Where Do We Go From Here? Coronavirus Update

by Financial Design Studio, Inc. / April 8, 2020 A lot is happening in response to the spread of the coronavirus. As you all know, many of us are in lock-down, working from home and hoping that these actions help “flatten the curve” on the spread of the virus.

A lot is happening in response to the spread of the coronavirus. As you all know, many of us are in lock-down, working from home and hoping that these actions help “flatten the curve” on the spread of the virus.

The Response

We are less than one month into stay-at-home orders and school shutdowns, but it already feels like we’ve lived an entire year. It’s time to take a step back and look at all that has happened.

While the Coronavirus started entering public consciousness in late January, it wasn’t until early March that we started to see the impact here in the U.S. In a short period of time, we went from a booming economy and record high stock market to economic conditions that rival the Great Depression. Consider:

- Almost 10 million people filed for unemployment in the two week period covering the end of March and beginning of April;

- The Federal Reserve has cut rates to zero and rolled out over a dozen programs designed to support financial market liquidity;

- Three bills have passed Congress and were signed by the President, injecting over $2 trillion into the U.S. economy;

These drastic measures have been taken because the economy is likely to experience its sharpest downturn ever. Second quarter Gross Domestic Product (GDP) growth is expected to contract anywhere from -30-50% on an annualized basis. That level of contraction is simply unheard of in our country’s economic history.

Similarly, the impact on small business and employees is brutal. We will see unemployment easily surpass the 10%+ unemployment rate we saw in the Great Recession, with some economists expecting the rate to exceed 20%.

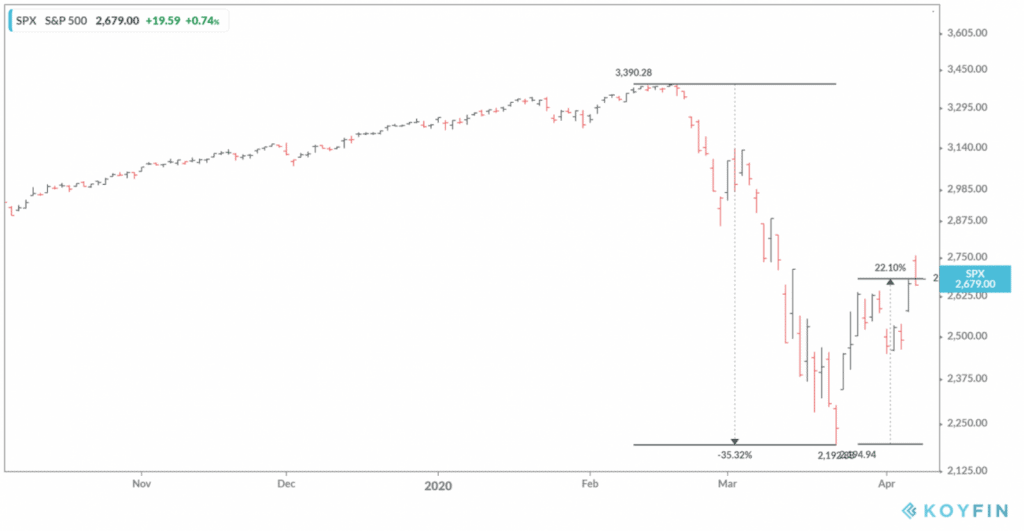

With these terrible numbers it’s almost a surprise that the stock market is only down about 20% from its all-time high. Granted, the market fell -35% in just over a month as the virus started to spread, but the last two weeks have seen a sharp recovery in index levels.

Now that COVID infections appear to be leveling off, it’s time to consider how the world may look from here. Of course, this is pure speculation given the unprecedented nature of what the country is going through. But that doesn’t mean we can’t try.

Potential Positives:

- The nature of the virus and likelihood of a viable treatment or outright cure suggests that stay-at-home orders could be lifted in the not-too-distant future, allowing a rapid snap-back in economic activity.

- Interest rates will be locked down at very low levels due to the Federal Reserve’s commitment to support economic activity.

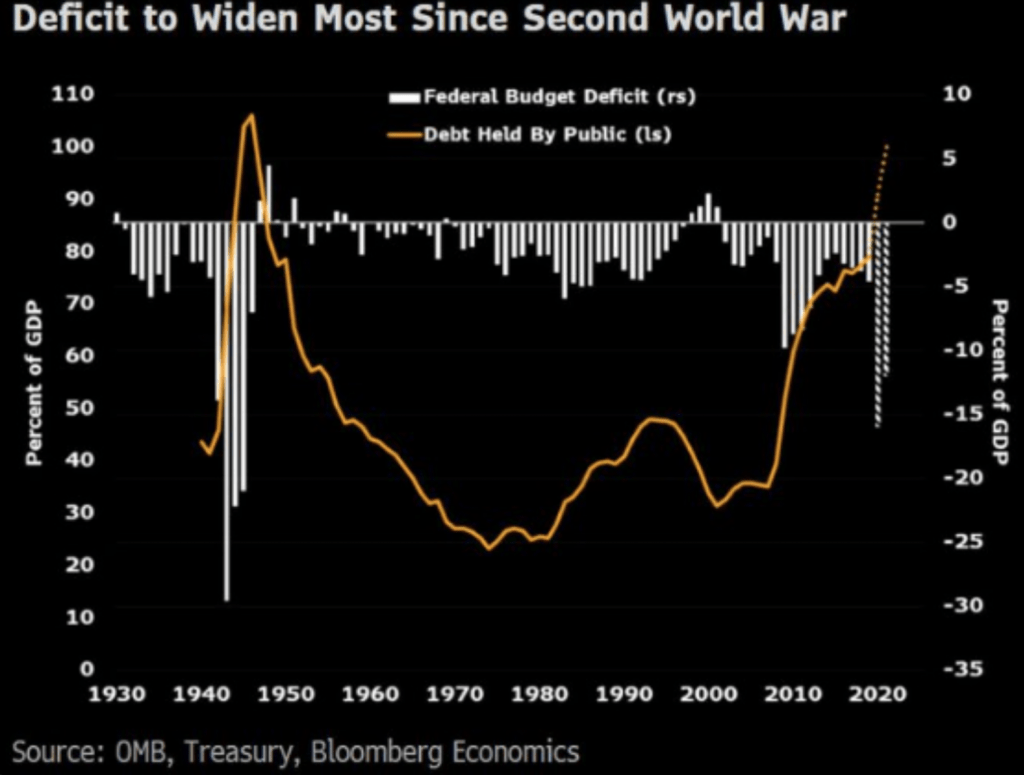

- Government spending as a percent of GDP will reach “wartime” levels in support of individuals and businesses.

Potential Negatives:

- The scale and suddenness of the economic disruption means that thousands of businesses will fail, reducing employment opportunities.

- Even if stay-at-home orders are lifted, many people will be hesitant to rush back out into public. Restaurants, airlines, and hotels will likely see a very slow recovery.

- Individual animal spirits will be slow to come back. Going from an all-out sprint to sudden stop is likely to make people cautious about spending.

- The Federal Reserve’s programs to support markets may end up doing more long-term harm than good, as they’ve destroyed price discovery in stock and bond markets and have interrupted capitalism’s process of creative destruction.

Given the balance of these positives and negatives it wouldn’t surprise us to see markets settle into a trading range for a period of time. People need time to digest what has happened.

The bigger question for you, the Client, is, “What does this mean for our family’s financial goals?” That’s what we’re here for. To help you understand where you are financially and what the future may look like.

If you’re not already working with us, and are feeling a bit shell-shocked from recent events, please reach out to us. Understanding where you are and where you’re going can be of great comfort, and that’s what we’re here to help you do.

Wondering how this affects your future finances? Schedule a call with Financial Design Studio, financial advisors in Deer Park, to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.