Now What? New Year’s Lower Taxes

by Financial Design Studio, Inc. / December 28, 2017Now What? New Year’s Lower Taxes

Now that Christmas has come and gone everyone is left thinking ahead to the New Year finances in 2018. What will the new year bring? What changes do you anticipate making? These same questions can be asked of the markets and how to view the days ahead.

To Itemize Or Not?

We expect lower taxes for most individuals and corporations ahead. With the passage of the TCJA (Tax Cuts and Jobs Act) corporate taxes and individual tax rates were lowered. Depending on the itemized deductions you claim each year you may still continue to itemize. In some situations it will make sense to take the standard deduction instead though.

Because every person will be affected differently you need to be careful not to listen to what “everyone” is doing as it may adversely affect you, if you prepay items in 2017 rather than keeping the itemized deductions for next year. Especially if you give charitably you could easily have itemized deductions higher than the increased standard deduction. So be careful not to act too quickly.

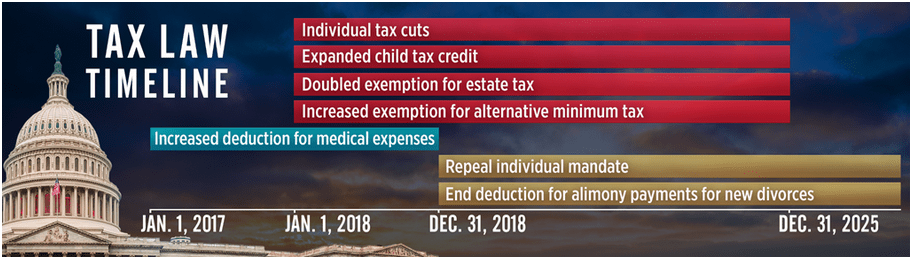

This article is a good summary of when we will start to see the changes from the TCJA take effect. And we will wait to see over the course of the year how these changes will trickle in to affect your investments in the market.

Lower Taxes = Higher Earnings

As corporations are paying lower taxes we would expect to see higher earnings numbers when they report each quarter. Now, aside from the lower tax rate they will pay there were other expense items that were changed too. Like the ability to expense all at once for various items or the ability to shift profits overseas. Still we expect to continue to see strong earnings numbers, which will help to drive stocks higher. In addition to strong earnings we may see increased dividends or one time special dividends.

Overseas Repatriated Funds

Well known companies have a lot of cash still overseas, that has not been repatriated back to the US. In 2018 these companies will have to begin repatriating the funds. And they will have the option of stretching the tax bill over 8 years. The TCJA brought a special one-time dividend of 8% for illiquid assets and 15.5% for cash. So we will wait to see how companies use this cash when it comes back to the US.

Hurry Up & Wait

We really have to wait and see the economic impact from the tax reform and the difference that it will make. But these changes will at least point us in a direction that should help individuals and corporations succeed. The result is still to be seen. So we look ahead to the new year anticipating good results from investments like 2017.

We wish you a Happy New Year! We would be honored to be a part of any changes you need to make regarding your finances and setting a plan in place.

VIEW NEXT

Ready to take the next step?

Schedule a quick call with our financial advisors.