Trend Alert: Is Eating Out Taking A Bigger Bite Out Of Your Budget?

by Financial Design Studio, Inc. / September 26, 2019 One of the biggest expenses for any family is the cost of food. If you like to cook, that cost is borne out in your monthly grocery bill. But if you’re pressed for time and don’t like to cook every day, you’ll see that in how much you’re spending at restaurants when you are eating out.

One of the biggest expenses for any family is the cost of food. If you like to cook, that cost is borne out in your monthly grocery bill. But if you’re pressed for time and don’t like to cook every day, you’ll see that in how much you’re spending at restaurants when you are eating out.

Surprisingly, the cost of eating in vs. eating out ebbs and flows with the economy.

And for the last 10 years since the Great Recession, the economy has been generally strong. Jobs are plentiful and wages are growing at their fastest pace in over a decade.

How has the economy’s strength translated in the cost of the food we get?

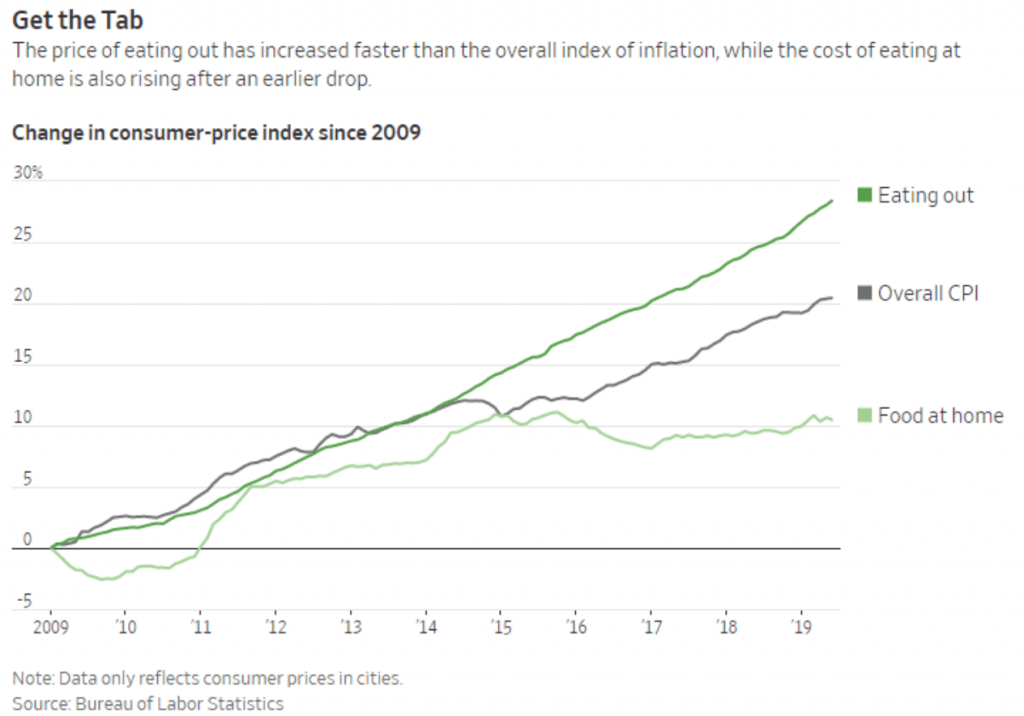

Using numbers from the Bureau of Labor Statistics, the Wall Street Journal recently reported on this phenomenon. And the results are surprising!

Cost of Eating Out Versus Eating In

As you can see, the cost of eating out has risen a lot more than cooking your meals at home. This is not only driven by higher consumer demand for eating out as their incomes have risen. But it’s also due to recent moves by many municipalities to set higher minimum wages. Labor costs are one of the biggest costs for any restaurant, and they’re offsetting higher wages with higher menu prices.

What Does The Increased Cost To Eating Out Mean For You?

Whether you use a monthly cash flow budget or not, it’s always a good idea to take a regular look at what you’re spending your money on. If you look at your most recent bank and credit card statements, how much did you spend eating out at restaurants? You might be surprised at what you see!

Eating out is oftentimes a lifestyle choice and there’s nothing wrong with that. But given how quickly the cost of eating out has risen the last decade, it might be worth taking a quick look at how much your family is spending on food and restaurants. At Financial Design Studio, we not only work with you on your investments but will also work with you on your cash flow to make sure your hard-earned dollars are being allocated to the things most important to you and your family.

Wondering how this affects your investments? Schedule a call with Financial Design Studio to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

How to Set Financial Goals (According to a Coach) [Video]

Many aren't sure how to set financial goals. In this video, ICF coach Sarah Fincher shares how she works with her clients on their goals.

How to Find College Scholarships [Video]

In this video, we break down how to find college scholarships for athletics, academics, geography, merit, and more!

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.