More Stimulus and Interest Rates – Does one lead to the other?

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / January 14, 2021

With the political situation in DC finally settled, attention is turning towards what new policy initiatives the Biden Administration will undertake.

Front and center in these discussions are talks about a fresh stimulus package, reportedly as high as $2 trillion. Will more stimulus lead to higher interest rates?

Many factors influence interest rates in the economy. The health of the economy is one factor, as it shows where future monetary policy is likely to go.

But another big factor that gets less attention from the Main Street press is supply and demand dynamics in the bond market.

Supply and Demand Dynamics in the Bond Market

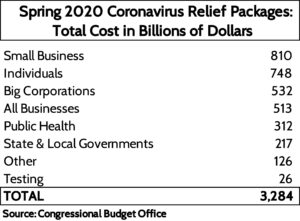

When coronavirus hit last Spring, the federal government unleashed a series of stimulus packages in short order.

The total cost of the stimulus bills passed topped $3 trillion. To fund those bills, the government had to issue debt very quickly. Even in a market as deep as the U.S. Government bond market, that’s an enormous amount of supply for the market to absorb.

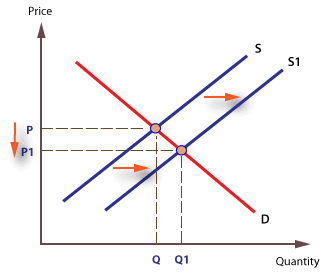

If we go back to our Economics 101 class, we can recall what happens when supply of widgets increases while demand stays the same: prices go down. We illustrate this in the graphic below.

It’s the same dynamic in the bond market. If the government is issuing a lot of debt (“supply”), then the natural reaction is for bond prices to go down. And when bond prices go down, interest rates go up because investors want extra compensation for taking the risk that the government is now more heavily indebted.

Things didn’t play out this way in Spring 2020. Instead of interest rates rising from the torrent of new debt issuance by the U.S. government, they plunged. Why?

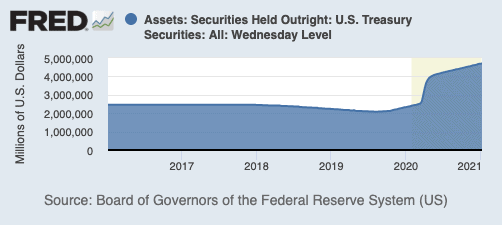

To help ensure that the government could raise debt quickly without causing interest rates to rise, the Federal Reserve committed to buying most of that issuance. Holdings of U.S. Government debt increased by $2.4 trillion, almost mopping up all the issuance and keeping interest rates low. Effectively, Fed buying shifted the Demand curve upwards, keeping bond prices high and yields low.

Will More Stimulus Lead to Higher Interest Rates This Time Around?

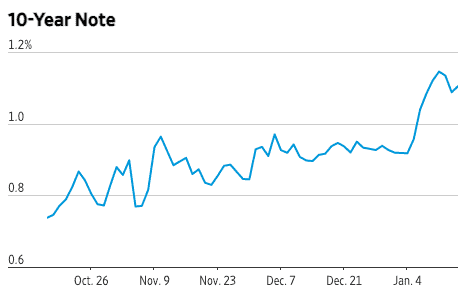

With talks of another round of multi-trillion dollar stimulus coming, interest rates are rising. The reason they’re rising this time around is because it’s unclear how much new debt the Federal Reserve will commit to buying.

Yields have risen from 0.90% before the election to over 1.10% today. That’s still an extremely low level of interest rates from a historical perspective, but represents an interesting change in the environment.

So far the increase in government interest rates hasn’t translated into higher mortgage rates and other lending rates. But if this continues, it’s just a matter of time until they do.

The Federal Reserve has been clear that it will keep monetary policy very easy for an extended period. But it seems to us that bond investors are going to test their resolve by pushing rates higher until the Fed commits to more aggressive support for the market.

This may lead to short-term volatility in markets as investors try to gauge what the Fed’s next move is. Remember, stock and bond markets are beholden to the direction of monetary policy like never before, so keep those seat belts buckled!

Ready to take the next step?

Schedule a quick call with our financial advisors.