Emergency Rate Cut By The Federal Reserve

by Financial Design Studio, Inc. / March 5, 2020Emergency Rate Cut By The Federal Reserve

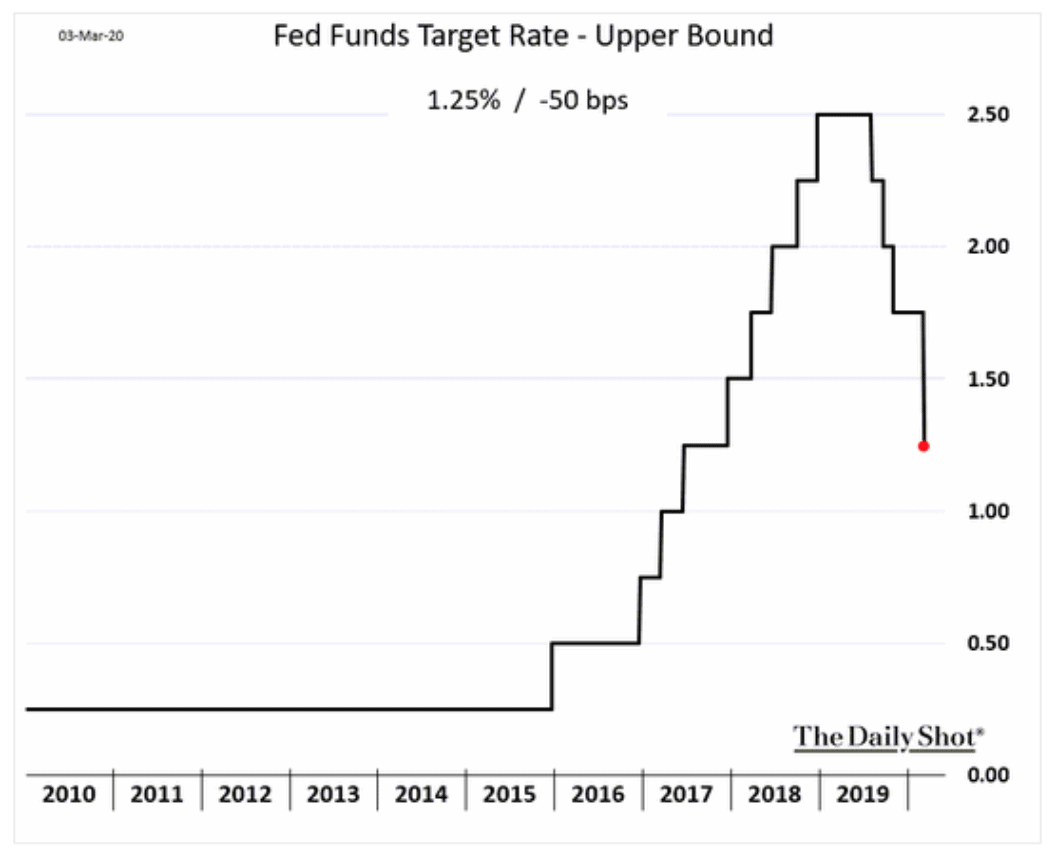

On Tuesday, March 3, the Federal Reserve announced a surprise rate cut of 0.50%. This was the seventh time in the last 20 years that the Federal Reserve cut rates between its normally scheduled meetings.

Let’s look at the impact and implications.

First, it’s important to point out that the Fed has completely shifted gear from what it was doing just 14 months ago. Rate cuts since mid-2019 have reversed over half of the rate increases they implemented in 2016-2018.

The reason for the rate cut is uncertainty related to the coronavirus, as we spoke about last week.

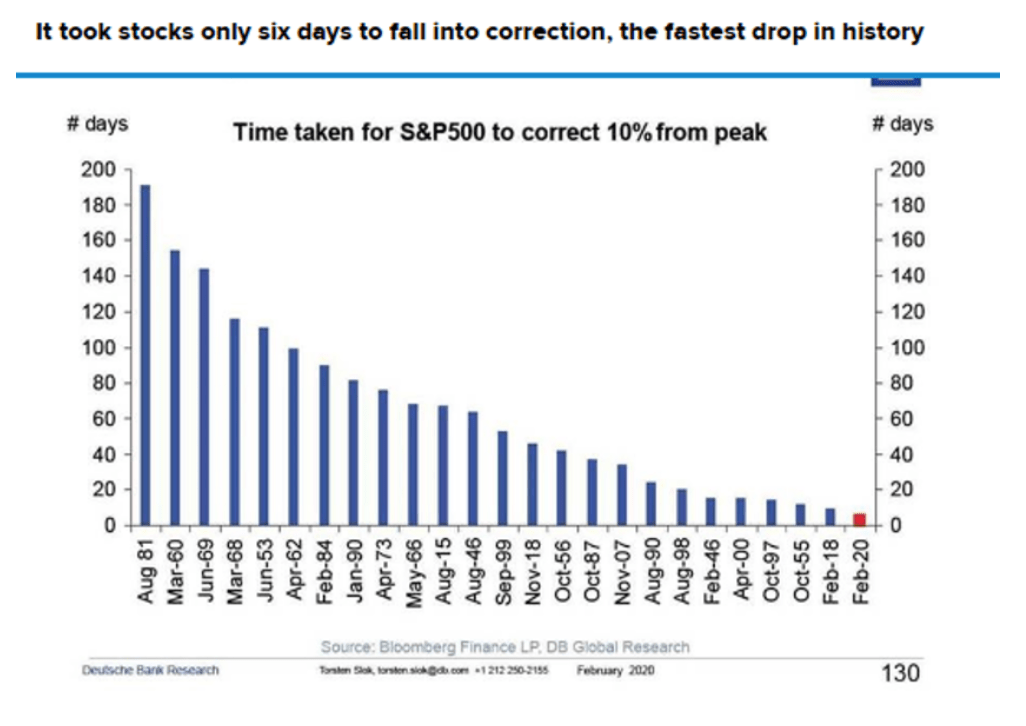

Since the virus started moving outside of China, markets reacted swiftly and negatively. In fact, the 10% correction we’ve seen in stocks was the swiftest correction on record!

The market reaction to this rate cut was surprising. After initially surging on the news, U.S. stocks ended -3% lower on the day.

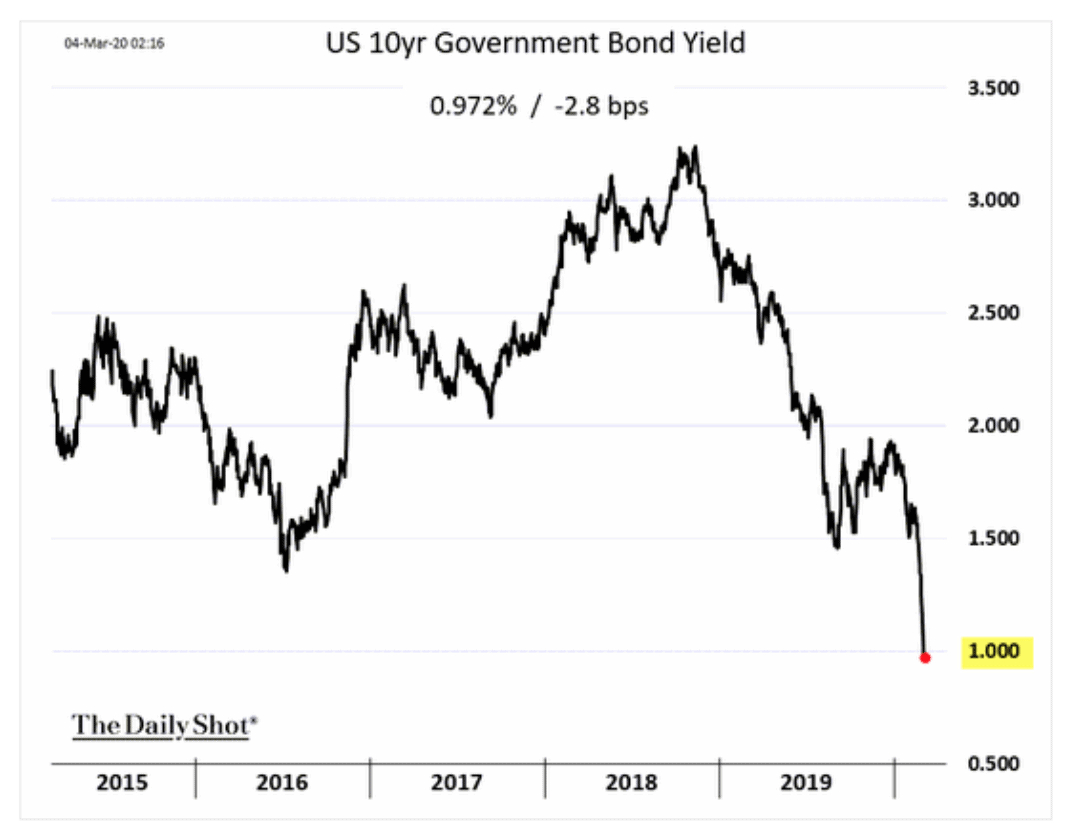

But the real story of the day was what happened with U.S. Government Bond Yields, where the 10-year yield fell below 1.00% for the first time ever.

The significance of this move in bond yields cannot be overstated: we are witnessing history.

Markets are already pricing in another 0.25% rate cut at the Fed’s March 18 meeting and another 0.50% cut in rates by year-end.

Market expectations can obviously reverse quickly. But there are some important implications from what we’ve seen in recent weeks.

First, the market prices in shifts in sentiment very quickly compared to the “old days.” In the chart above you can see that the two quickest 10% declines have happened in the last two years. There are any number of reasons for this, but computer-driven trading strategies (also known as “algo” trading) is a big reason.

Secondly, the rapid decline in bond yields could have lasting implications for long-term investing if these extremely low yields persist. Pension funds and retirees are particularly hurt by persistently low interest rates.

Third, emergency rate cuts and rapid declines in government bond yields are typically seen at the onset of a recession. While there has been little sign of economic weakness in the data we follow, the coronavirus impact isn’t completely known.

In short, we’re in a very dynamic and rapidly shifting environment. The coming weeks and months will do a lot to determine whether the coronavirus impact will be a short-term blip or cause a recession.

Wondering how this affects your future finances? Schedule a call with Financial Design Studio, financial advisors in Deer Park, to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.