The Significance of Volume

by Financial Design Studio, Inc. / April 3, 2018The Significance of Volume

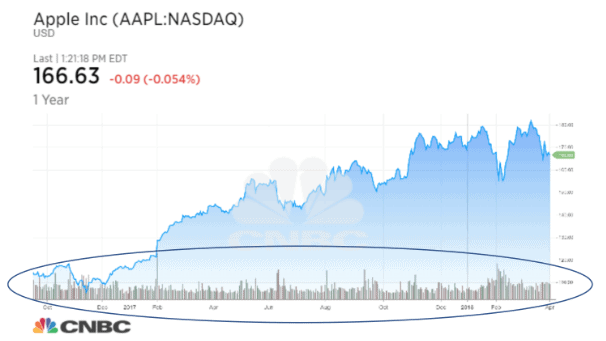

Every day when stocks trade on the market there is a measure tracking how many shares are bought and sold. This measurement is known as volume. Notice below how you can see the volume change each day. Volume is another tool that can help investors understand how and what other investors are choosing to buy and sell. The following chart shows a popular stock, Apple Inc. and you can see how at different times the volume traded spikes higher or lower. It’s at these times there is more activity than an average day.

Why Does Volume Matter?

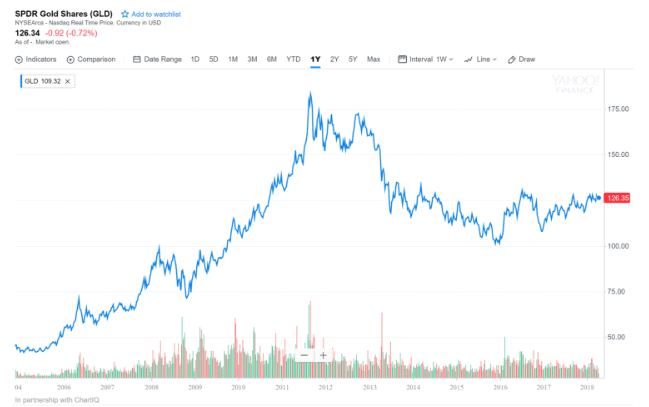

Let’s consider a couple of other investments, iShares 20+ Year Treasury Bond ETF (TLT) and SPDR Gold Shares (GLD:NYSE Arca). These are investments known for safety when investors believe the market is in for tougher times ahead and they move to protect their portfolios.

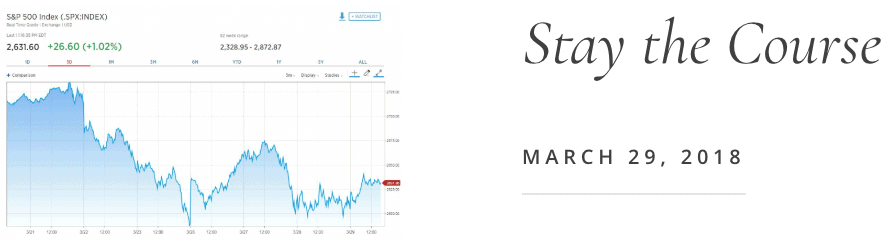

This matters because when the market has large pullbacks it’s easy to wonder if we should be getting out or selling. While the market has seen large swings of volatility we can see the volume has not spiked like in times of big corrections like a 2008-2009 time period. By analyzing the volume we can see the scale that investors are trading at to weigh perception of market movements.

This past week has brought much volatility and news stories that have brought disruption. At the same time there has been little positive news and reports to outweigh them. But we haven’t seen increased volume in trading of “safe” assets to warrant concern of major changes ahead. Remember to stay the course as we encouraged in last week’s update!

VIEW NEXT

Ready to take the next step?

Schedule a quick call with our financial advisors.