State of the Stimulus

by Financial Design Studio, Inc. / June 3, 2020

As we wrap up our 12th week of COVID social distancing and stay-at-home orders it’s a good time to take inventory of all the stimulus money the government has thrown at the problem.

State of the Stimulus

To review, there have been four Cornoavirus-related bills passed by Congress and signed by the President since the beginning of March:

- Coronavirus Preparedness and Response Act (March 6)

- Families First Coronavirus Response Act (March 18)

- Coronavirus Aid, Relief, and Economic Security Act (CARES Act; March 27)

- Paycheck Protection Program and Health Care Enhancement Act (April 24)

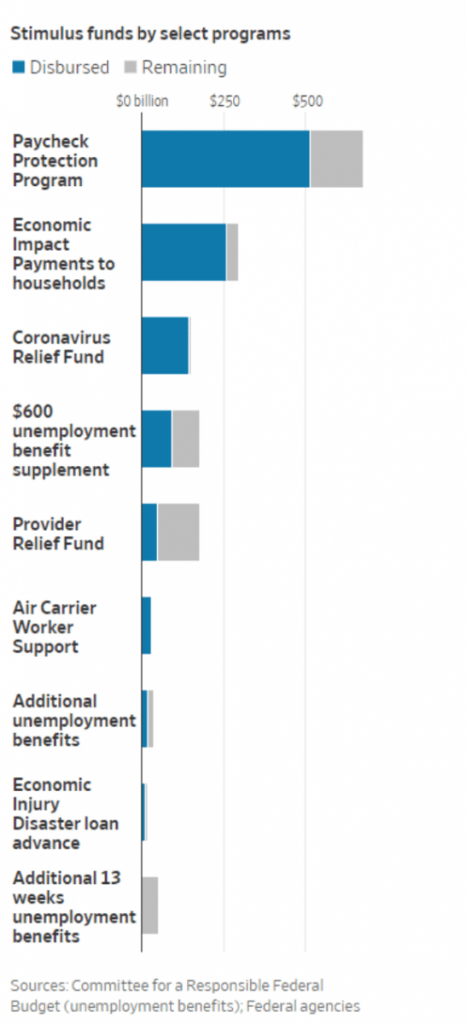

All told, $1.6 trillion of relief money was approved by the Federal Government. Of this amount, $1.1 trillion has already been disbursed to consumers, states, hospitals, airlines, and small businesses. The Wall Street Journal produced a handy chart of what’s been spent and what’s left.

The question is, “Where do we go from here?” As of now, there’s no additional stimulus being seriously debated in Washington. We believe many are taking a wait-and-see approach to allowing this stimulus to work its way through the economy.

Over the last two weeks [see Consumer Expectations Improving, and Better Days Are Ahead For The Economy] we’ve talked about how we’re starting to see early signs of an economic recovery. Expanded unemployment benefits continue for those out of work and over $150 billion of small business Paycheck Protection Loans remain available.

Will CARES Act stimulus be enough?

Loans from the Paycheck Protection Program (PPP) were designed to be used within 8 weeks of the loan getting disbursed. That means that these monies will start running out starting in late June and into July. The extra $600/week unemployment check is also set to expire at the end of July.

June will prove to be a key month. As states have started to re-open, there’s been a burst of activity as consumers had a lot of pent-up demand from being stuck at home for two months. But the reality for small businesses and consumers is that the recovery will likely prove slow, extending beyond July when stimulus money starts to run out.

Existing stimulus funds may not be enough to survive on until a full recovery.

The problem is the political landscape is treacherous. Let’s not forget it’s an election year. Our message: don’t get too crazy with your pent-up spending demand until we know the coast is clear!

Wondering how this affects your future finances? Schedule a call with Financial Design Studio, financial advisors in Deer Park, to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.