2021 Stock Market Performance Is Broadening Out

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / October 14, 2021

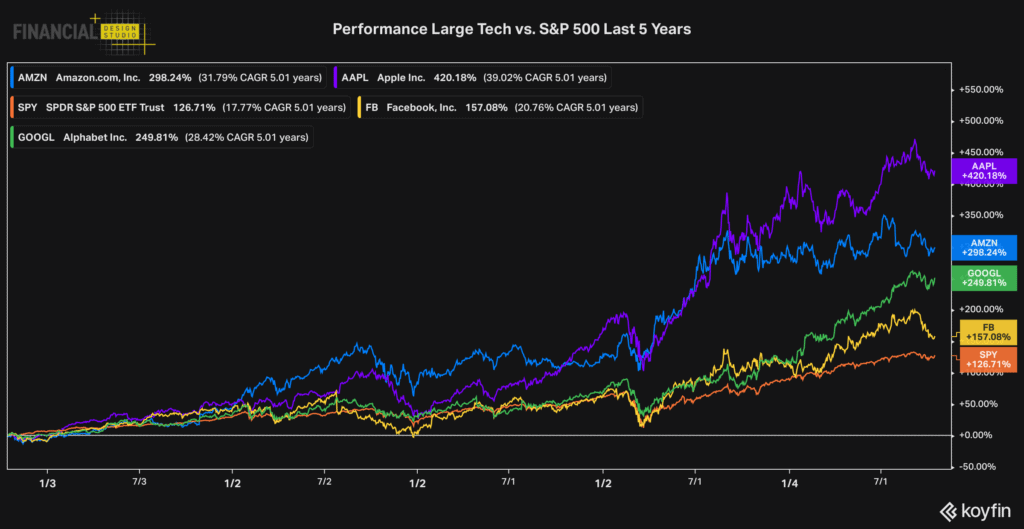

The last several years have seen incredible concentration in stock market performance. Big tech stocks such as Google, Apple, Facebook, Amazon and others have largely powered indexes higher, while other stocks fell behind. This was especially the case in 2020, as investors rushed to “hide” in these supposedly safe stocks. Yet through the first 9 months of the year, we’re finding that 2021 stock market performance is broadening out nicely.

How Has the Overall Stock Market Done versus Big Tech Stocks?

We’ve been living in a unique, but not uncommon, time for the stock market. “New Economy” tech stocks (if we can borrow a phrase from the late 1990s) have grown to dominate our daily lives, remaking the way we live and do business. As a result, their stocks have massively outperformed the broader stock market, especially in 2020.

This concentration in stock market leadership is rare. We saw it at the tail end of the 1990s Tech Bubble. But the most relevant comparison is the Nifty Fifty Era of the early 1970s, which we’ve written about before. Back then, “new” consumer products companies were booming, and investors similarly piled into their stocks.

If you follow the link to that piece, you’ll see that the situation changed abruptly when inflation became a problem. Are we heading for a similar situation today?

Commodities Are Dead. Long Live Commodities!

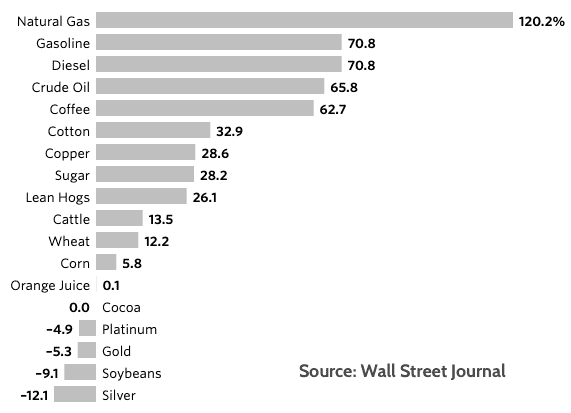

One of the main reasons investors piled into tech stocks in 2020 is that everything else looked terrible. The economy was shut down, which meant that end-demand for anything that wasn’t toilet paper or hand sanitizer collapsed. What a difference a year makes!

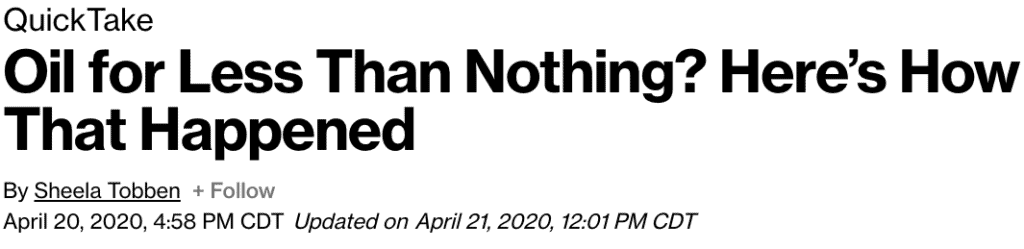

What’s most surprising on this list is Energy. This is a sector that many investors left for dead under the thesis that climate change policies were going to destroy companies that produce fossil fuels. But what investors forget is that our economy still relies heavily on oil & gas, and their prices are extremely sensitive to short-term disruptions in supply & demand. Lest we forget that oil prices went negative in April 2020.

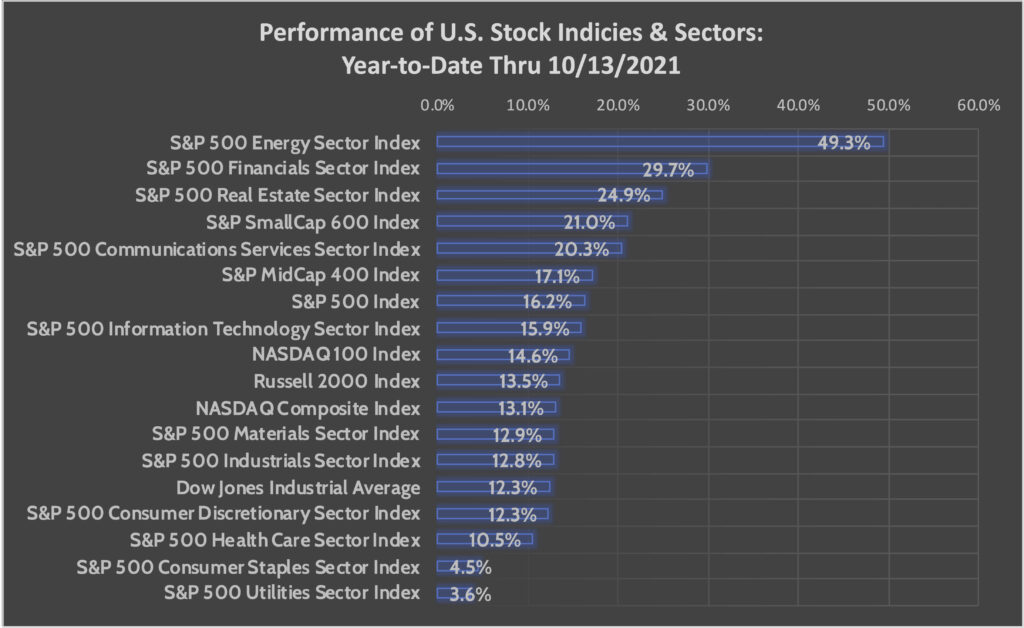

More Sectors Outperform the S&P 500 in 2021

This pickup in commodity prices has led to a performance pickup in sectors of the stock market, other than Technology. For example, the Energy sector was -33% in 2020. But this year, it’s leading the way, up a whopping +49% in 2021.

What’s notable in this chart is that several Old Economy sectors are leading the way. Energy, Financials, and Real Estate aren’t “growth” stocks, by anyone’s definition. The safe plays of 2020 – Health Care, Consumer Staples, and even some parts of Tech have lagged.

Also, make a note that smaller stocks have done better this year. While the large cap S&P 500 index is up a nice +16% this year, the mid-cap index is +17% and small cap index is +21%.

Is the Stock Market Going Through a Regime Change?

My belief is that this “broadening out” of sector performance indicates an important shift in the investment landscape. I won’t bore you with another screed on why we believe inflation is heading higher (check out our blog) but higher inflation is at the core of this shift.

The Fed has, can, and will manipulate stock and bond prices to meet its “goals” (i.e. make the 1% as rich as humanly possible while inflicting financial repression on the masses). But they can’t control the basic commodities that make up a large part of our monthly budgets. Simple supply and demand drive those dynamics. And politics influences heavily that supply and demand, either by shoveling money/stimulus at consumers or via regulations on industries that produce commodities.

Our belief is that politics during the last 18 months of COVID have decisively shifted supply and demand curves in favor of higher commodity prices. And while it’s highly likely that Energy and other leading sectors will go through corrections at some point, the basic regime shift is firmly in place now.

What does this mean? The chart above says it all – stay diversified. If profit dynamics of “old economy” sectors are getting better, investors eventually take notice. Big cap tech growth stocks are no longer the only game in town.

How this plays out is anyone’s guess. But the last two times we saw market leadership get as concentrated as it is today (70s, late 90s) there was eventually a big correction in the stocks of those market leaders. Other sectors fared better. Meaning, a well-diversified investor didn’t suffer as much during those regime changes.

Professional Investment Management to Guide You Through These Changes

There are two parts to the comprehensive, ongoing service we offer to clients. Wealth Management is the financial planning piece that helps you set your financial goals based on what your family wants to achieve in life.

Investment management is on the execution side, taking those savings goals and investing them for future growth. We can’t control what the stock market does, but we can take steps to mitigate negative outcomes. Diversification and rebalancing are the value drivers of what we can do for you.

Speaking frankly, my concern is for people nearing retirement. The last two big investment regime shifts not only produced bad bear markets for stocks (1974, 2000-2003) but often found investors overly concentrated in the previous decade’s “winner” stocks. Now is the time to perform a thorough “checkup” on your investments to make sure you’re not depending too much on one kind of stock to get you through retirement.

Ready to take the next step?

Schedule a quick call with our financial advisors.