Business Owners, Separate Your Business And Personal Finances [Video]

by Financial Design Studio, Inc. / March 16, 2020This is specifically for our business owners. Trevore and I are going to talk about some things that our business owners should be thinking about. Whether you are a one man, one woman shop, or you have a team surrounding you that you can separate your business and personal finances .

What’s the very first thing people should be considering?

Depending on your net income we want you to be thinking how to separate yourself both legally and also from a tax perspective. Like setting up an LLC so if your business is sued or has any type of legal issue.

As far as an S Corp that helps separate yourself from your business for tax planning.

So one is legal and one is tax.

Along those lines another element of the tax side is your business is a separate entity.

So when you incorporate you get a new EIN or identification number. This is different from your social security number and it is very important that you have both of those handy incase you have to use something for business and something for personal use.

We always want to be thinking about how we segregate things. We have personal bank accounts and personal credit cards. And we want to make sure that as we are drawing the line that we have business bank accounts and business credit cards as well.

We keep those separate from a creditors protection and to make sure everything is very straightforward and not crossing any lines.

And with those bank accounts, that will also help with accounting. So whether you are recording on a spreadsheet, piece of paper, a software, this way you keep what is yours, personal and separate from the business.

It will make your tax filing that much easier, cleaner, and straightforward.

The last item we want to talk about is pay yourself. This is very important, you are a business, treat it like a business. You are not working for free. No one else is working for you for free so make sure you are paying wages to yourself and your employees.

So those are five ways you can separate yourself from your business.

Think about that in this upcoming year. If Trevore or I can help you here at Financial Design Studio, let us know!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Retirement Saving Strategies for High Income Earners [Video + Free PDF]

One of the most common questions we get from high earning business owners and corporate executives is: how can I be saving more money for retirement? Here are several options to consider, along with a video and free PDF guide.

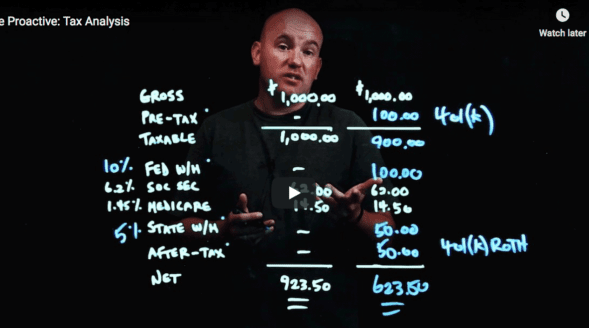

Be Proactive: Tax Analysis [Video]

One question we hear a lot from those who are self-employed and doing some type of payroll is: “How do I balance my taxes and save for the future?” For this let’s discuss your tax analysis… Let’s go through an example so I can show you some of the mechanics of how a…

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.