This Year’s Charles Schwab Conference [Long Version]

by Financial Design Studio, Inc. / November 29, 2018I’m writing to you as I fly home fresh from Schwab’s annual conference held in our nation’s capital, Washington D.C. There couldn’t have been a better place for this year’s conference as we anticipate next week’s mid-term elections and recent market volatility. To summarize my experience at the conference it is this: my humbling respect for the offices held in our administration far outweighs the current noise.

I will explain this in greater detail through the following sessions and speakers that I was privileged to hear:

Political/Economical

-

- Janet Yellen, Chair, Board of Governors, Federal Reserve System (2014-2018)

- Andrew Card, Chairman, National Endowment for Democracy; Former White House Chief of Staff under President George H.W. Bush

- Denis McDonough, Senior Principal, Markel Foundation; FOrmer White House Chief of Staff under President Barack Obama from 2013-2017

- Greg Valliere Chief Political Strategist, Horizon Investments

- Niall Ferguson, Author of Founder of Greenmantle, LLC

Investment

- Jeffrey Kleintop Chief Global Investment Strategist and Senior Vice President, Charles Schwab & Co., Inc.

- Liz Ann Sonders Senior Vice President and Chief Investment Strategist, Charles Schwab & Co., Inc.

Trends and Innovation

- Rohit Bhargava, Founder and Chief Trend Curator, The Non-Obvious Company

After the last few days, I have a renewed sense of hope and optimism that I admit can fade easily in the constant noise. What I look forward to most with this conference each year are the keynote speakers that come to share their perspective. Being in Washington D.C. provided access to hear from those who speak because of their seat at the table.

Let’s start with a reminder of humbling respect for the offices held by our administration. Recent noise like market volatility, bombs being mailed and twitter ramblings leave us hopeless for progress ahead. White House Chiefs of Staff nicknamed “gatekeepers” hold tremendous power to decide what and when the President needs to know and who gains access to the leader of the free world. These men were tasked with running the White House Staff to foster teamwork when needed most.

You will undoubtedly remember Andrew Card for his responsibility to whisper in President George W. Bush’s ear that the twin towers had been struck twice on September 11, 2001. Hearing his description of the moments leading up to and following that attack left me with goose bumps. Being reminded of this moment in history leaves me overwhelmingly struck with an immense and humbling respect for the administration’s responsibility to respond in that and any crisis.

Denis McDonough spoke of the commitment and promise from the previous administration to find whoever was responsible for that 9/11 attack. As the book-end to the previous administration, you’ll no doubt remember the moments when we were told of the Navy SEAL strike against Osama bin Laden. Hearing about the critical, life changing decisions that were made on our behalf, as Americans, I find it impossible to disrespect the Offices held by those in the White House.

If we start our outlook both politically and economically from this point of view, we will end at a very different place than starting from the noise of today. As Douglas Holtz-Eakin from the American Action Forum noted, there are two ways to make change: either by leadership or crisis. With this in mind, let’s continue forward with the specific issues at hand for our outlook ahead.

The market has had our stomachs a bit uneasy with the volatility we’ve seen in the past month. These moves have been caused largely by uncertainty with global trade, interest rate expectations and mid-term election results. The old saying says we’re supposed to avoid talk of money and politics, but we are forging ahead to bring clarity.

The shortest issue to address is mid-term elections as it will be decided in a matter of days. Greg Valliere, a life long political analyst who lives in the nation’s capital has knowledge of all the rumblings and happenings in the political sphere. If you ever hear him speak he will say he’s neither republican nor democrat but stays alert to all that happens in “his great city”. Greg expects Republicans to maintain control of the Senate and Democrats to pick up enough seats to gain a majority in the House of Representatives. He does not expect the new majority in the House to be by overwhelming numbers as initially thought months ago.

After the elections if we see the expectations become reality there are some items he noted to pay attention to. He does think the Democrats may begin to push right away for impeachment on the charge of obstruction of justice. This will only cause to further divide us from the polarized place we are today. However, he did not believe there would be the 67 votes needed to make impeachment come to fruition.

Greg has never seen a climate like this in his career. He believes that the center of politics has evaporated. Those leaving politics such as Paul Ryan and Jeff Flake, are centrists and rather than try to stay and pull the two sides together they are leaving because of the seemingly impossible differences that only seem to widen.

Looking a couple of years ahead Greg doesn’t see any other candidate who could possibly run against President Trump as things stand today. He just doesn’t see anyone with any potential to gain more traction with Republicans. He noted the Democrats have a real problem on their hands with a party that continues to lean heavier toward socialism and the prominent party leaders are elderly. They do not have young talent in a household name that seems to be strong enough for party leadership.

I do believe that some of this market volatility has been caused, in part, by pricing in the expectations of the election outcomes and actions expected immediately after. Let’s dive into the details of our market outlook in light of the political landscape.

First, Jeffrey Kleintop brought the outlook for global markets, both emerging and developed markets. With the US seeing a strong dollar and rising interest rates Jeffrey believes we still have some time before global equities see another growth period. This year international and emerging market stocks have seen poor performance. Emerging market growth peaked when the US had lower interest rates earlier in 2018. The rising dollar also suggests that emerging markets will continue to see poor performance in the short-term. Over the next 3-6 months Jeffrey expects the weakness could continue, with the main drag in the rear-view mirror. Just as many are estimating the next recession he believes we will see a peak in the global economic cycle in the next six to eighteen months, with the US and international performance opposite of each other.

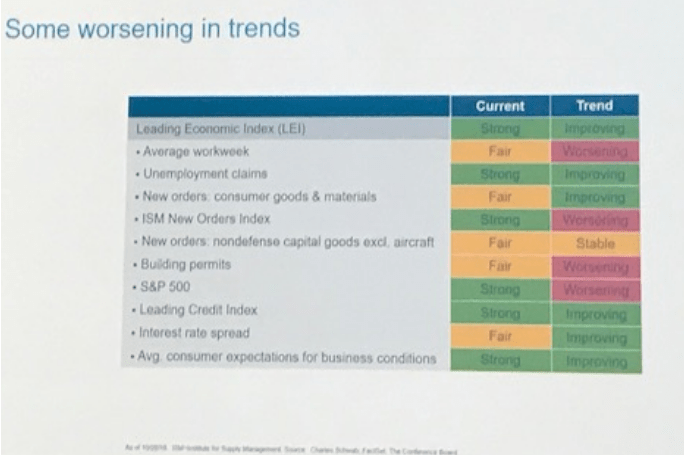

Let’s turn our attention to the US market as Liz Ann Sonders brought her expert outlook. If she could use one word to describe the attitude of investors it would be complacency. She believes we have grown accustomed to a stock market that experiences repeated new daily highs. Leading indicators forecast what the economy is going to do not what the stock market is going to do. And bear markets can still occur when the leading indicators are still rising.

Liz Ann believes there is still a low likelihood of a US recession in the near future. Though the likelihood for a global recession has recently increased to an 80% probability. Tipping points that could cause an earlier recession would be pending tariffs that aren’t even in force yet. This leads her to believe there is weakness under the surface of the US market. She feels that earnings over the past couple of quarters have somewhat been juiced by 2017 tax cuts, with revenues seeming more subdued.

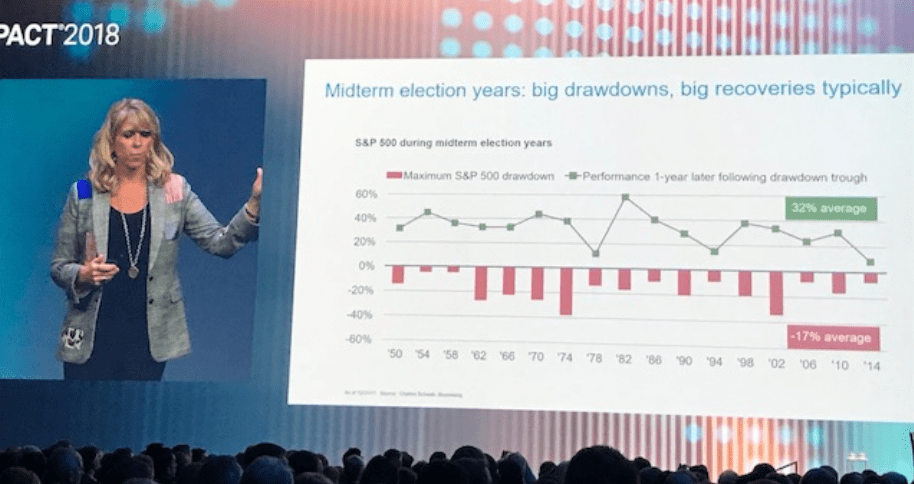

Even with these lingering concerns she noted she does think after the midterm elections that we could see a bounce going through year-end. You may find this chart interesting which shows the drawdowns (in red) that tend to happen prior to an election and then the positive performance that followed after 1-year. If we see this again it looks like another positive year ahead.

Another noteworthy keynote presentation was a discussion with Janet Yellen, the Federal Chairwoman from 2014-2018. Most helpful to hear from Janet Yellen was confirmation that she agrees interest rate raises are necessary with this strong economy. She was known to be dovish with interest rate policy, meaning that she looked at the economic data to make decisions on rate changes and did not want to cause a shock in the system but make changes with a smooth, easing effect. The current Fed Chair, Jerome Powell, is known to be hawkish toward raising rates which means he may cause a bit more of a shock because he believes it needs to be done now while the economy is strong.

These two individuals had the same role in their positions yet they each viewed the necessary action differently. Hearing Janet’s agreement that she would have likely done the same as Mr. Powell was actually very confirming that this is an appropriate pace and time. She shared that she believes a neutral interest rate could be around 3%. Keep in mind that the markets have been volatile because we are getting near 2%. So if rates continue to increase, which we believe they will, then volatility may return over the next couple of years with a higher than expected neutral rate.

We believe volatility will continue into next week. The certainty that election results bring could clear the way for the market to move higher into the end of the year. Remember the market doesn’t like uncertainty and heading into next week that’s what we have.

Let’s shift away from our outlook forward to a scorecard of sorts for President Trump’s record while in office. Douglas Holtz-Eakin brought a session filled with the administration’s progress on policy and the effects on the economy. He is the president of the American Action Forum, an independent, nonprofit organization that seeks to educate the public about the complex policy choices facing the country. Douglas believes that the American people elected the current government to increase their personal income and financial situation. He believes that has been delivered. Below is a list of the policy changes that have helped or hurt, in his opinion, the success of the economy.

Policy Reform and effects which have helped the economy:

- Regulatory reform rolled back many costly policies that were in place

- Corporate tax reform, and the lower rates corporations can benefit from.

- Decreased unemployment

- Standard of living increase because of productivity and increased wages

Policy reform and effects which have/may hurt the economy:

- Administration’s trade policy with China, Canada, EU, Mexico – the trade environment is hindering plans that companies can make

- Tariffs on steel and aluminum which had immediate retaliation to favorite agricultural products. These were all costs and no benefits.

Douglas summarized his thoughts that economic growth is not a bill, it is a policy. If you choose against growth you’ll get bad growth. He also reminded that entitlement programs have to see reform as they haven’t been fixed since the 1960s. Politicians aren’t addressing this because if they do they won’t win their next election. He believes the Trump administration has to address these entitlements. But in review the border and trade was the platform President Trump ran on and he has been tackling those issues since taking office.

Now that we’ve looked back and looked ahead I want to share some outlying issues trending in today’s world. I share these because I do believe they can seep into our everyday lives effectively touching even the areas we’ve discussed already.

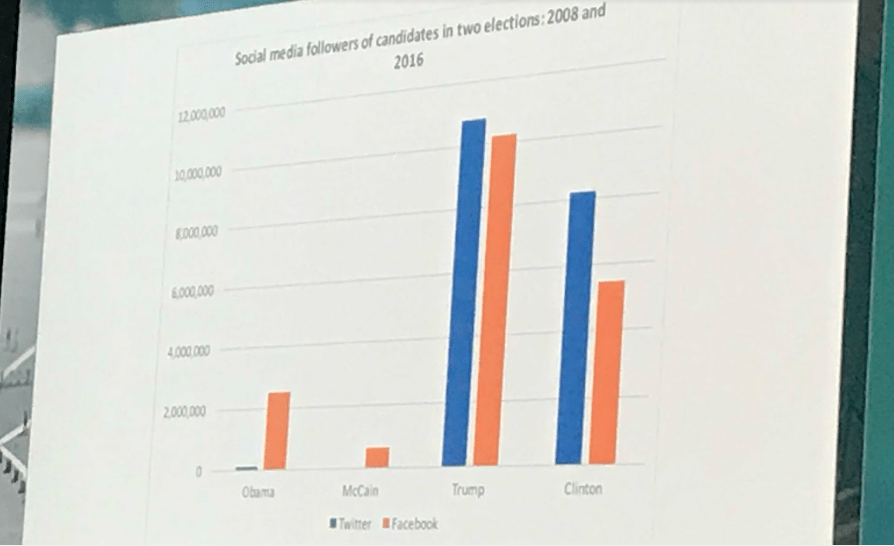

Niall Ferguson makes the case for social networks as drivers of power and change in human history and predicts which hierarchies will withstand the latest wave of network disruption. You may be shocked with his seemingly simple suggestion that the leader with the largest social network wins. Just look below at this chart which shows the twitter and facebook followers for each presidential candidate in 2008 and 2016. He very simply stated “politicians either lose elections or understand Facebook advertising.” If that doesn’t convey the power of a network I don’t know what does.

But to take these implications one step further networks can also be powerful for causes that are unintended. Niall echoed Greg Valliere’s opinion that there is a centrist group of politicians that don’t have a party. They are the exhausted and alienated middle. You see, networks can also polarize us by placing us on one side or the other. History shows that while we desire for networks to bring us closer together they actually do the opposite. Niall slyly commented that had Mark Zuckerberg took his class he would have learned this before creating Facebook.

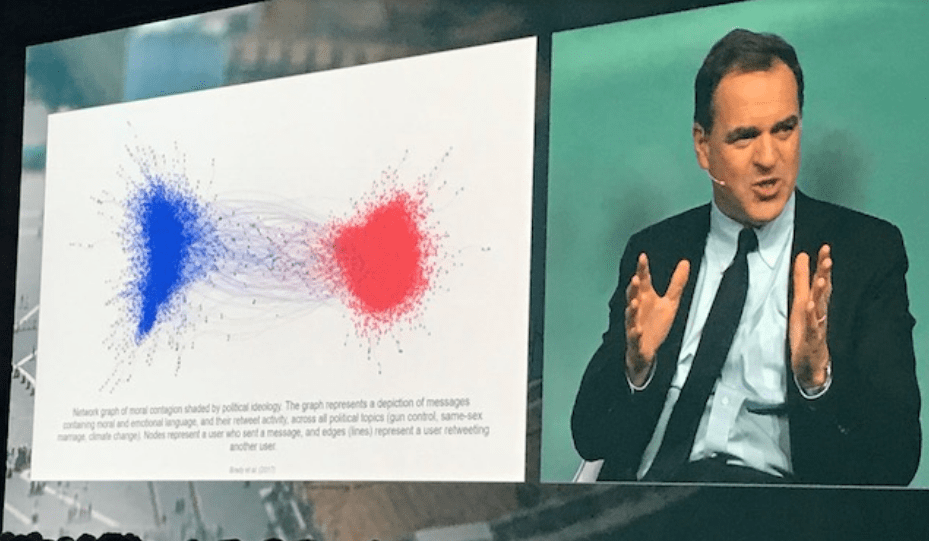

Tweets, for instance, that have stronger moral and emotional language get more attention. Notice in this very interesting graph that represents a depiction of messages containing moral and emotional language, and their retweet activity, across all topics (gun control, same-sex marriage, climate change). The nodes or dots represent a user who sent a message, and the lines represent a user retweeting that message. We tend to repeat the messages of those who think like us.

Why does a topic like this even matter? If our decisions and elections are increasingly based on this network-mentality then it will be very hard to change the polarized places we sit in today. This will begin to affect our economy and markets and more so, the future ahead. Niall believes we will look back and treat the cell phone like we do cigarettes. Here were some things he suggested offered:

- Be offline enough of the time to be able to think

- A day with a great book is worth 365 days on social media

- Buy books and magazines on a totally different subject than you know so you’re always learning something.

A natural follow-up to Niall’s discussion was hearing from Celeste Headlee who stated that most of us communicate from behind electronic screens and studies show that Americans feel less connected and more divided than ever before. The blame for some of this disconnect can be attributed to our political landscape, but the erosion of our conversational skills as a society lies with us as individuals and the only way forward is to start talking to each other.

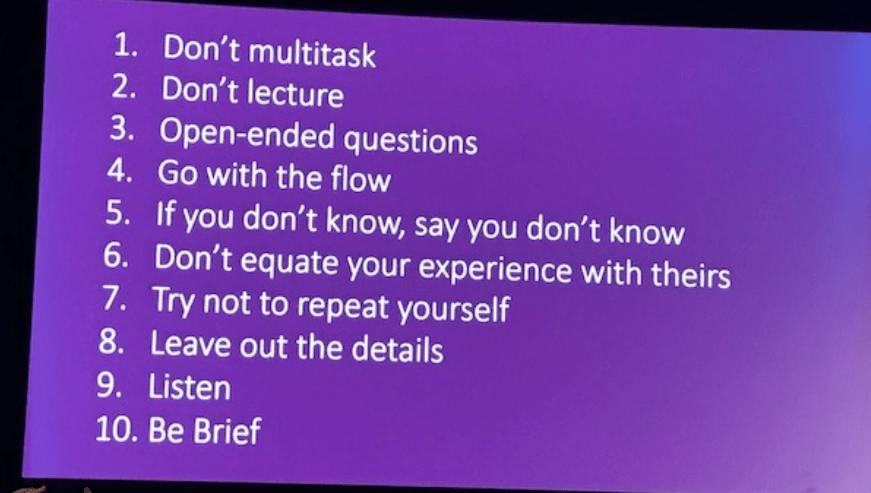

You can view a previous recording of her findings where she outlines the strategies that have made her a better conversationalist and offers simple tools that can improve anyone’s communication. Whether you’re struggling to communicate with your kid’s teachers at school, an employee at work, or the people you love the most. Here’s the list of things to be aware of as you practice your conversational skills.

To summarize so many great sessions, which I have only included a portion of, I believe we have progress to make and believe it is possible as we all do our part in the process.

In the short-term we believe that financial markets could see a strong end to the year, erasing much of the losses we’ve seen in the month of October. Midterm elections should bring clarity to forge ahead with the known results.

In the longer term we believe that a shift from growth to value investments will be warranted over the next 1-2 years. Transitioning to value names will provide your portfolio the ability to see growth as you continue saving even in the midst of an economic recession. It may warrant a shift to increasing allocations in international holdings which will be dependent on the outcomes of global trade we have yet to see ahead.

Remember that change doesn’t have to come from a crisis, but instead can come from leadership. We know you, our clients, are leaders in your various spheres of life whether career, family, or organizations you are a part of. We are always keeping ourselves up to date on factors that we believe can affect how the markets react to all that happens in the world. If we can help as you make financial decisions in light of all that’s happening in the world, please reach out to schedule a meeting today.

Wondering how this affects your investments? Schedule a call with Michelle and Steve to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.