Nasdaq 20 Year Comeback Story

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / July 2, 2020On March 27, 2000, the NASDAQ 100 index of leading technology stocks peaked at 4,700 in midst of the Tech Bubble of the late 1990’s. It fell the next day and wouldn’t see 4,700 again until the middle of 2016. It took 20 years for the performance of the NASDAQ 100 to surpass the performance of the S&P 500 index. As the Grateful Dead would say, “What a long, strange trip it’s been!” Let’s look at what we can learn from the Nasdaq’s 20 Year Comeback story.

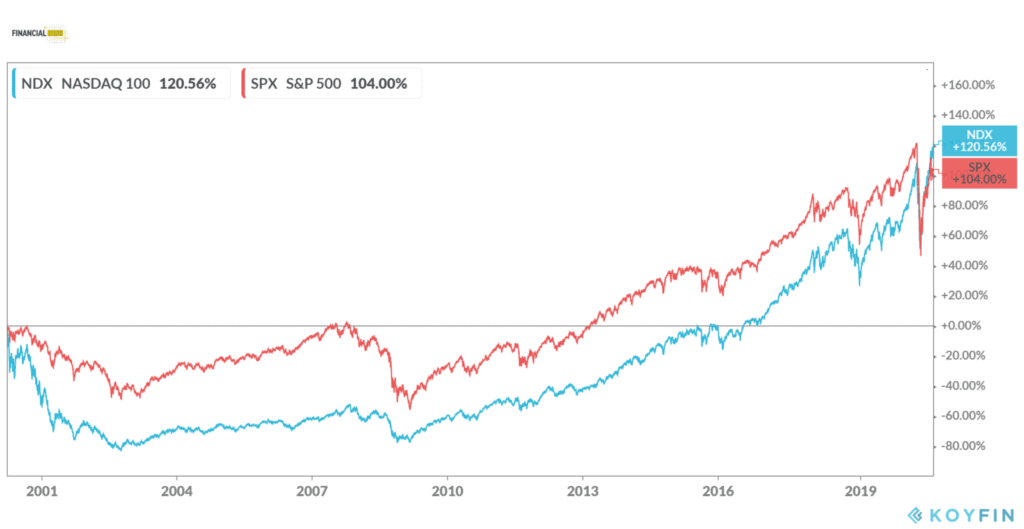

It took 20 years for Nasdaq 100 to overtake S&P 500

You can see the blue line in the chart above – that’s the NASDAQ 100 index. After the Tech Bubble burst in 2000, the index proceeded to drop 80% within 2-1/2 years. The S&P 500 index (red line) did better – “only” declining 48% – but needless to say it was a pretty brutal wake-up call for investors.

If you would’ve bought index funds on the broad market index S&P 500 and the NASDAQ 100 on that fateful March day in 2000, you would’ve had to wait until June 2020 for the NASDAQ to catch up and surpass the S&P 500. That’s a wait of 20 years and 3 months.

No one in March 2000 could’ve imagined that it would take 20 years to overcome the previous peak.

But it did. A lot of the companies that drove the index higher ended up going bust, while other companies survived.

Some of those survivors – Microsoft, Amazon, and Apple – are also leading the way this time around. They’re joined by this era’s version of “new growth.” Companies like Tesla, Netflix, and Facebook, which became public companies after the 2000 Tech Bubble burst.

Clearly investors are once again gravitating towards ‘tech’ stocks.

The NASDAQ 100 is up nearly 20% in 2020 despite all the economic turmoil from COVID-19, while the S&P 500 is still -2% on the year. Is the performance of these tech stocks sustainable? Time will tell. No one rings a bell at the top!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.