[Video] Small Business Retirement Plan Options: 401(k)

by Financial Design Studio, Inc. / October 30, 2018STEPHEN SMALENBERGER, EA ®

We have already talked about setting up a retirement plan for a company that’s not incorporated. What if your company is incorporated? What options are available now with a 401(k) and what’s different?

With an S-Corp you’re required to pay yourself a reasonable salary.

This just means that out of your profit you need to have some type of wage which is not required for a sole proprietor.

To make the math easy, let’s assume that you pay yourself $50,000 in wages (W-2) and take the remaining $50,000 as distribution/dividends (K-1). The $50,000 paid as wages becomes what is subject to self-employment taxes. The other $50,000 paid out to you as a dividend/distribution is not. This is very different from what we went over in the previous video.

This allows you to therefore manage the how much is subject to various taxes: Income Tax and Self-Employment Tax.

Like before, the company is able to contribute to a SEP-IRA on behalf of you and any employees. Instead of Net Income, the contribution amount is now based upon wages paid and the rate is increased from 20% to 25%.

If reducing your personal tax situation beyond this is important, you may consider deferring some of your paycheck(s) into a 401(k) throughout the year. The limit for 2018 is $18,500 for those under 50 and $24,500 for those older the 50.

The company could also contribute to your 401(k) which is called Profit Sharing. The amount is calculated the same as the SEP-IRA above and is limited to 25% of wages paid.

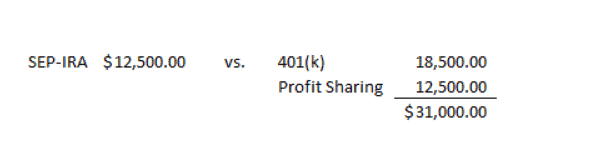

Here is an example displaying the maximum amount that could be contributed between the two based upon a $50,000 salary:

As noticed, both are good options.

The combination of the 401(k) deferral with the company profit sharing contribution just allows more to be done each year.

The employee payroll deferrals into a 401(k) would need to done by year-end.

The company contributions into either a SEP-IRA or Profit Sharing could wait until the deadline of the tax return and even an additional six months if an extension is filed.

These are two great options to consider if your goals are to save for your retirement and reduce your taxes now!

Wondering how this affects your investments? Schedule a call with Michelle and Steve to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.