Are Negative Rates Coming To The US?

by Financial Design Studio, Inc. / May 14, 2020

This week Federal Reserve Board Chairman, Jerome Powell, gave a speech about current monetary policy. Market rumors of negative interest rates have increased in recent weeks. What did he say about that?

Current Short-term Rates Already 0%

In response to the COVID epidemic spreading in March, the Federal Reserve took aggressive action to cut interest rates to near 0%. Their reasoning for doing so is that lower rates will spur consumers and businesses to borrow and spend, pulling the economy out of recession.

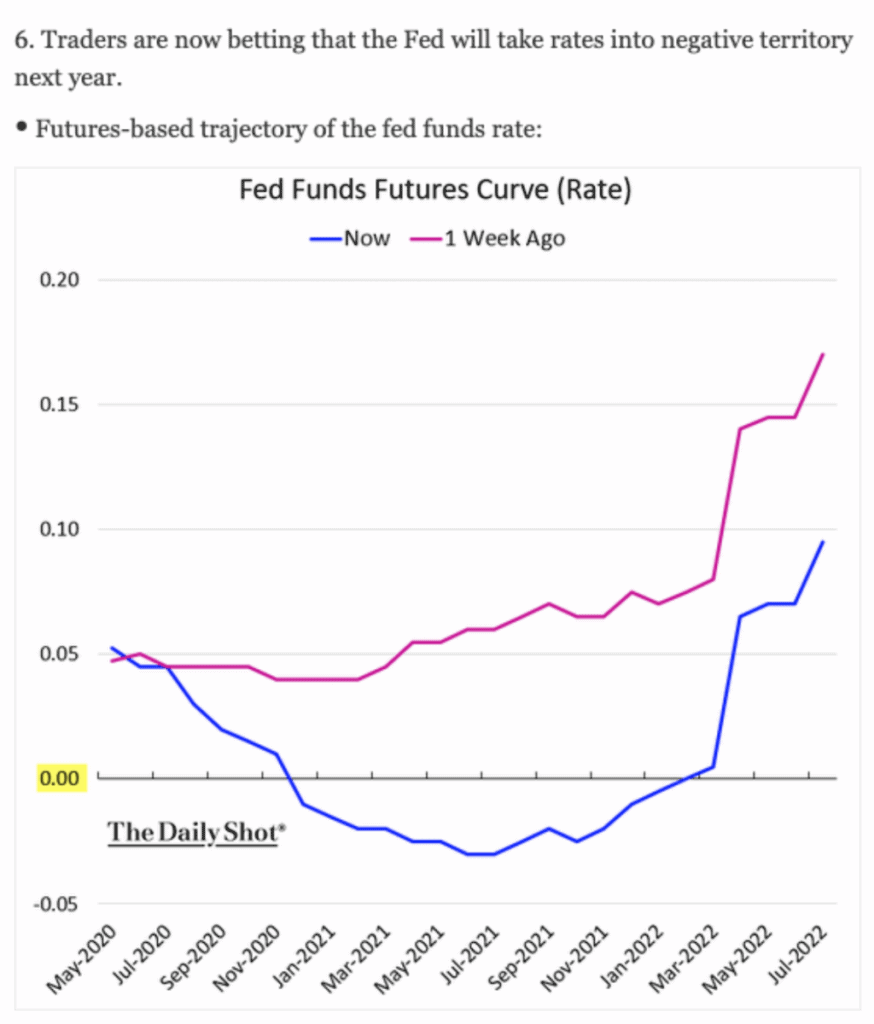

But in the last couple of weeks bond traders have started to price in the prospect that the Federal Reserve will cut rates to below zero.

As kooky as that sounds, negative rates have been a fact of life in Europe and Japan for the last several years. The idea is that if zero rates don’t spur borrowing and spending, maybe negative rates will!

What has the US Federal Reserve Said About Negative Rates?

Negative rates are a very controversial policy, as you might imagine. And frankly, the experience of Europe and Japan has shown that they don’t work to get the economy going. But central bankers are like a fraternity: if one of them comes up with a crazy new idea, all of ‘em want to follow suit.

Mr. Powell, in his speech, addressed this question head-on:

Back when I was analyzing banks for a living, I attended meetings with Federal Reserve officials and we’d talk about the idea of negative rates. “That’ll never happen – people will be marching on Washington with pitchforks!” was their typical response. But so much has changed and the people in charge several years ago have moved on, making way for a new breed of central bankers.

So should we believe Mr. Powell? In the opinion of this analyst, the answer is NO.

The Federal Reserve and other central banks have engaged in policies that were unthinkable not too long ago. Sure, they’ve made these moves in response to extraordinary economic events (Great Recession, COVID). But the point is what’s a “no go” today can become a “go” in the right environment.

If the recovery from COVID proves to be slower than expected, then our view is that a negative interest rate policy becomes a real possibility. Will The People will get their proverbial pitchforks out and march on Washington?

Ready to take the next step?

Schedule a quick call with our financial advisors.