TWO Things That Happened This Week

by Financial Design Studio, Inc. / March 28, 2019There were two things that happened this week we want to share so you continue to learn how investments work!

First, you may have heard that Apple had an event this week! What has become normal for Apple is to update many of their current devices with new or better features. To investors this is not as exciting as coming out with a completely new product. This week; however, Apple did announce new products. They are rolling out the Apple TV streaming service and the Apple Card. Read the details! It’s not the Apple products or company specifically that have us hopeful but more so the fact that a company rolled out something new!

You see, when companies are announcing new products and showing innovation we see hope that they aren’t simply concerned about a slowing economy. New, cutting edge ideas provide us with confidence that companies are thinking ahead about how to get better…not just how to protect their bottom line by cutting costs. We would like to see much more of this news from all sectors!

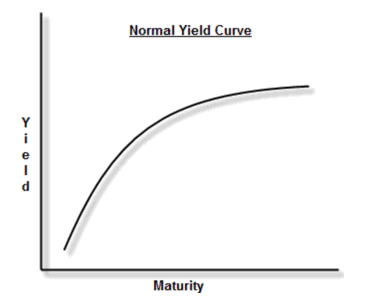

Second, the yield curve inverted. We’ll explain what this means to you. If you look below you’ll see a normal yield curve. You’ll notice with a normal curve you earn a higher yield for holding an investment for a longer period of time. And this makes sense. The longer we are willing to invest in something we should expect to earn more of a return. A yield is a return you earn on an investment, typically stated as an annual percentage.

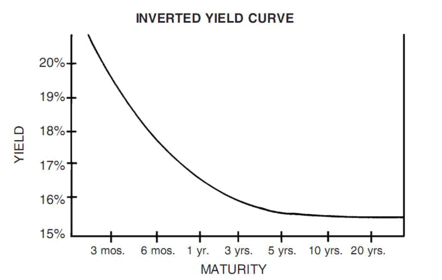

Then what does it mean that the yield curve inverted? Below you’ll see that with an inverted yield curve an investor actually earns a higher yield for buying something with a shorter term to maturity. If you think about it practically it doesn’t make sense that we earn less for investing longer.

Why does this matter?

Some experts have speculated that an inversion points to an upcoming recession. The problem with this analysis is that it hasn’t happened with perfect timing or accuracy for every recession that we’ve experienced. But, the inverted yield curve signals that investors are less confident about the economy.

We are watching for signs like this and others to see a continued pattern and higher certainty of a recession and its timing. These stories from the week may mean that changes are needed within your portfolio. We’ll be waiting, watching, and investing in the meantime!

Wondering how this affects your investments? Schedule a call with Michelle and Steve to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.