Are Interest Rates the Only Story in Town?

by Financial Design Studio, Inc. / May 3, 2019We’ve been discussing market factors we are watching, recently. The recent items have included global trade with China, corporate earnings season, and interest rates.

This week the Federal Reserve Chair, Jerome Powell, spoke again about direction for interest rates. The market pulled back for a couple days after his speech. I want to consider whether Interest Rates have really been the only story over the past seven months.

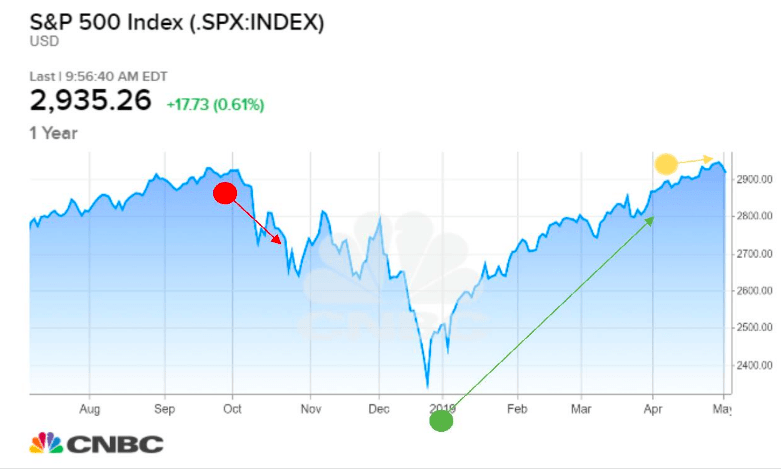

Consider in the chart below that the market started a large drop back in late September 2018. This drop followed news from the Fed that they were going to raise interest rates again. Then in January we received guidance from the Fed they would stop hiking interest rates, which caused the market to rally back to it’s September highs.

Now we are back in a state of unknown about interest rates.

Several politicians, investment analysts, and economists have called on the Fed to lower interest rates. However, this week’s decline was caused because the Fed did not say they were going to lower rates, but rather said they would wait to see if further rate hikes were needed. The Fed is watching to see if inflation stays in check for future movements. Today, unemployment numbers for April were released. We are seeing the lowest unemployment since 1969! You can also see what sectors the jobs are showing strongest for. This has helped the market to rebound for the closing day of the week.

Even if the past seven months have been mostly about interest rates, remember that the little peaks and valleys along the way have been driven by the other stories we’ve noted in previous weeks.

Keeping a diversified portfolio doesn’t just depend on one story or component; but rather many happening at once.

Image Credit: https://www.wsj.com/articles/mueller-report-release-11555590084

Ready to take the next step?

Schedule a quick call with our financial advisors.