Is Deferred Compensation a Good Idea?

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / February 2, 2023

Saving enough for retirement can be tricky for corporate executives that are high-income earners. Annual contribution limits put a cap on how much you can put into 401(k) and IRAs while income phase-outs can meaningfully reduce the tax benefit of saving for retirement.

Because of this, many executives fret they cannot save “enough” to satisfy their future retirement spending needs. What’s a solution? Deferred Compensation plans can help resolve this. Many companies adopt deferred compensation plans that can help executives save more for retirement and reduce current taxes. The problem is that these plans are complex, leaving many executives wondering, “Is Deferred Compensation a Good Idea?” That’s the question we answer below.

Key Takeaways

- Deferring compensation reduces your current year tax burden, which is valuable for high income earners in top tax brackets.

- Recognizing deferred compensation income at lower tax brackets when you’re retired can save you money on taxes.

- Choosing to defer income is very difficult to reverse if your circumstances change. Careful planning is essential if you choose to take part in a deferred compensation plan.

- You have flexibility in how you receive your deferred compensation in retirement, either in lump sums or an annuity stream over several years.

- Deferred compensation plans can be a powerful tool for early retirement goals.

- Deferring income to retirement might help avoid high state income taxes (ex: California, New York, etc) if you’re planning to move to a low-tax state.

- The biggest risk of deferred compensation plans is they’re not guaranteed; if your company goes bankrupt, you might receive none of the income you deferred.

What is a Deferred Compensation Plan?

Special rules laid out by the IRS govern deferred Compensation Plans “Deferred Comp Plans”. You may see these referred to as “nonqualified” plans, which is a fancy way of saying “non-retirement.”

Normally, workers have to recognize income on their tax returns as it’s earned. However, under IRS Section 409(a), a Deferred Comp Plan allows participants to defer recognition of their income from one year to a future year. Why would corporate executives want to defer their compensation? There are two primary reasons.

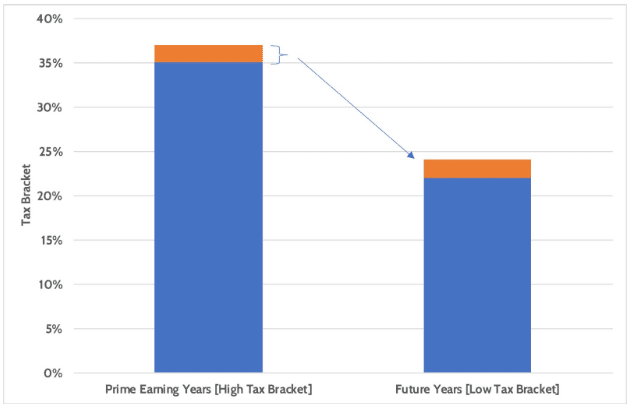

The first reason is to save on taxes. High-earning executives often find themselves in the highest marginal Federal and State tax brackets during their prime earning years. Yet If they expect to be in lower tax brackets in the future – such as during retirement – then deferring income to those years can lead to a lower overall tax bill on the amount that was deferred.

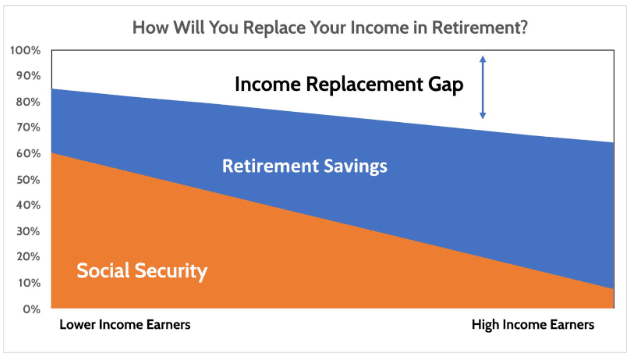

Second, high-income earners often find that their future retirement spending needs will be over what they’ll get from Social Security. Retirement vehicles such as a 401(k) plan, IRAs, and Roth IRAs help fill this gap. The problem is that Congress placed limits on the contribution amounts savers can make each year.

Executives – even if they’re maximizing their contributions to these plans – may still find their retirement savings falling short of what they’ll need. We call this a “retirement savings gap.” Learn more about this topic by watching this video! Social Security helps low-income earners the most by replacing a higher percentage of their income.

As your income rises, Social Security replaces a lower percentage of your income. As the retiree, you’re responsible for “filling the gap” between what you need to live on and what Social Security provides. Deferred Compensation Plans can help solve this retirement savings gap.

Every deferred compensation plan must meet IRS Section 409(a) requirements. But companies have flexibility in how they design their own deferred comp plans. This section looks at the most common features found in these plans. Later, we address the Pros & Cons of participating in these plans.

Key Features of Deferred Compensation Plans

Deferrals: Deferred comp plans allow you to defer a percentage of your salary, bonus, or commissions. They’re a tax-deferred savings plan, much like a Traditional IRA or 401(k) where you put in pre-tax dollars today but pay taxes when you take money out in the future. Ideally, in that future year you receive the cash, your marginal tax rate will be lower.

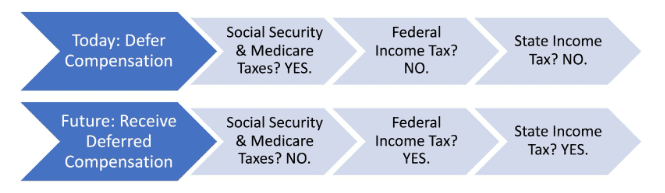

When you defer your compensation, you avoid Federal and State income taxes on that income in the year you deferred it. But you and your employer still pay Social Security and Medicare taxes, otherwise known as “FICA” tax.

The most attractive feature of Deferred Compensation plans is there’s no limit how much of your income you can defer. That said, most company plans impose a limit on how much of your salary you can defer in a year. But usually those are very high – up to 75% or 80% of your income.

Income deferrals achieve both of the desired outcomes we outlined above. (1) They delay tax recognition to a future (hopefully, lower) tax year, and (2) you’re able to put away a lot more pre-tax dollars towards retirement or some other financial goal.

The downside to deferring income is that it’s an “irrevocable election.” Once you decide to defer, you’re stuck with it. More on that below.

Distributions: The most complicated aspect of deferred compensation plans are the rules regarding distributions. This is where you want to be very careful before choosing to defer your income.

Why? At the time you choose to defer your income, you also have to be specific on when and how you want to receive the money back. Changes to those distribution plans are difficult and often require you to delay receipt of your deferred income for up to five years.

One important benefit with Deferred Compensation Plans versus IRAs or 401(k)s is that there’s no rule that you have to be 59-½ before taking money out. In that way, Deferred comp plans are flexible.

There are different deferred income distributions and different ways you can have that money distributed to you.

| Type of Distribution | Forms of Distribution |

| In-service Distributions, Retirement & Disability Distributions, Special Distributions (Death, Hardship, Leaving the company) | Lump Sum Payment, Installment Payments (5, 10, 15 years most common, made quarterly or annually) |

Types of Distributions:

In-service distributions. These are distributions you can make while you’re still working at your company. Typical examples for when an executive might want to do this is if they have a large, expected expense coming up. A new home purchase or sending kids to college fit this bill. The issue with in-service distributions is that you’re likely to still be in a high tax bracket since you’ll still be working, negating one of the key reasons to defer income.

Retirement & Disability Distributions. Deferring income for retirement is the most common reason for participating in a Deferred compensation program. This option can be useful to executives who plan to retire early, as they’ll need income from their retirement date until they receive Social Security or withdraw money from IRAs and 401(k)s.

Special Distributions: If you quit your job before retirement or when you’re scheduled to receive your deferred compensation, you’ll usually receive a lump sum of what you deferred. Hardship distributions are sometimes available but are very difficult to receive because of stringent IRS rules. Your company’s plan will spell these terms out.

Forms of Distribution:

Lump-sum distribution. You receive your deferred compensation in a lump sum payment in the year you specify.

Installments. Most plans allow you to choose an installment plan over a set number of years, with 5, 10, and 15 years being most common. If you choose this option, companies may allow you the choice of receiving these installments on a quarterly or yearly basis.

Is a Deferred Compensation Plan a Good Idea? (The Pros and Cons)

Now that you understand how Deferred Compensation plans work, it’s time to ask, “Is a deferred compensation plan a good idea?” The answer you don’t want to hear is, “It depends,” but that’s the truth. There is no silver bullet to gaining to clarity in all your questions. Choosing whether to take part in the plan depends a lot on:

- The specific rules of your company’s plan.

- Your current and expected future tax situations.

- Your level of comfort in being “locked in” to a decision.

Before making a decision, we urge you to speak with a financial advisor. We don’t say that because we’re financial advisors; we say that because these plans are complicated. You need to clearly understand what you’re doing and why you’re doing it. But also, without confidence in a financial professional, all the stress of getting your retirement plan right is on you. Let’s talk through some of the pros and cons you will have to weigh as you make your decision.

Pros of a Deferred Compensation Plan:

Tax savings. Corporate executives are usually in one of the top tax brackets while they’re working, subjecting them to Federal tax rates of 35% or more. Pre-tax 401(k) deductions aren’t enough to reduce their tax burden and they’re phased out of making deductible IRA contributions.

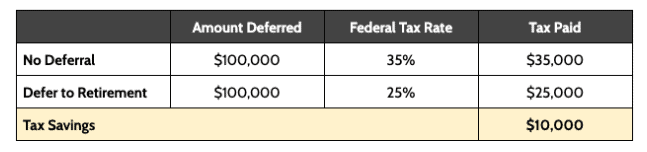

If the executive expects his or her tax rate to decline once they retire, deferring income might be a good tax reduction strategy. Suppose an executive is in the 35% tax bracket today but expects to be in the 25% tax bracket once they retire. They’re thinking about deferring $100,000 of their bonus next year.

By opting to defer $100,000, this executive would avoid having to pay $35,000 of Federal taxes next year. Instead, they’d pay $25,000 in taxes when they actually received it in retirement.

Tax-deferred Growth. Many deferred compensation plans allow you to “invest” your deferred amount for future growth. The word “invest” is in quotes for an excellent reason: the amounts you defer are NOT in an account that you own. We address this distinction in the “Unsecured Creditor” section below, under Cons.

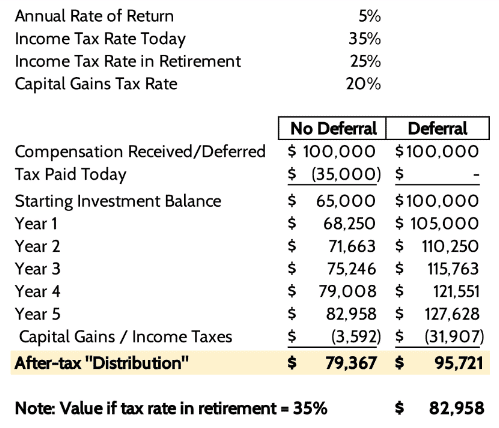

Let’s continue to use the example of our executive above. They have two choices:

- Receive money today, taxed at 35% with what’s left over they’ll invest and achieve returns of 5% per year. At the end of 5 years they sell everything and pay 20% of capital gains tax.

- Defer their income to retirement. Again, they’ll invest these funds for 5 years, earning 5% each year. At the end of 5 years they’ll take the money and pay ordinary income taxes at a 25% rate.

At the end of 5 years this executive would be much better off deferring income, investing it, and paying a lower tax rate when they retire. Even if we assume that their tax rate in retirement is the same as it is today, they’d still be better off by deferring, investing, and paying tax later.

Income for Early Retirement. Few executives we work with are retiring at Age 65. After a long, hectic career many executives want to retire early, say at Age 55.

The roadblock to early retirement for many executives is figuring out what they’re going to live on if they retire early. We call these “income gap years.” For example, if they retire at Age 55, they have to wait 5 years before taking money out of 401(k)s and IRAs, and another 5-7 years before reaching Social Security’s Full Retirement Age.

One way to overcome this issue is to defer income and choose to receive it in installments after you retire. This would help “bridge the gap” between your early retirement and when you receive other retirement benefits.

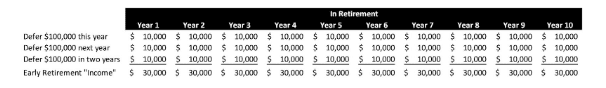

If our example executive deferred $100,000 of income for three years and chose the 10-year installment option, they’d receive $30,000 per year for the first 10 years they’re retired, ignoring the potential for investment returns. For early retirees, this type of deferred income strategy could be attractive.

Retire Early To Do Roth Conversions. Many times, executives have the bulk of their retirement savings in pre-tax accounts, such as their 401(k)s or IRAs. This can create very large Required Minimum Distributions.

The benefits of Roth Conversions are beyond this article, but are a powerful pre-retirement planning tool. For example, we may advise an executive to retire a few years early in order to create the “income gap years” described above. These lower-income years allow them to take advantage of low tax brackets by strategically converting some of their pre-tax accounts to a Roth IRA.

A deferred income plan similar to the one seen in the table above can help pay for taxes and living expenses during the Roth Conversion years.

Saving State Income Tax By Moving From High Income Tax State to a Low Tax State

You’re taxed at your marginal Federal tax rate when you receive your deferred compensation. But the rules for state income taxes are different and can be a powerful planning strategy for executives looking to move from a high-tax state to a low (no) income tax state.

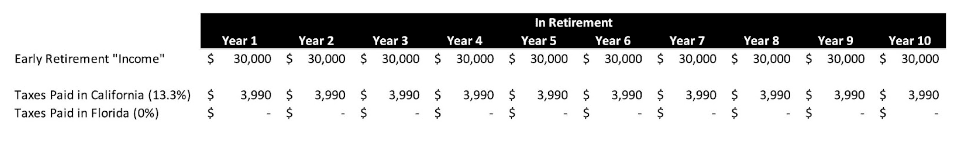

Normally, you pay state income taxes in the state you earned the income in. However, a special rule for deferred compensation plans allows you to be taxed in your state of residence if you choose to receive your deferred compensation in installments over 10 years or more.

For example, our example executive lives in California, where the top income tax rate is 13.3%. But when they retire, they plan on moving to Florida, where there’s no state income tax. Watch this video to learn which states have no income tax!

If they choose to defer their compensation while they work, and choose to receive the compensation on a 10-year installment plan (or longer), they’ll be able to avoid California’s income tax.

To be clear, if the executive receives their deferred compensation in a lump sum or installment plan less than 10 years, they’re going to pay California income tax. That’s why it’s important to start your retirement plan well before you’re ready to retire.

Cons of a Deferred Compensation Plan

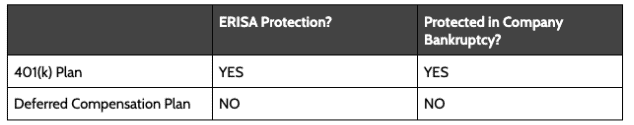

The Compensation Your Defer Isn’t Guaranteed If Your Company Goes Bankrupt. This “con” is by far the most important aspect you need to consider when thinking about deferring income in a deferred compensation plan. If you defer your compensation, you become an unsecured creditor to your company.

This can be confusing because many deferred compensation plans look a lot like their company’s 401(k) plan. They allow you to defer a percentage of your income, with those monies put into an “account” that you can invest. Some companies even offer the same investment choices as they do in their 401(k)!

IRS rules only allow deferred compensation plans to exist if there’s a “substantial risk of forfeiture.” Being an unsecured creditor to your company satisfies that requirement.

The “investment account” holding your deferred compensation isn’t actually an account set aside for you. And you’re not really invested in the investment choices offered. It’s nothing more than an accounting mechanism to track what the company would owe you when it’s time to pay out your funds.

There have been high-profile cases of executives losing the compensation they had deferred. Eastman Kodak in 2012 and Chrysler in 2008. In each of those cases, the company went bankrupt and deferred compensation was lost.

Given that the key benefits of deferred compensation plans are to defer income to future, lower-tax years, and to provide income during retirement, there can be a long gap between deferring income today and receiving it in the future. A lot can happen to companies, even ones that seem to be strong.

We caution executives against having too much exposure to their employers. Owning a lot of company stock and large deferred income balances can put you in an uncomfortable position. Losing your job is one thing. Losing your job and your life savings is another.

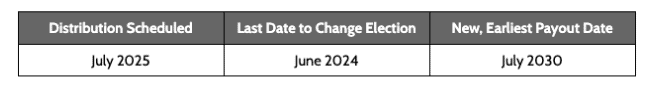

5 Year Delay if You Change Your Distribution Choice. If you decide to defer your compensation, you also have to choose when to receive it. That date may be many years away, and your circumstances might change. What happens then?

You can change your distribution date, but it can’t be any earlier than five years after the original distribution date. Making matters worse and more confusing, you can only change your distribution date at least a year before you’re scheduled to get it.

To make this clear, we’ll look at a couple of examples.

Example 1: Your Child Changes Their Mind About Going to College.

Assume you deferred income and choose to receive it in a lump sum in July 2025 to coincide with your son or daughter going to college. As they get closer to age 18, they make it clear they have no intention of going to college.

You can either choose to take the distribution as scheduled or to defer it. Here’s what happens if you defer it.

You can see the challenge here. You’d have to make the distribution election change at least one year in advance and you wouldn’t get the distribution until five years after it’s originally scheduled!

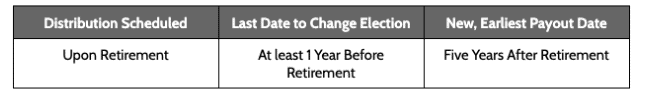

Example 2: Chose a Lump Sum Distribution at Retirement But Want 5 Year Installments Instead

This example isn’t uncommon. Suppose an executive has been taking part in a deferred compensation plan for many years and had been choosing the “receive lump sum at retirement” option.

As they get closer to retirement, they realize they’re going to receive several lump sum payments as soon as they retire. So much so that the combined lump sum payments will push them into an even higher tax bracket than the one they’re in, thus defeating the purpose of deferring their income.

They’d like to change a lump sum payment to a 5-year installment schedule. They can do that, but will defer receipt of that payment by 5 years.

There’s one last wrinkle to being able to change your distribution election. Some companies limit the number of times you can make changes. So if you made a mistake the first time, you may only get one or two chances to correct it.

Limited Investment Choices. We’re always surprised at how few good investment choices Fortune 500 companies offer in their 401(k) plans. The choices may be poorly diversified or have high investment fees. Their deferred compensation plans also have a limited set of choices.

If you’re setting aside money for retirement but can only choose between a limited set of investments in your 401(k) and deferred comp plan, then you might be better off avoiding the deferred comp plan and putting money in a taxable brokerage account instead. You may lose tax benefits, but gain diversification benefits.

Unforeseen Financial Needs. Companies will ask you to make your deferred compensation election once a year, usually coinciding with your Open Enrollment period. When you choose to defer your income, you’re choosing to defer next year’s income.

This is more challenging for executives whose companies pay annual bonuses after the fiscal year ends. They may choose to defer income on a bonus they wouldn’t receive until a year from now.

What if you have an unforeseen financial need? Can you revoke the deferral election? Yes, but only if your need meets the rules of an “unforeseeable emergency” or hardship withdrawal.

An executive may elect to defer 50% of their bonus next year, thinking they’ll get a similar-sized bonus that they usually get. But then their company has a terrible year, and they cut bonuses across-the-board. Suddenly the executive is getting a much smaller check – bonus cut in half, with half of that smaller amount being deferred! Unfortunately, they won’t be able to go back and cancel their deferral election.

10 Questions To Ask Yourself Before Jumping In To a Deferred Compensation Plan

These are some key questions to ask yourself before you consider taking part in your company’s deferred compensation plan.

- Am I maxing out my 401(k), HSAs, and IRAs? If you’re not doing that, then start by increasing your contributions to those plans before considering deferred compensation.

- How much income should I defer? Carefully plan out your spending needs for the coming year.

- What is my future tax rate likely to be? If your future tax rate isn’t expected to differ from what it is today, then deferring compensation might not make sense.

- How much of my wealth is tied to my employer? If you own a lot of company stock on top of earning a high income at your company, then taking part in a deferred compensation plan will only increase your exposure to something bad happening at your company.

- When should I receive deferred income? Carefully plan when you’d want to receive your deferred compensation, as you have limited ability to make changes.

- Are there alternatives to taking part in a deferred compensation plan? It may make more sense to open a taxable investment account or purchase a nonqualified annuity if you need to save more for retirement.

- Which investment choices are offered in the plan? If investment choices are limited and similar to what’s offered in your 401(k), you might not achieve good investment diversification.

- How long do you have until retirement? If your goal is to save more for retirement but you’re still many years away from retiring, be mindful that if you defer income to retirement, you can’t move that date up.

- Is my company financially strong? As an executive, you know your company as well as anyone. If there’s even a hint that future prospects are grim, you may want to avoid deferring compensation.

- Do I want to retire early? If you plan on retiring early, a deferred compensation plan may be a good way to generate income after your early retirement but before you’re eligible for IRA distributions and Social Security.

Concluding Thoughts: Is Deferred Compensation a Good Idea?

Deferred compensation plans are complicated, even for executive-level employees. When you see phrases like “irrevocable election” and “5 year delay in payment” the normal reaction is to avoid the plan altogether. But don’t let that deter you! With careful planning, deferred compensation plans can be a powerful way to create retirement income and even retire early.

We hope that you’ve seen some excellent reasons to take part in your company’s deferred compensation plan. And some important reasons you’d want to avoid it!

As you consider your participation in a plan like this, our recommendation is to speak with a financial planner first. That’s not a self-serving statement. We truly believe that executives need to have a clear view of what they’re trying to achieve and then make sure the math backs the plan up. Our job as financial advisors is as much to help you avoid costly financial mistakes as it is to plan and achieve your goals.

Maybe you’re feeling like you’re not able to save enough for retirement, even after maxing out all your other options. Or, maybe you’re looking for ways to reduce your tax bill. Our team here at FDS can help you assess your deferred compensation plan options. We can help you figure out if taking part would be beneficial for you or not! Let’s get your questions answers; why wait? Schedule a meeting with us!

Ready to take the next step?

Schedule a quick call with our financial advisors.