Update On Coronavirus

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / February 27, 2020We’ve spoken a couple of times about the Coronavirus since it first appeared on the scene in mid-January [Markets Survive Yet Another Scare & Coronavirus Impact On The Market].

Up until the past week, the issue was largely contained to China.

And China has reputation for providing low-quality (i.e. untrustworthy) data about their economy and other issues going on in their society.

Since this past weekend, however, we’ve seen new datapoints that suggest the impact from the coronavirus will in fact matter for the economy.

- South Korea has seen a large increase in reported infections. Since Korea is a critical global manufacturing hub, any impact to Korea will likely disrupt global supply chains, much as is happening in China.

- Italy reported new infections. Since Italy is one of the top travel destinations, the worry is that people may have become exposed as they traveled to the country and returned home.

- Japan announced on Thursday, February 27, that they’d be closing schools for the next three weeks to contain the fallout from the virus.

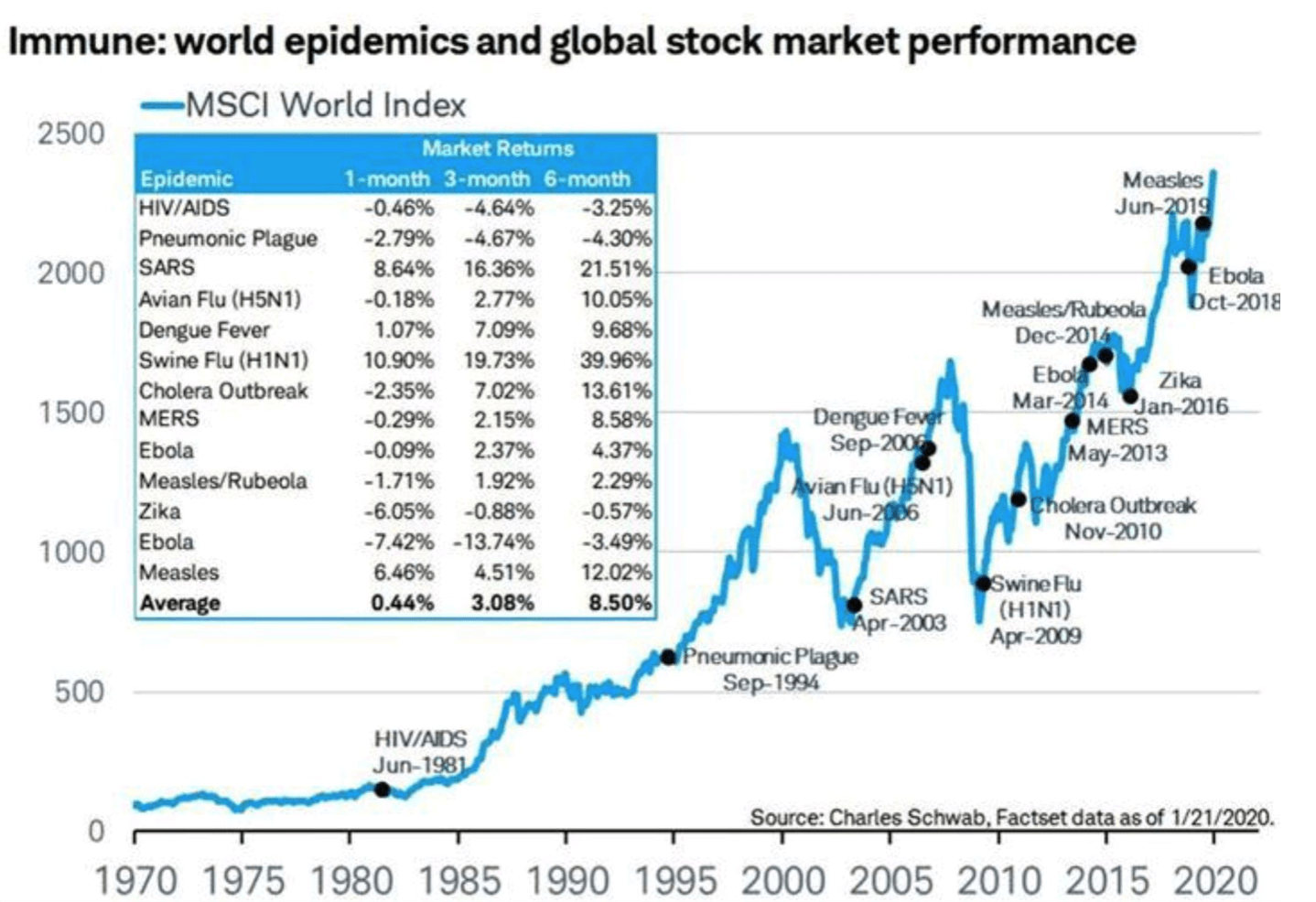

The market reaction has been swift, with the S&P 500 index declining ~10% since hitting an all-time high on February 19.

While that’s a meaningful move to the downside, given the market’s strength over the last year we’re simply back to where we were on Halloween last year.

Go-Forward Impact

That said, it seems clear to us that the coronavirus issue has progressed far enough such that it will have a negative impact on the economy.

Global supply chains are being disrupted which affects trade and getting goods from one part of the world to the next.

Travel and leisure are almost certainly going to grind to a halt due to the uncertainty about contagion. In fact, Royal Caribbean’s stock is already -40% in the last month! Since travel is an important part of the economy, this slowdown will be felt in those areas that most depend on travel.

Investment Implications

Clearly the market hates uncertainty.

And we’re rapidly shifting from a mindset that the economy is strong and stable to potentially seeing a sharp reduction in activity for at least a short period of time.

The Federal Reserve is almost certainly going to cut rates, perhaps as soon as their meeting in March. While low interest rates don’t have any impact on contagion’s impact on society, it is a support for the market.

The market will be very volatile as this story plays out. We’ve experienced a period of extremely low volatility the last few years. So it’s natural to feel uneasy about the market as it moves around very quickly. But volatility is normal in the stock market so it’s important to keep one’s cool during these gyrations.

What We’re Doing

We’ve explained in previous blog posts and in recent monthly newsletters the importance of having a disciplined investment process. In plain English, this means:

- Setting an appropriate balance between stocks and bonds for your financial goal’s time horizon. This is done at the outset of our relationship with Clients.

- Maintaining good investment diversification. We invest Client money in different asset classes and look for asset classes that have a low correlation with stocks. For example, Core Bond funds and Gold have gone UP this past week, even as stocks sold-off.

- Focus on highly liquid investment funds. We don’t invest in illiquid, esoteric investments. Liquidity is king in volatile markets.

- Rebalancing as necessary. Stock market moves like we’ve seen in the last 18 months will cause your portfolio to deviate from its target asset allocation. We have a disciplined process in place to adjust your portfolio when it gets “out of whack” vs your target.

This last point is key. A disciplined rebalancing process only makes changes when market moves dictate changes should be made. In the last several months this has meant trimming Stock exposure as the markets were surging to new highs and causing Client portfolios to become over-exposed to Stocks.

To Sum Up

- The coronavirus situation is rapidly evolving

- It seems inevitable that there will be at least a short-term, negative impact on the economy

- We are monitoring the situation and Client portfolios on a constant basis.

- We’ll make portfolio changes (i.e. rebalancing) as becomes necessary as part of our normal portfolio management process.

Wondering how this affects your future finances? Schedule a call with Financial Design Studio, financial advisors in Deer Park, to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.