2023 Retirement Savings Update: IRS raises limits on 2023 retirement savings contributions

by Financial Design Studio, Inc. / January 2, 2023

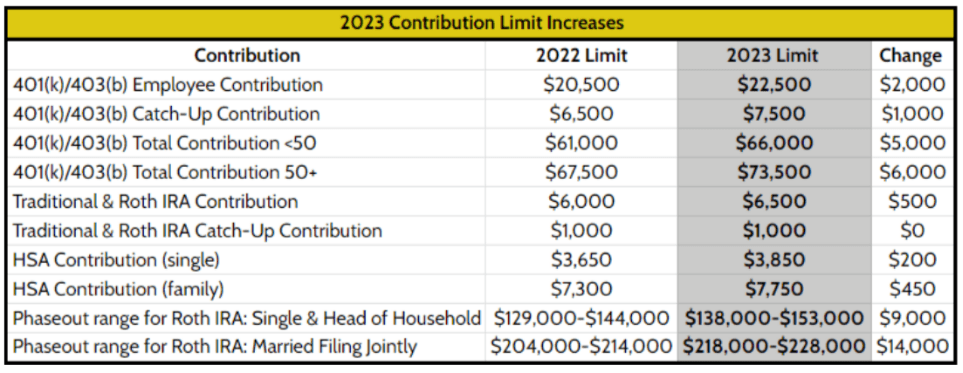

When it comes to saving for retirement, the IRS puts limits on how much we are allowed to save in tax-deferred accounts like IRAs, 401(k)s, 403(b)s, and 457s. With inflation on the rise, it was announced in October that there will be a 2023 retirement savings update. Limits will increase in 2023 by more than they have in decades. This is great news for everyone in the workforce looking to maximize their retirement savings!

What Are These New Limits?

These increases in the contribution limits give savers and pre-retirees an opportunity to get caught up, or to accelerate their retirement savings.

What should you be doing in order to take advantage of these increased limits?

Here are just a few ideas for consideration:

- Workplace retirement plans: 401(k), 403(b) Employee Contributions

Take a look at your most recent pay stub in 2022. Have you contributed, or are you on track to contribute your maximum amount this year? Figure out if you may need to increase the percentage you contribute to your workplace plan, per pay period, in order to max out in 2023.

Here is an example of how to do this:

With a salary of $150,000 and contributions of 14% pre-tax earnings to your 401(k) you’ll maximize your 2022 contributions of $20,500.

This equates to 13.7% of your total salary. $20,500/$150,000 = 13.7%

In order to ensure the maximum contribution in 2023, you would need to increase your contribution percentage to 15% (assuming no salary increase).

$22,500/$150,000 = 15% or $150,000 x 15% = $22,500

You can use this formula to calculate your own percentage to maximize the annual contribution.

(2023 Maximum Contribution) / (Your annual salary) = Your % contribution needed to reach the annual maximum amount

Who Is This For?

Anyone with an employer sponsored retirement plan can make contributions to maximize annual savings’ amounts. Remember you can save the maximum amount into a variety of employer accounts as they are available to you. Here are some additional approaches we’ve written about to guide you with employer sponsored retirement accounts you can save in.

Retirement Saving Strategies for High Income Earners [Video + Free PDF]

The Bright Start to 2023

So while inflation has been on the rise in 2022, there is one bright spot. It’s that we are getting a 2023 retirement savings update. Now is the time to get your savings strategy in line to take advantage of these increased limits beginning in January. If you need help designing or fine tuning your financial plan, please reach out. We would be happy to see how we can help!

Ready to take the next step?

Schedule a quick call with our financial advisors.