A 2020 Charitable Giving Strategy You Don’t Want to Miss!

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / December 3, 2020

It’s been a tough 2020. And not just for individuals and families, but for charitable organizations as well. The coronavirus pandemic not only affected a charity’s ability to perform its charitable duties, but funding levels as well. As we head into year-end, it’s a good time to remind ourselves that the government created a special $300 charitable giving benefit for 2020 that’s available to ALL taxpayers.

CARES Act Created Special $300 Charitable Deduction for 2020

As the coronavirus pandemic spread in March 2020, Congress acted quickly to inject stimulus into the economy. We wrote about several of these benefits in March.

One change they made was to allow taxpayers to take an above-the-line deduction for charitable contributions made in cash. They limit this deduction to $300 for 2020, but normally taxpayers only get a benefit for charitable giving if they itemize deductions on their tax returns.

Before getting into the specifics of this change, it’s good to look at how recent tax law changes affected the deductibility of charitable giving.

Fewer Taxpayers Itemizing Deductions After Tax Cuts & Jobs Act

The 2017 Tax Cuts & Jobs Act (TCJA) reduced taxes for most Americans. The law not only reduced rates at each of the tax brackets, but made these brackets wider so more people could benefit from lower taxes.

Another big change was the doubling of the Standard Deduction. This is a taxable deduction that’s available to all taxpayers regardless of income level. Before TCJA, if a taxpayer’s itemized deductions exceeded the Standard Deduction, they’d report their itemized deductions. If not, they’d stick with the Standard Deduction.

With the doubling of the Standardized Deduction and reduction of taxpayers’ ability to deduct state and local taxes (a big issue here in Illinois!), fewer taxpayers have been itemizing taxes of late.

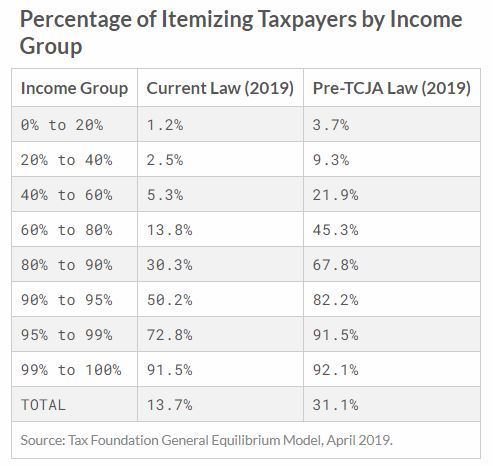

The Tax Foundation estimates that the number of taxpayers who itemize deductions dropped by more than half because of TCJA. Unfortunately, that means a lot of charitable giving that received a tax benefit before no longer does.

How to Qualify for Special $300 Charitable Giving Deduction for 2020

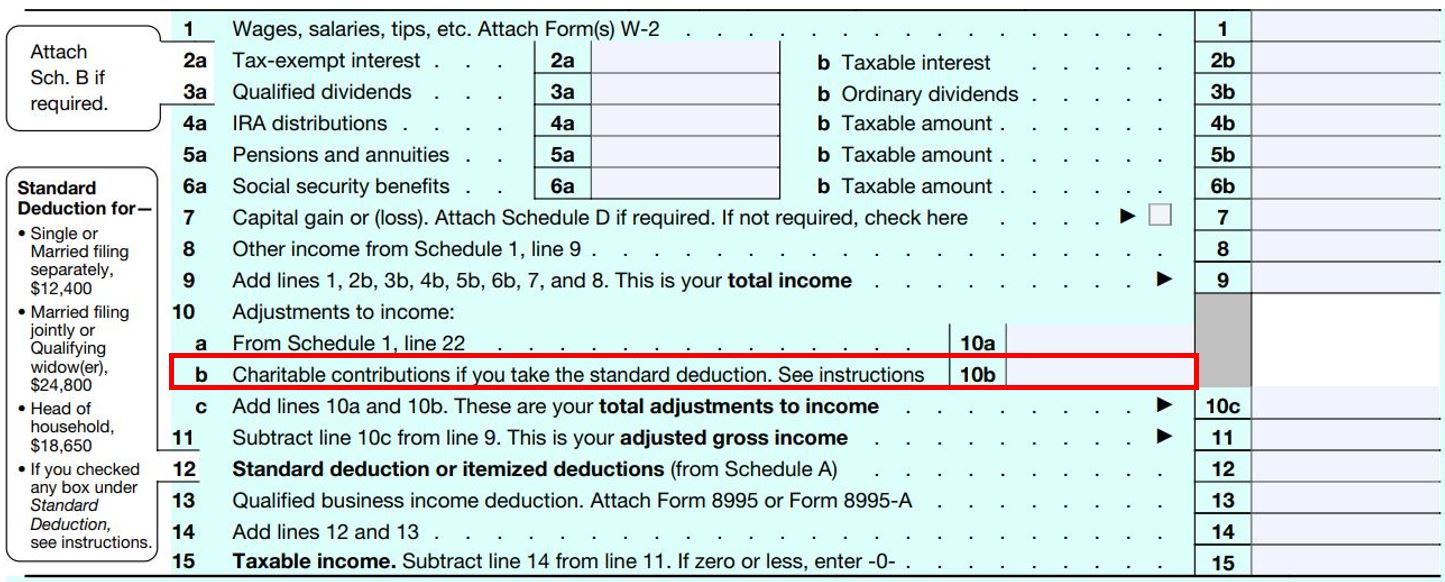

The new $300 charitable deduction as part of the CARES Act is available to everyone. The reason is that this is an “above-the-line” deduction. You can see how this will look on the 2020 Form 1040 from the IRS.

You’ll see that it says, “Charitable contributions if you take the standard deduction.” We saw in the first table that over 85% of taxpayers take the standard deduction. This means that everyone can benefit from making charitable contributions in cash during 2020.

There are a few limitations on this deduction.

- You can only deduct up to $300 in contributions on this line. If you gave more than $300 and use the Standard Deduction, you won’t get tax credit for your contributions above $300.

- The contribution has to be in cash.

- If you itemize your deductions, you can’t get the $300 above-the-line benefit here. You’ll still get credit for your giving, but it’ll come as an Itemized Deduction.

Also, for low-income taxpayers whose income is lower than Standard Deduction amounts, there’s no benefit from this charitable giving deduction. Income needs to exceed the Standard Deduction amount for there to be a tangible tax benefit.

Why is 2020 a Good Year to Give to Charity?

As mentioned at the outset, 2020 has been a tough year for charities. People have pulled back from giving because of economic uncertainty. We’ve seen this firsthand at Financial Design Studio with the charities we’re actively involved with.

Fortunately, many people have been able to adjust to our new reality and keep their jobs. The stock market is at a record high and it looks like a coronavirus vaccine is on the horizon.

Now would be a great time to support a charitable organization you’re excited about. It’s also an excellent opportunity to teach kids about the value of giving. By working together as a family on year-end giving, you’ll not only realize a tax benefit in 2020 but can also instill a spirit of generosity in kids that will last generations!

If you’re looking for other ways to make gifts or strategies to consider for the future, please check out other videos we’ve created to explain options you may have available to you. You can group charitable contributions together in one or more years. There are also a variety of ways to make contributions. You can even use tax efficient savings to give to organizations by make qualified charitable distributions.

Ready to take the next step?

Schedule a quick call with our financial advisors.