inc. / March 31, 2020

CARES Act: New Deductions & Charitable Contributions

Qualified Charitable Contributions – NEW Above The Line Deduction

Background: This new deduction is for taxpayers that are claiming the Standard Deduction and made charitable donations. In the past, you weren’t able to deduct these donations and therefore didn’t experience any benefit.

Amount & Timing: Starting with the filing of the 2020 Tax Return, a $300 deduction will be available.

Benefits: Taxpayers will be able to benefit from both the Standard Deduction plus a $300 deduction regardless of meeting the Itemized Deduction threshold or not.

How do I qualify? “Qualified Charitable Contributions” must be made to 501(c)(3) organizations in the form of cash (ex. dollar bills, checks & credit cards). Donations in the form of non-cash (ex. clothing & household items) to organizations like the Salvation Army or Goodwill are not eligible just as contributions to a donor-advised fund also do not qualify!

AGI Limit For Cash Charitable Contributions Limit Temporary Repealed

Background: Of all the Tax Returns filed today, only about 10% of taxpayers are now itemizing meaning their deductions add up to more than the increased Standard Deduction which started in 2018. While the reason for this is more than just one variable, it often is because they are charitably-inclined.

Amount & Timing: The “CARES Act” will temporarily increase the charitable contribution limit starting with the filing of the 2020 Tax Return. Therefore, taxpayers can technically make enough charitable contributions starting January 1st of 2020 to eliminate any tax liability. If they should give more than 100% of their AGI, this excess is treated as a carryover to future years.

Benefits: The deduction of charitable contributions is temporarily not limited by a percentage of Adjusted Gross Income.

Donations, also known as charitable contributions, are deductible up to a percentage of your Adjusted Gross Income (AGI). Historically, the deduction was limited to 50% of AGI but with the passing of the “Tax Cuts & Jobs Act” in 2017, this increased the limit to 60%. And now the “CARES Act” of 2020 has increased it again but now to 100%.

How do I qualify? “Qualified Charitable Contributions” meaning cash donations need to be made to 501(c)(3) organizations. Contribution to donor advised funds or non-cash donations do not qualify.

Interested in the other areas of the CARES Act? We are breaking down these details by section in the following resource. You can click to the particular section you’re interested in directly below if you’d like to read the specifics of those first. We do encourage you to look through all of the sections that could potentially impact you since this is a very generous bill aimed at keeping our country’s economy strong during and after this pandemic.

Financial Design Studio CARES Act Summary

Like any benefit that becomes available to you it is critical to see if it makes sense to use the provisions allowed. While a benefit might make your temporary financial situation better, it might not be beneficial in the long term. However, those who need these provisions were created for are likely in immediate need to use the benefits until employment returns to normal.

Individuals:

Coronavirus-Related Retirement Distributions

Enhanced loans from employer retirement plans

Required Minimum Distributions waived for 2020

Qualified Charitable Contributions – NEW Above the line deduction

AGI Limit for Cash Charitable Contributions Limit Temporary Repealed

Miscellaneous Healthcare Benefits

Business Owners:

Paycheck Protection Program & Forgivable Loans

Wondering how this affects your future finances? Schedule a call with Financial Design Studio, financial advisors in Deer Park, to discuss your portfolio today.

VIEW MORE FROM FINANCIAL ADVISORS IN DEER PARK

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Retirement Saving Strategies for High Income Earners [Video + Free PDF]

One of the most common questions we get from high earning business owners and corporate executives is: how can I be saving more money for retirement? Here are several options to consider, along with a video and free PDF guide.

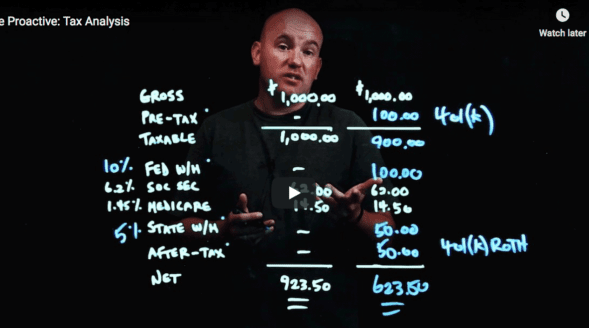

Be Proactive: Tax Analysis [Video]

One question we hear a lot from those who are self-employed and doing some type of payroll is: “How do I balance my taxes and save for the future?” For this let’s discuss your tax analysis… Let’s go through an example so I can show you some of the mechanics of how a…

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.