3 Surprising Facts About Your Credit Card Interest Rates In 2019!

by Financial Design Studio, Inc. / October 9, 2019 3 Surprising Facts About Your Credit Card Interest Rates In 2019!

3 Surprising Facts About Your Credit Card Interest Rates In 2019!

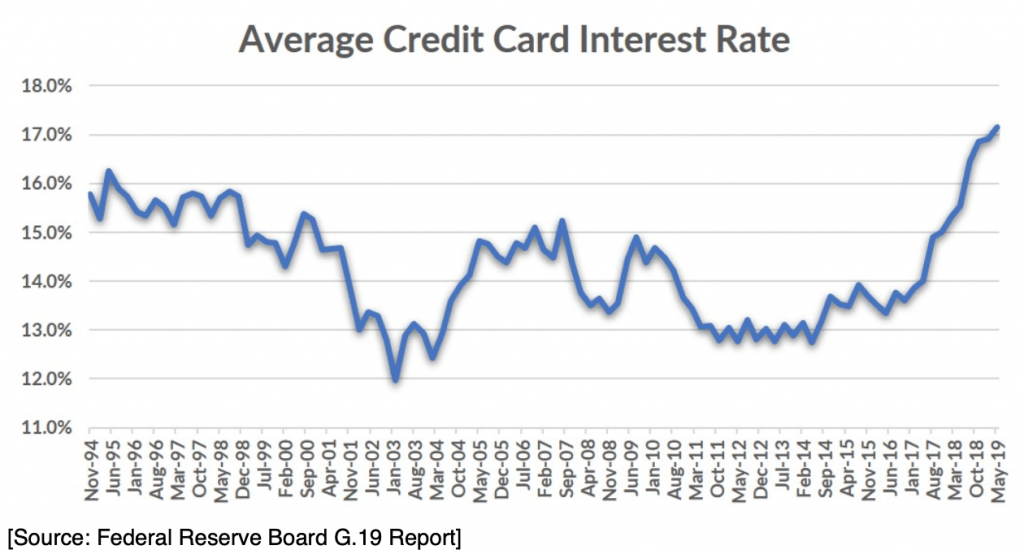

There’s been a lot of talk about lower interest rates in recent weeks with the Federal Reserve cutting rates two times since July. We’ve talked about how mortgage rates have followed suit and are now the lowest they’ve been since 2016. But you might be surprised by what credit card interest rates are doing.

While almost all lending rates for consumers and businesses alike are falling…

Interest rates on credit cards have surged to their highest levels in 25 years!

How Did The CARD Act Protect Us From Rising Credit Card Interest Rates?

Ten years ago, Congress passed the CARD Act of 2009, which put new restrictions on banks’ ability to increase the interest rates on your credit card.

Ten years ago, Congress passed the CARD Act of 2009, which put new restrictions on banks’ ability to increase the interest rates on your credit card.

Prior to the CARD Act, banks could increase your interest rate for any reason. For example, if the bank thought you were a greater risk, they could increase the interest rate on your credit card even if you never missed a payment.

No more interest rate protection!

These days, banks can raise your interest rate any time the Federal Reserve increases rates or you start missing payments. They can also raise your rate if you’ve taken advantage of any 0% interest promotional offers. Other than those circumstances, they can’t arbitrarily increase your interest rate.

Did You Know? The Average Credit Card Interest Rate Is At 17%.

With credit card interest rates over 17% and rising, now is a good time to see whether you’re paying too much in credit card interest. You can try contacting your credit card holder and negotiating down your interest rate.

Our advice to clients is to avoid carrying over too much credit card debt from month-to-month given the high interest rates you pay.

Credit Card Interest Rates Increased 30% Over The Last 20 Years!

You’ll see from the chart above that the lowest credit card interest rate took place in 2003 at around 12%.

You’ll see from the chart above that the lowest credit card interest rate took place in 2003 at around 12%.

That is a 30% interest increase!

If you had $3,000 credit card balance, that would be an interest difference of $510 (at 17% in 2019) compared to $360 (at 12% in 2003)!

Given that we have a strong job market and good wage growth here in 2019, now is a good time to pay down those pesky credit card balance if you have them.

Talk with us to learn how to pay off our outstanding balance quicker and get to saving towards retirement sooner.

Wondering how this affects your future finances? Schedule a call with Financial Design Studio to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

How to Set Financial Goals (According to a Coach) [Video]

Many aren't sure how to set financial goals. In this video, ICF coach Sarah Fincher shares how she works with her clients on their goals.

How to Find College Scholarships [Video]

In this video, we break down how to find college scholarships for athletics, academics, geography, merit, and more!

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.