Corporate Bonds: More Risk, Less Reward?

by Financial Design Studio, Inc. / February 20, 2020Two charts came across my desk recently that shed light on what I like to call “creeping risk” in the market. This happens when the character of an investment changes slowly over time without anyone really noticing the change.

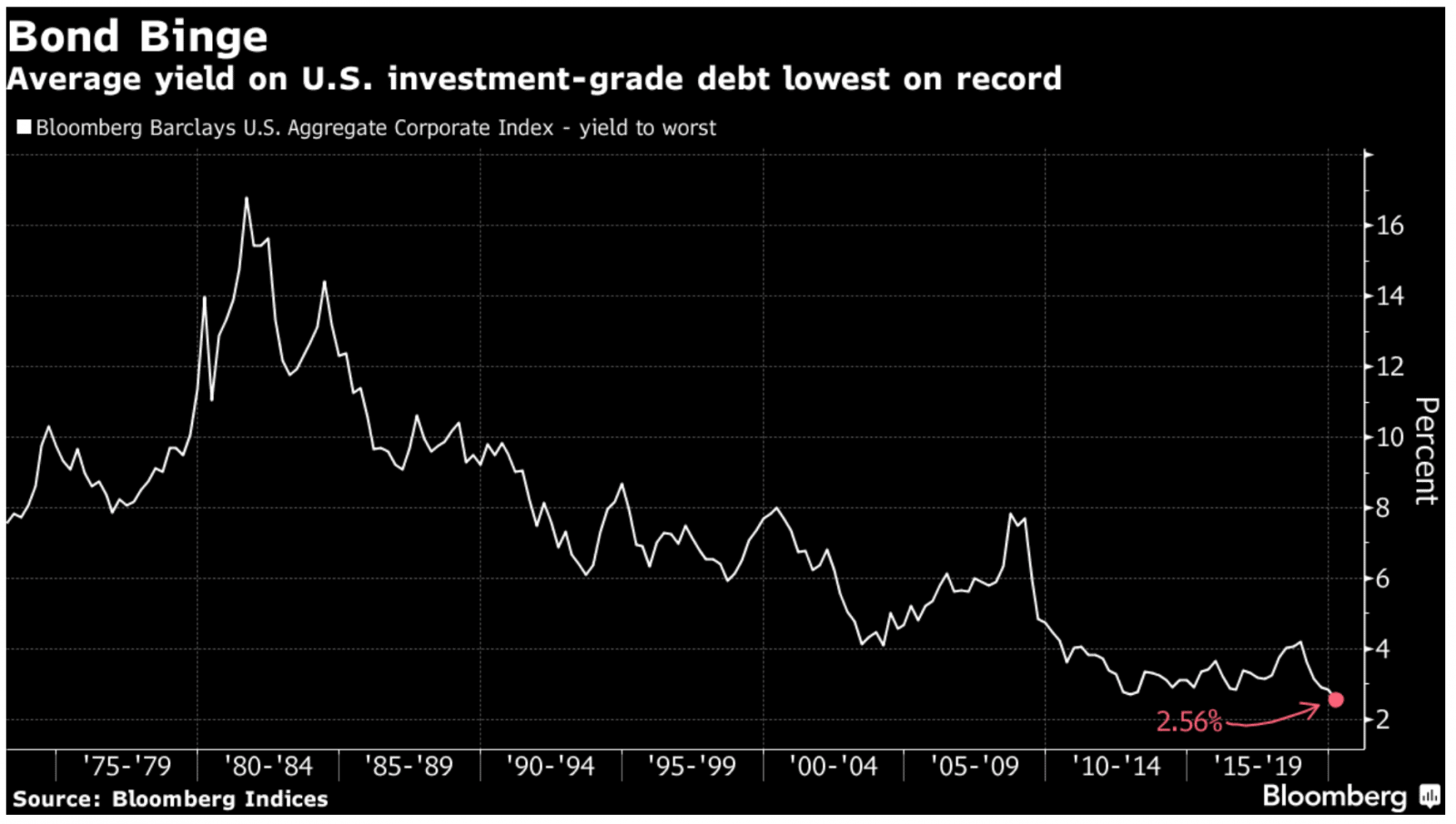

The first chart that caught my attention was a long-term historical chart of investment-grade corporate bond yields. By “investment-grade” I mean high-quality companies such as Apple, Microsoft, 3M and others.

As anyone with a savings account has noticed, interest rates have plunged in the last 10 years, making it very difficult to earn much on bonds and other savings products. This dynamic has also dragged the bond yields on corporate bonds to all-time lows, as seen here.

While this chart is interesting in and of itself, it reminded me of another chart I saw recently regarding the QUALITY of these bonds.

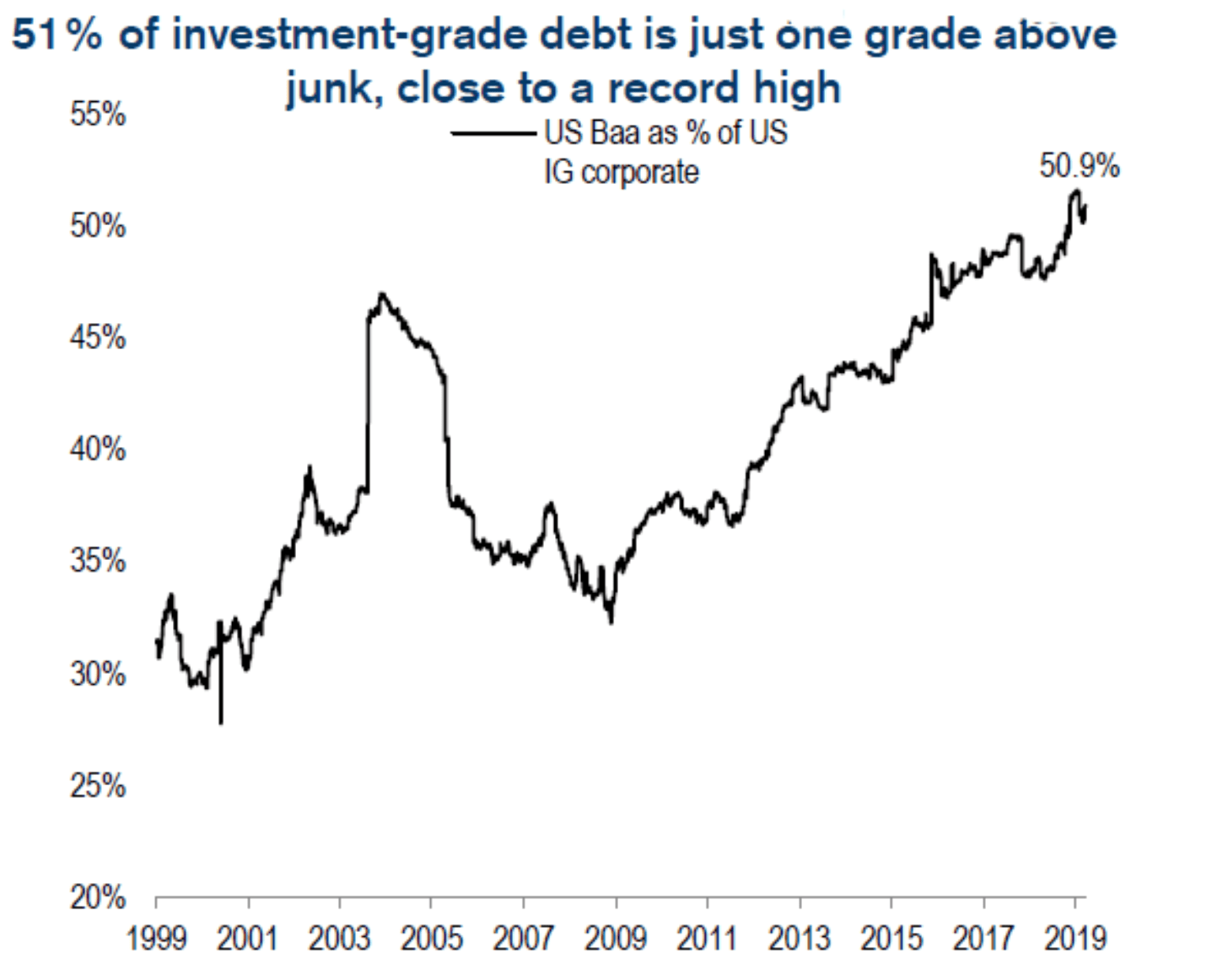

To be considered an investment-grade bond, the company can be rated as high as AAA or as low as BBB.

There’s a big difference in the quality of companies between those two “grades,” even though they’re both technically considered investment-grade.

The chart that I was reminded of was the percentage of investment-grade bonds that are currently rated BBB. This is important because if a BBB-rated bond gets its ratings cut again, it’s suddenly considered a junk bond.

As you can see, over one-half of the ‘investment-grade’ corporate bond market is currently rated one notch above junk level. That is a record.

Putting these two charts together, what we find is that investors are being paid record-low yields for record-high credit risk. Talk about creeping risk!

It’s a reminder to all investors that you still need to understand what you’re investing despite the ease with which you’re able to invest your hard-earned money. Target Date mutual funds, passive “index” ETFs, and commission-free trading make it easy to invest these days. And that’s good. But if you’re not paying close attention, you might find more “creeping risk” in your portfolio than you desire!

Wondering how this affects your future finances?

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.